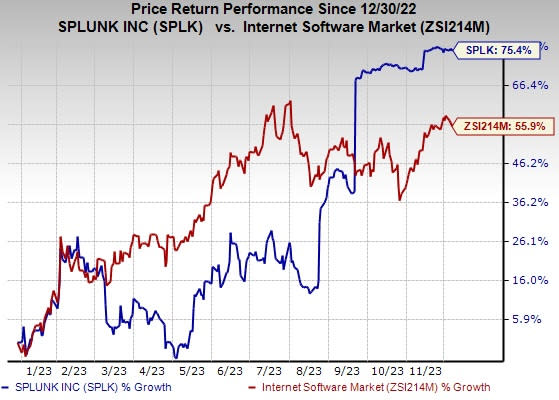

Splunk (SPLK) Soars 75% YTD: Primed for Further Appreciation?

Shares of Splunk Inc. SPLK have surged 75.4% year to date as it continues to gain traction from healthy customer engagement, evident from the competitive win rates alongside solid momentum with large orders overall. Earnings estimates for the current fiscal have soared 53% over the past year, while that for the next fiscal are up 39.1%, implying solid inherent growth potential. With healthy fundamentals, this Zacks Rank #3 (Hold) stock appears primed for further appreciation. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Growth Drivers

San Francisco, CA-based Splunk provides software solutions that enable enterprises to gain real-time operational intelligence by harnessing the value of their data. It enables users to investigate, monitor, analyze and act on machine data and big data, irrespective of format or source, and help in operational decision-making.

The company’s software has a broad range of applications, including security analytics, business analytics and IT operations. The valuable insight into machine and big data allows users/enterprises to improve service levels, reduce operational costs, mitigate security risks and maintain compliance. This has enabled the company to strengthen its market position.

Its software can be deployed in a wide variety of computing environments, from a single laptop to large globally distributed data centers as well as public, private and hybrid cloud environments. The company’s top line is benefiting from the high demand for its cloud solutions. Splunk’s ES (Enterprise Security) solutions also hold promise. Users leverage ES to centralize security management on a single platform and better handle the big data scale of their security operations center.

The company is also benefiting from the ongoing security threats and information and event management replacement cycle. Further, the company’s integration with Amazon Web Services (“AWS”) security hub to help customers accelerate detection, investigation and response to potential threats within their AWS security environment is likely to be a key catalyst in the long haul.

The company’s expense-control strategy and focus on improving operational efficiency have supported bottom-line growth. Splunk’s business transition from perpetual licenses to subscription or renewable model is expected to benefit it in the long run. It has been witnessing an increase in the number of renewable term contracts, which is a tailwind. Cloud annual recurring revenues (ARR) in third-quarter fiscal 2024 improved 15% year over year to $4 billion. The company had 851 customers with ARR of more than $1 million.

Splunk delivered an earnings surprise of 99.3%, on average, in the trailing four quarters and has a long-term earnings growth expectation of 29.6%. It has a VGM Score of B.

Key Picks

Comtech Telecommunications Corp. CMTL, carrying a Zacks Rank #2 (Buy), is a solid pick. Headquartered in Melville, NY, the company is a leading global provider of next-generation 911 emergency systems and secure wireless communications technologies to commercial and government customers.

Comtech’s key satellite earth station modems incorporate forward error correction and bandwidth compression technologies, which enable its customers to optimize their satellite networks by either reducing their satellite transponder lease costs or increasing data.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 20.4% and delivered an earnings surprise of 12%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

AudioCodes Ltd. AUDC sports a Zacks Rank #1. It has a long-term earnings growth expectation of 24.8% and delivered an earnings surprise of 14%, on average, in the trailing four quarters.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products, and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report