Top 3 Stocks to Buy From Promising Restaurant Industry

The Zacks Retail – Restaurants industry is benefiting from rapid increases in menu prices, average check growth and expansion efforts. Industry participants also benefit from partnerships with delivery channels and digital platforms. Sales have steadily risen, which is a good sign for the industry. However, high wages and food cost inflation woes stay. Stocks like Yum! Brands, Inc. YUM, Wingstop Inc. WING and Brinker International, Inc. EAT are well-poised to counter the scenario.

Industry Description

The Zacks Retail – Restaurants industry comprises several owners and operators of casual, upscale casual, fine dining, full-service and fast-casual restaurants. Some industry participants operate as roasters, marketers and retailers of specialty coffee. Some companies develop, operate and franchise quick-service restaurants worldwide. A few restaurant operators offer cooked-to-order dishes, which include noodles and pasta, soups, salads and appetizers. Some industry players develop, own, operate, manage and license restaurants and lounges worldwide. A few companies also operate technology-enabled Japanese restaurants in the United States and provide Japanese cuisine through a revolving sushi service model.

4 Trends Shaping the Future of the Restaurant Industry

Sales Continue to Increase: Despite inflationary pressures, sales at U.S. restaurants showed a consistent upward trend throughout 2023, fueled by a growing number of Americans opting to dine out. According to the Commerce Department, sales at food services and drinking establishments reached $94.7 billion in November, marking a 2% increase from the previous month’s levels. On a year-over-year basis, November recorded an 11% rise in sales. Most restaurant operators are also gaining from implementing ghost or virtual kitchens. The idea of providing off-premise offerings and a connected curbside service is steadily garnering positive customer feedback.

Digitalization to Drive Growth: Restaurant operators’ focus on digital innovation, sales-building initiatives and cost-saving efforts has been a catalyst. With the growing influence of the Internet, digital innovation has become the need of the hour. Restaurant operators constantly partner with delivery channels and digital platforms to drive incremental sales. Partnerships with delivery channels like DoorDash, Grubhub, Postmates and Uber Eats and the rollout of self-service kiosks and loyalty programs continue to drive growth. Restaurant operators focus on driverless delivery systems to augment sales amid the coronavirus crisis.

Off-Premise Sales Acting as a Key Catalyst: The industry has been gaining from the increase in off-premise sales, which primarily include delivery, takeout, drive-thru, catering, meal kits, and off-site options such as kiosks and food trucks, owing to the coronavirus pandemic. Most restaurant operators have initiated testing of ghost or virtual kitchens. The idea of providing off-premise offerings and a connected curbside service has been garnering positive customer feedback.

Traffic Woes & High Costs Linger: The restaurant industry has been facing declining traffic for quite some time now. A rapid increase in menu prices is the primary reason behind traffic erosion. Restaurant operators are grappling with the high cost of operations. Intense competition, high wages and food cost inflation remain concerns. The industry continues bearing increased expenses, which have been affecting margins. Higher pre-opening costs, marketing expenses and costs related to sales-boosting initiatives are exerting pressure on the company’s margins.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Gaming industry is grouped within the broader Retail-Wholesale sector. It carries a Zacks Industry Rank #94, which places it in the top 34% of more than 252 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the top 50% of the Zacks-ranked industries results from a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, analysts are gradually gaining confidence in this group’s earnings growth potential. Since Jul 31, 2023, the industry’s earnings estimate for the current year has increased by 0.7%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

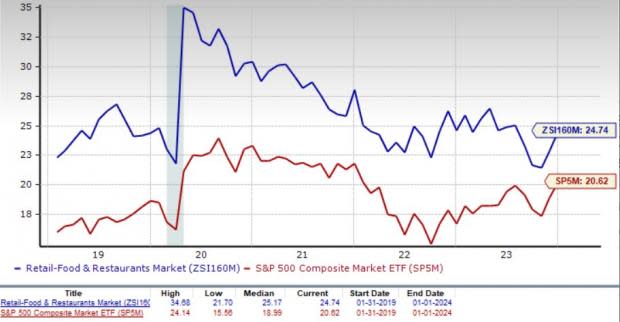

Industry Underperforms the S&P 500 & Sector

The Zacks Retail – Restaurants industry has underperformed the Zacks S&P 500 composite and its sector over the past year.

