Here's Why Investors Should Buy AECOM (ACM) Stock for Now

AECOM ACM is expected to benefit from the clients' solid funding backdrop, including benefits from the $1.2-trillion infrastructure bill in the United States. Also, higher demand for solutions that help support customers' energy-transition efforts will continue to provide growth opportunities for AECOM.

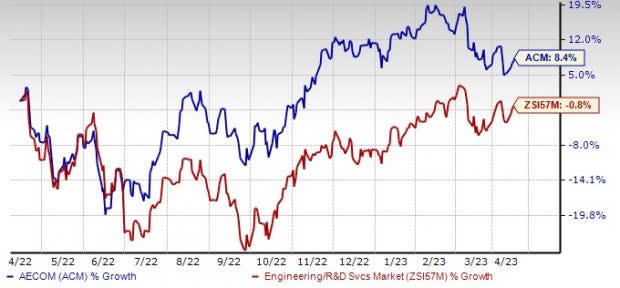

Shares of this leading solutions provider for supporting professional, technical and management solutions have gained 8.4% over the past year against the Zacks Engineering - R and D Services industry’s 0.8% decline.

Also, the fiscal 2023 earnings per share estimates for this Zacks Rank #2 (Buy) company have moved upward to $3.67 from $3.65 over the past 60 days. This positive trend signifies bullish analysts’ sentiments, indicating robust fundamentals and the expectation of outperformance in the near term.

Image Source: Zacks Investment Research

Let us delve into the growth drivers.

Strong Wins and Backlog: AECOM’s solid backlog level depicts good visibility of growth and pipelines for the upcoming quarters. In the last reported quarter, the company acknowledged that its continued high win rate, record design backlog, continued margin expansion and strong cash flow are a testament to the strength of the benefits of its technical expertise.

Contracted backlog, one of the best leading indicators for future growth, increased 1.7% in the first quarter of fiscal 2023, and the total backlog increased to $40.8 billion from $38.8 billion reported in the prior-year quarter. The design business had a 1.3 book-to-burn ratio, and the design backlog increased 9% to a record high, including strong growth in both the Americas and International markets.

Higher Infrastructural Spending: Strengthening funding backdrop backed by the benefits from the $1.2-trillion infrastructure bill in the United States, AECOM expects backlog to grow continuously. In the United States, the $1.2-trillion Infrastructure and Jobs Act marks a generational investment in the U.S. infrastructure. This bill provides the much-needed long-term funding certainty across the company’s strongest end markets, such as transit modernization, electrification, environmental remediation and climate resilience.

Also, the U.S. government passed its fiscal 2022 Omnibus Budget in March, which creates optimism around the pace of growth for AECOM’s government clients in the country in fiscal 2023.

The company’s net service revenues or NSR — defined as revenues excluding subcontractor and other direct costs — have been benefiting from strength across core transportation, water and environment markets. NSR for the first quarter of fiscal 2023 increased 8%, marking the eighth consecutive quarter of accelerating organic growth.

Superior Return on Equity (ROE): AECOM’s superior ROE is also indicative of growth potential. The company’s ROE currently stands at 18.5%. This compares favorably with an ROE of 8.8% for the industry it belongs to. This indicates efficiency in using its shareholders’ funds and AECOM’s ability to generate profit with minimum capital usage.

Push for Energy Transition: The company is prioritizing its investments in ESG or Environmental, Social and Governance. The company has been benefiting from the industry-leading position in green building and green design, environmental compliance and remediation, energy efficiency and infrastructure resilience.

Demand for AECOM’s technical, advisory and program management capabilities is increasing against a backdrop of an improving funding environment, which is highlighted by the recent passing of the federal infrastructure bill in the United States and rising demand for ESG-related services. These underpin the company’s expectation for accelerating revenue growth in fiscal 2023 and continued margin, adjusted EBITDA and adjusted earnings per share growth.

3 Other Top-Ranked Construction Stocks Hogging in the Limelight

Eagle Materials Inc. EXP — holding a Zacks Rank #2 — produces and supplies heavy construction materials and light building materials in the United States.

EXP’s expected earnings growth rate for fiscal 2023 is 29.4%. This company surpassed earnings estimates in three of the trailing four quarters but met on one occasion, with the average surprise being 4.1%.

Otis Worldwide Corporation OTIS — holding a Zacks Rank #2 — is one of the leading elevator and escalator manufacturing, installation and service companies. Otis’ primary focus on innovation is core to its strategy. The company connects global R&D efforts through an operating model that sets global and local priorities based on customer and segment needs. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company focuses on innovation and expansion of the digital ecosystem and a suite of digital solutions for existing service portfolio customers and new equipment shipments from factories.

OTIS surpassed earnings estimates in all the trailing four quarters, with the average surprise being 4.6%. The company’s earnings for 2023 are expected to increase 8.2%.

Masco Corporation MAS — holding a Zacks Rank #2 — manufactures, sells and installs home improvement and building products.

MAS benefits from its market-leading brands, acquisition synergies and cost-saving move. Notably, its solid long-term growth prospect amid slow housing demand is commendable. MAS’ VGM Score is A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Masco Corporation (MAS) : Free Stock Analysis Report

AECOM (ACM) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report