First Mover Americas: Crypto Traders Await Fed Meeting, Bitcoin Rises, Cathie Wood's Ark Dumps Coinbase Shares

Price Point: On the day of a Federal Reserve meeting, bitcoin trades higher alongside stock futures.

Market Moves: Cathie Wood's Ark Invest unloads Coinbase shares as the stock price falls; MicroStrategy's stock tumbles 11%.

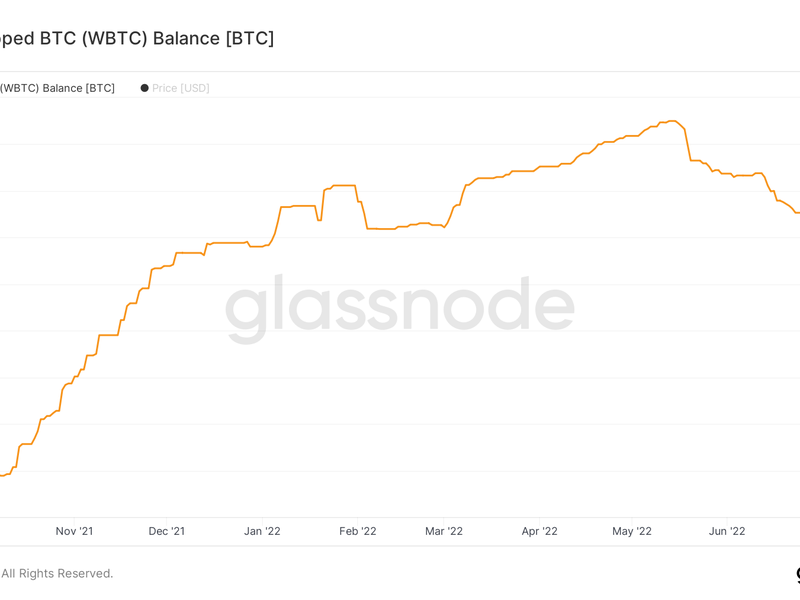

Chart of The Day: Balance of wrapped bitcoin (WBTC) drops to an eight-month low

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price Point

Bitcoin (BTC) traded higher on Wednesday, as stocks rose and the dollar dipped ahead of an expected Federal Reserve rate increase.

The top cryptocurrency by market value changed hands at $21,300 during the early U.S. hours for a 0.8% gain on a 24-hour basis. Futures tied to the S&P 500 rose 0.4% alongside similar gains in the major European equity indexes. The U.S. dollar index, which tracks the greenback’s value against major fiat currencies, slipped 0.2% to 106.97.

The Fed is expected to announce a second consecutive 75 basis points (0.75 percentage point) rate hike at 2 p.m. ET (18:00 UTC). Some observers said that the impending rate hike is priced in already and that bitcoin could see a relief rally following the announcement.

ING analysts expect the rate hike to put a floor under the dollar.

“Unless the Fed sends some dovish signals along the lines of the July policy announcement, we think that the 75 basis-point rate hike can fit well into a largely supportive dollar narrative on the monetary side,” ING analysts wrote last week.

Any post-Fed dollar strength might not bode well for bitcoin, as historically the cryptocurrency has exhibited an inverse correlation with the greenback.

“Bitcoin’s fortunes are negatively correlated with the underlying strength of the U.S. dollar, and so moves downwards on any sign of dollar strength,” Bitfinex market analysts said in an email.

Ether rises

Ether, the second-largest cryptocurrency by market capitalization, traded at $1,460, extending late Tuesday’s recovery from $1,350 to $1,440. Ethereum classic (ETC), an offshoot of ether, traded 14% higher, while the privacy-focused monero token (XMR) was up 7%. The losing side included such tokens as cosmos (ATOM), chainlink (LINK) and helium (HNT).

ONE, the native token of Harmony, an open-source blockchain for decentralized applications, traded 0.7% lower as developers proposed issuing ONE tokens to compensate for the losses from the hack of the platform's Horizon bridge in June.

In other news, the cryptocurrency exchange Kraken is facing a federal investigation for a potential violation of U.S. sanctions by allowing users in Iran and elsewhere to buy and sell digital tokens. Marco Santori, Kraken’s chief legal officer, told CoinDesk the exchange wouldn't comment "on specific discussions with regulators."