Over this period, the industry has increased 8.1%, compared with the Zacks S&P 500 composite’s gain of 24.5%. The sector has increased 24.8%.

One-Year Price Performance

Restaurant Industry's Valuation

Based on the forward 12-month P/E, a commonly used multiple for valuing restaurant stocks, the industry is currently trading at 24.74X compared with the S&P 500’s 20.62X. It is above the sector’s forward 12-month P/E ratio of 23.15X.

Over the last five years, the industry has traded as high as 34.68X and as low as 21.71X, with the median being at 25.17X.

3 Key Restaurant Picks

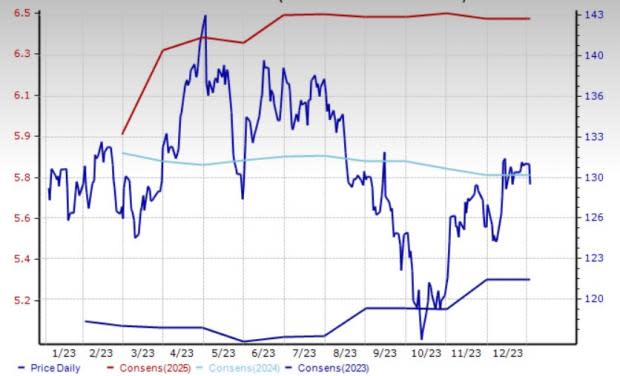

Yum! Brands: The company likely to benefit from consistent focus on off-premise channels, strategic investments in digital technology and refranchising efforts. The company has implemented various digital features in mobile and online platforms across all brand segments to enhance the guest experience. It is working toward accelerating its delivery services and the results have been positive so far.

YUM carries a Zacks Rank #2 (Buy). Yum! Brands’ sales and earnings for the fiscal 2024 are anticipated to improve 8.3% and 8.5% year over year, respectively. In the past year, shares of the company have gained 20.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: YUM

Wingstop: The company, along with its subsidiaries, franchises and operates restaurants under the Wingstop brand name. The company is benefiting from robust system-wide sales, royalty revenues and franchise fees. New restaurant openings are also aiding the company.

WING carries a Zacks Rank #1. Wingstop’s earnings for fiscal 2024 are anticipated to improve 18.2%. In the past 30 days, the consensus mark for 2024 earnings has been revised upward by 1.4%.

Price and Consensus: WING

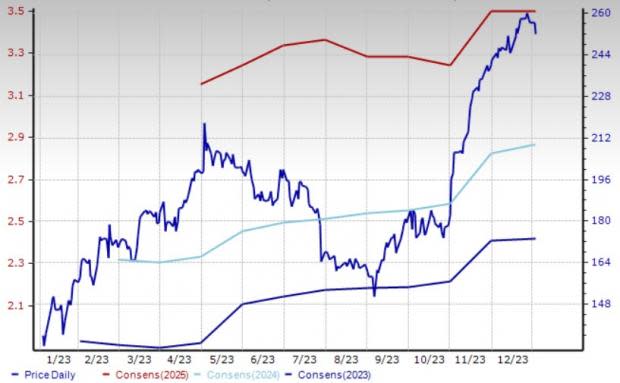

Brinker International: The company is notably benefiting from improved menu pricing and a favorable menu item mix. Margins expanded on the back of sales leverage, menu pricing, favorable commodity mix, lower delivery and off-premise supplies.

Shares of this Zacks Rank #2 company gained 23.7% in the past year. EAT’s sales and earnings for fiscal 2024 are anticipated to rise 3.5% and 9.5%, year over year, respectively.

Price and Consensus: EAT

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report