Yum China (YUMC) Outperforms the Industry: More Room to Run?

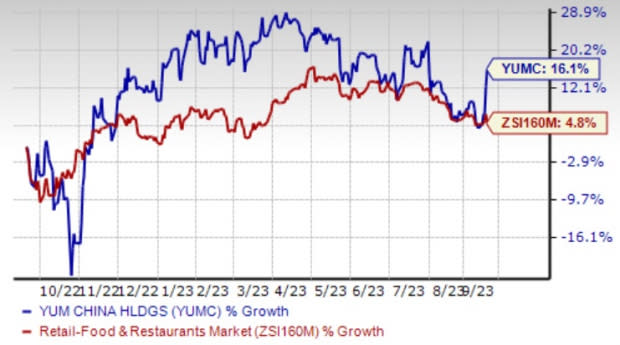

Shares of Yum China Holdings, Inc. YUMC have gained 16.1% in the past year compared with the Zacks Retail – Restaurants industry’s 4.8% growth. The company has been benefiting from menu innovation, unit expansion and digitalization efforts.

The leading quick-service restaurant brand has a long-term earnings growth rate of 20.6%, highlighting its inherent strength. The Zacks Consensus Estimates for 2023 increased to $2.06 per share from $1.98 in the past 60 days. This depicts analysts’ optimism regarding the stock growth potential.

Let’s discuss the factors substantiating its Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Growth Catalysts

Menu Innovation: Yum China's growth potential lies in its continuous menu innovation to boost revenue. Increased sales of popular menu items such as the crayfish burger, stuffed chicken wing and spicy chicken burger drive the company's exceptional performance. The company is also expanding its presence in the coffee and dessert categories, planning to invest further in the coffee segment due to strong demand in China.

During the second quarter of 2023, the company reported solid performance of Juicy Whole Chicken, roasted chicken fried burger and K-Coffee (comprising of Our Iced Sparkling Americano with Zesty Lemon). During the quarter, the company launched K-zza (a creative twist on pizza comprising of thin crust and popcorn chicken) and fried chicken tacos. Given the solid feedback for the limited-time offering, the company remains optimistic and anticipates launching more K-zza variations in the upcoming periods.

Unit Expansion: Yum China's strategy emphasizes continuous restaurant expansion to boost sales incrementally. In second-quarter 2023, Yum China opened 422 net new stores.

Meanwhile, the company also focuses on expanding its supply chain network to support store and portfolio growth and enhance intelligent supply chain operations. For 2023, the company has increased its net new stores target to 1,400-1,600, compared with its previous target of 1,100-1,300. Attributes of flexible store formats, healthy new store payback periods and a strong store pipeline will likely add to the positives.

Focus on Digital Initiatives: Yum China is leading in the Chinese restaurant industry for delivery, mobile ordering, and loyalty memberships. The company increasingly focuses on digital and content marketing to expand its customer base. It has implemented a robust delivery strategy, collaborating with aggregators for traffic and utilizing KFC riders to fulfill orders.

Digitalization has been a driving factor in the company’s expansion plans. The initiative supports streamlined workflows, empowered store management and increased flexibility, courtesy of its digitalized operational tools and automated technology solutions.

The company is expanding the usage of AI technology to significantly enhance customer experience, store operations and human resource management. Much optimism prevails on the company’s in-house digital capabilities to drive innovation in future AI-enabled applications.

Long-Term Growth Plan: The company remains steadfast in its focus on long-term growth, continuously aligning its strategies with a forward-looking vision. On Sep 14, 2023, the company unveiled its refreshed "RGM 2.0" strategy during the 2023 Investor Day in Xi'an, China. The initiative focuses on accelerated network expansion (by leveraging flexible store formats and strategically partnering with franchisees), sales growth (via menu innovation) and profitability (through proactive cost management).

The company plans to reach 20,000 stores by 2026 and target a high-single-to-double-digit CAGR for system sales and operating profit, along with double-digit EPS CAGR from 2024 to 2026. The company also aims to return approximately $3 billion to shareholders through quarterly dividends and share repurchases over the same three-year period, effectively doubling shareholders’ returns of the past three years.

Other Key Picks

Some other top-ranked stocks from the Zacks Retail-Wholesale sector are:

Abercrombie & Fitch Co. ANF holds a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 724.8%, on average. Shares of ANF have surged 226.5% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ANF’s 2023 sales and EPS implies increases of 10.4% and 1,644%, respectively, from the year-ago period’s levels.

BJ's Restaurants, Inc. BJRI sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 121.2%, on average. Shares of BJRI have declined 4.6% in the past year.

The Zacks Consensus Estimate for BJRI’s 2023 sales and EPS indicates a 5.6% and a 447.1% growth, respectively, from the year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO currently carries a Zacks Rank #2. ARCO has a long-term earnings growth rate of 11.4%. The stock has gained 34.1% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2023 sales and EPS suggests a rise of 19.2% and 13%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Yum China (YUMC) : Free Stock Analysis Report