Elsewhere, financial services company and Bitmain partner Antalpha unveiled several miner-dedicated products like co-lending with other financiers.

Biggest Gainers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

Polygon | +8.9% | ||

Ethereum | +7.2% | ||

Terra | +5.4% |

Biggest Losers

There are no losers in CoinDesk 20 today.

Market Moves

Ark Invest Offloads Over 1.4M Coinbase Shares as COIN Price Falls; MSTR and MARA Drop 11%

By Greg Ahlstrand and Michael Bellusci

Three funds of noted investor Cathie Wood’s Ark Investment Management sold a total of more than 1.4 million shares of Coinbase Global on Tuesday, the firm said in its daily trading update email on Wednesday, Greg Ahlstrand and Michael Bellusci report.

The move comes almost three months after Ark bought more than half a million shares of the crypto exchange in May.

On Tuesday, Coinbase shares closed down 21% at $52.93. Based on that price, the value of the offloaded shares is over $75 million. Coinbase shares were trading 5.7% higher at $55.96 during after-hours trading.

“Coinbase was considered one of the better-run crypto companies that tried to obey the rules and work with the regulatory bodies,” Edward Moya, senior markets analyst at Oanda, said in a note Tuesday.

“The risk of tougher regulation has been a constant headache for crypto, and it seems that a couple of tough rulings could cripple a good portion of the crypto-verse. If some cryptos are deemed securities, that would make the life of so many brokerages so much harder,” Moya added.

Stocks of other crypto-related companies also fell on Tuesday. Shares of MicroStrategy, a software company that holds a large amount of bitcoin in its treasury, and Marathon Digital, a crypto mining company, declined about 11%.

Also read: Coinbase's 20% Decline Leads Crypto Names Lower Following Report of SEC Probe

Chart of the Day

The number of wrapped bitcoin (WBTC) balance has declined to 236,434, the lowest since Nov. 8, 2021, according to Glassnode.

The tally has dropped 17.2% since the collapse of Terra in mid-May.

“It’s likely related to Celsius’ repayment of their WBTC loan, and following redemptions prior to Chapter 11, at least the sharp decline in early July,” Vetle Lunde, an analyst at Arcane Research, told CoinDesk.

WBTC is the first ERC-20 token backed 1:1 with bitcoin and designed to act as a representation of the top cryptocurrency on the Ethereum blockchain.

Glassnode defines the WBTC balance as the amount of bitcoin held by BitGo, the custodian responsible for minting new WBTC ERC-20 tokens and guaranteeing backing of new ERC-20 tokens by actual BTC.

Latest Headlines

Unstoppable Domains Hits Unicorn Status With $65M Series A: The funding round was led by Pantera Capital with Polygon, CoinDCX and CoinGecko also contributing.

Ethereum’s Rollup Race: What is a ‘True’ zkEVM?: The ZK rollup race between Ethereum layer 2s Scroll, Polygon and Matter Labs may come down to definitions.

EY Has Built an Ethereum-Based Product to Help Firms Hit Carbon Accounting Goals: Enterprise users’ data-privacy concerns are less of a constraint when it comes to showing how supply chains are meeting their ESG mandates, said EY blockchain lead Paul Brody.

Crypto Traders Split on Upcoming Fed Rate Hike's Impact on Bitcoin: The Fed has raised rates by 150 basis points since March, injecting volatility into asset markets. Yet some analysts expect BTC to stay resilient after Wednesday's hike.

Top GOP Senator Slams SEC for Ignoring Crypto Inferno: U.S. Senator Pat Toomey (R-Pa.) sent a letter accusing the securities agency of failing to give regulatory clarity that could have prevented some of the recent industry damage.

EU Banking Regulator Worries It Can’t Find the Staff to Regulate Crypto, Financial Times Reports: José Manuel Campa, chair of the European Banking Authority, told the Financial Times he is worried the agency does not yet have the capacity to supervise digital assets.

Cathie Wood's Ark Invest Offloads Over 1.4M Coinbase Shares as COIN Price Falls: Coinbase shares have taken a big hit following disappointing results and a report that the company is being investigated by the U.S. Securities and Exchange Commission.