Workday (WDAY) Boosts Adaptive Planning With Advanced AI

Workday, Inc. WDAY recently introduced state-of-the-art AI-powered features to enhance the capability of Workday Adaptive Planning solution. The software is designed to simplify complex planning requirements in the finance and human resource domain for businesses across all industries.

In today’s dynamic landscape, the ability to quickly make informed business decisions and comprehend their implications has become very crucial. However, effective planning is becoming increasingly challenging, owing to a multitude of reasons.

Global economic uncertainty and market volatility are making it difficult to predict financial trends and demand for human resources. Rapid technological innovation is also intensifying competition across the industry. Growing preference toward remote work has also induced changes in HR processes and employee engagement. Furthermore, shifts in consumer preferences can significantly impact a company's product development, sales strategies, as well as its financial and human resource planning.

The newly-introduced generative AI capability enables planners to validate unlimited scenarios with ease before implementing them into the operational workflow. Leveraging machine learning models, its predictive forecaster rapidly generates demand forecasts within a user-friendly interface.

The next-generation Elastic Hypercube Technology, with embedded AI, caters to even the most complex multi-dimensional planning requirements. The solution’s workforce planning analyzes the employee resources and facilitates the precise allocation of the right personnel for the right project. It helps enterprises to efficiently manage headcount and align future workforce composition to strategic goals and business initiatives. Workday centralizes all the workforce and financial data of the enterprise. This induces greater versatility in the system and saves around 10,000 employee hours annually.

The company has introduced an enhanced and intuitive interface in its HCM (Human Capital Management) solution, simplifying the updates and creation process of various positions in Workday HCM. The changes made are automatically reflected in financial and headcount plans in the Workday Adaptive Planning.

The automated headcount reconciliation process enriches planners with real-time cost comparisons for sudden changes in hiring plans. This early visibility facilitates better decision making, cost optimization and drives efficiency in business operations. The generative AI also expedites data retrieval and enriches business with contextually relevant insights.

The Workday operation planning leverages real-time data to offer more reliable forecasts. It fosters collaboration among different teams including finance, sales, marketing and IT, and boosts adaptability in the organization to cope with ever-evolving business conditions.

Workday’s diversified product portfolio continues to yield a steady flow of customers. Its revenue growth continues to be driven by high demand for its HCM and financial management solutions. The company’s cloud-based business model and expanding product portfolio have been the primary growth drivers. Moreover, the growing clout of Workday Prism Analytics and Adaptive Insights business planning cloud offerings holds promise.

Management is putting a strong focus on integrating advanced AI and ML capabilities. The ongoing AI-powered product development emphasizes natural language generation, content search, summarization, content augmentation and document understanding. This augurs well for the long-term growth of the company.

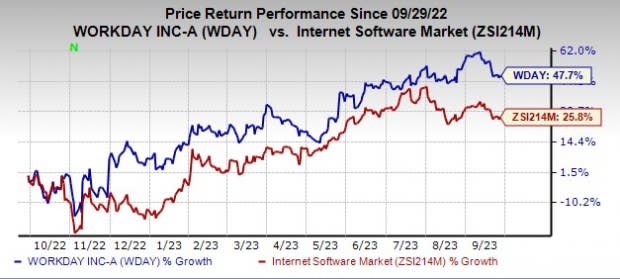

The stock has gained 47.7% in the past year compared with the industry’s growth of 25.8%.

Image Source: Zacks Investment Research

Workday currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Motorola Solutions, Inc. MSI, carrying a Zacks Rank #1 (Strong Buy) at present, delivered an earnings surprise of 5.62%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 5.58%. You can see the complete list of today’s Zacks #1 Rank stocks here.

It provides services and solutions to government segments and public safety programs, along with large enterprises and wireless infrastructure service providers. It develops and services both analog and digital two-way radio, voice and data communications products and systems for private networks, wireless broadband systems and end-to-end enterprise mobility solutions to a wide range of enterprise markets.

NVIDIA Corporation NVDA, currently sporting a Zacks Rank #1, delivered an earnings surprise of 9.79%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 29.19%.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit or GPU. Over the years, the company’s focus has evolved from PC graphics to artificial intelligence-based solutions that now support high-performance computing, gaming and virtual reality platforms.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has delivered an earnings surprise of 12.8%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed data center segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report