Rio Tinto (RIO) Proceeds for Full Ownership of Turquoise Hill

Rio Tinto plc RIO has entered into a binding agreement with Turquoise Hill to acquire the remaining 49% stake in the latter. Following the completion of the deal, RIO can hold a 66% interest in Oyu Tolgoi, one of the world’s largest known copper and gold deposits.

The independent directors of Turquoise Hill unanimously recommended that minority shareholders vote in favor of the C$43 per share offer. Also, senior officers at Turquoise Hill entered into voting support agreements with respect to all the Turquoise Hill shares they own or control. The deal will be implemented througha Canadian Plan of Arrangement and require the approval of 66.67% votes cast by all Turquoise Hill shareholders and a simple majority of the votes cast by its minority shareholders. A shareholders’ special meeting is expected in the fourth quarter of 2022. The deal is expected to close shortly after receiving the nod.

The deal is valued at $3.3 billion, which will be paid out of Rio Tinto’s existing cash reserves. RIO made its first offer on Mar 14, 2022, at C$34 of cash per share, which was subsequently raised to C$40. Both companies confirmed that the deal is now finally settled at C$43 per share. The agreed-on price represents a premium of 67% to Turquoise Hill’s closing share price on the Toronto Stock Exchange on Mar 11, 2022, a day prior to RIO’s first proposal.

Rio Tinto agreed to provide Turquoise Hill with secured short-term liquidity during the transaction period of up to $1.1 billion, subject to certain conditions. This will be repaid from an equity issue in the first half of 2023 if the transaction is not finally approved by shareholders. Per Turquoise Hill’s estimates, an additional funding of $3.6 billion is required to complete the project. It plans to fulfill the same through a funding plan, including renegotiating debt repayment dates, requiring the unanimous consent of participating lenders.

RIO currently has a 51% stake in Turquoise Hill, mainly focused on operating the Oyu Tolgoi copper-gold mine in Mongolia. Turquoise Hill has 66% ownership of the Oyu Tolgoi mine with the Government of Mongolia holding the remaining 34% stake. The deal will help simplify the Oyu Tolgoi ownership structure, while augmenting Rio Tinto’s copper portfolio. It will also help RIO work directly with the government of Mongolia to expedite the Oyu Tolgoi project.

Following the comprehensive agreement reached between Rio Tinto, Turquoise Hill and the government of Mongolia in January this year, underground operations are now underway at the Oyu Tolgoi project hub. The agreement unlocks the most valuable portion of the mine, with the first sustainable production expected in the first half of 2023. Once the underground project is complete, Oyu Tolgoi will be one of the biggest copper mines in the world. Production in its early years is estimated at around 500,000 tons.

This will aid Rio Tinto in capitalizing on growing demand for copper. Copper prices have been affected lately by heightened concerns over a global economic slowdown and the resurgent COVID-19 restrictions in China, top consumer of the metal.

Nevertheless, the long-term outlook for copper remains positive as copper demand is expected to grow, driven by electric vehicles and renewable energy plus infrastructure investments. However, grade decline, rising input costs, water constraints and scarcity of high-quality developmental opportunities continue to disrupt the industry's supply. This demand-supply imbalance will flare up copper prices.

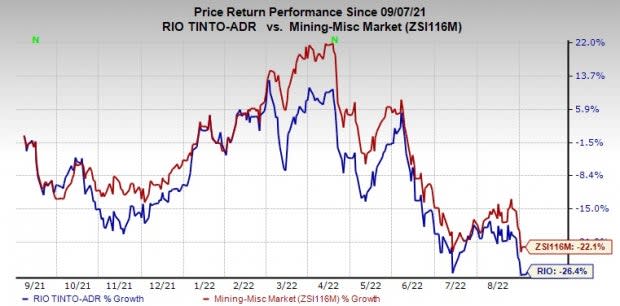

Price Performance

Image Source: Zacks Investment Research

In the past year, shares of Rio Tinto have fallen 26.4% compared with the industry’s decline of 22.1%.

Zacks Rank

Rio Tinto currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Albemarle Corporation ALB, Daqo New Energy Corp. DQ and Sociedad Quimica y MINERA de Chile S.A. SQM .

Albemarle has a projected earnings growth rate of 425.7% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 67.9% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. ALB has a trailing four-quarter earnings surprise of 24.2%, on average. ALB has gained around 11% in a year and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

Daqo New Energy, currently flaunting a Zacks Rank of 1, has an expected earnings growth rate of 177.5% for the current year. The Zacks Consensus Estimate for DQ's current fiscal year earnings has been revised 20.8% upward in the past 60 days.

Daqo New Energy’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, missing the mark in one, the average beat being 10.8%. DQ has gained around 1% over a year.

Sociedad has a projected earnings growth rate of 517.6% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 33.4% upward in the past 60 days.

Sociedad’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missing the mark in the remaining two, the average beat being 28.2%. SQM has rallied roughly 96% in a year. SQM carries a Zacks Rank #2 (Buy) at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rio Tinto PLC (RIO) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research