Cloud Services Stocks: The Key to Outperformance in 2024?

Prepare for a Strong Q4

Just last week, amidst a relatively sharp -8% correction in the S&P 500, investors were certain that something in the market was about to break. Three days later and stocks are suddenly screaming higher. What happened?

Admittedly, interest rates on long-term treasuries were reaching 16-year highs, and the Fed was sounding increasingly hawkish, but the signs of an imminent rally were forming. I personally noted a key technical level holding in the Nasdaq 100, sentiment was loudly bearish, and seasonality trends were strongly in favor of a bullish second half of October and Q4.

Image Source: TradingView

Dovishness on the Rise

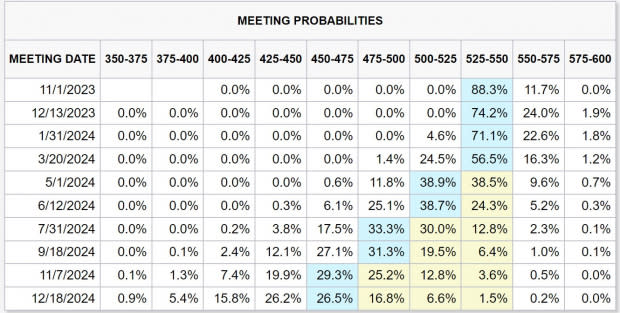

Furthermore, several other Zacks analysts were growing increasingly bullish, and most importantly, Fed Funds futures markets were quickly drifting more dovish. As of today, the market is pricing in three rate hikes in 2024, while just a week ago it was just one.

Image Source: CME Group

Forget Fear – Plan for the Future

Now that we have moved passed the extreme bearishness, investors should again focus on long-term trends rather than, week to week moves. The market consistently climbs the wall of worry. And don’t forget it.

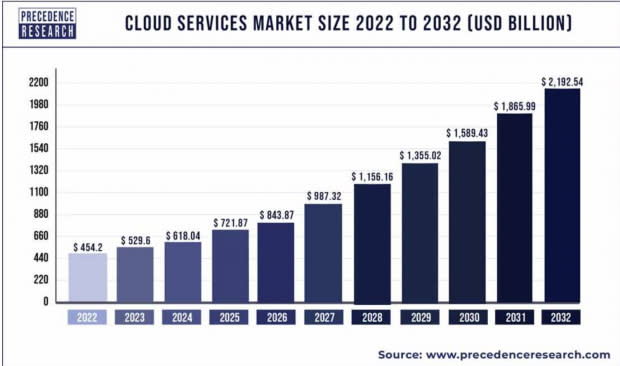

So where should investors look for big trends? Cloud computing and the services surrounding it is one of the fastest growing segments in the market, and with the explosion in Artificial Intelligence that trend may begin to accelerate. The Cloud Services market is projected to grow at a CAGR of 17% over the next 10 years.

Image Source: Precedence Research

Cloud Services

Amazon AMZN is the industry’s first mover and market share leader, while Alphabet GOOGL is the fastest growing of the big players.

Alphabet recently notched near 30% YoY revenue growth in its cloud services segment and expects EPS to grow 15.3% annually over the next 3-5 years.

Amazon enjoys a Zacks Rank #1 (Strong Buy) rating as well, with analysts unanimously raising earnings estimates across timeframes. EPS are forecast to grow an incredible 34% annually over the next 3-5 years.

I also have my eye on the descending wedge breakout in AMZN stock.

Image Source: TradingView

Cloud Security

Cloudflare NET, CrowdStrike CRWD, and Zscaler ZS are all cloud-based security solutions. CrowdStrike has a Zacks Rank #2 (Buy) rating, reflecting upward trending earnings revisions, and sales growth estimates of 35% in FY23.

Cloudflare expects to grow its EPS at 54% annually over the next 3-5 years and Zscaler is projecting 40% annual growth in EPS.

The breakout in CrowdStrike stock this week was emphatic.

Image Source: TradingView

Data

Then on top of cloud computing and security, AI power users are going to require robust data storage and manipulation capabilities. That’s where Datadog DDOG and MongoDB MDB come in.

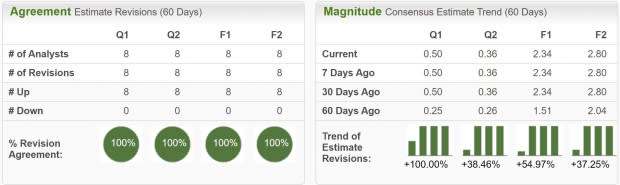

DataDog boasts a Zacks Rank #2 (Buy) rating and MongoDB has some incredible earnings estimate upgrades over the last two months, seen below. Both expect well above market sales and earnings growth.

Image Source: Zacks Investment Research

Bottom Line

While some of the direct AI investments may be a bit extended at this point, utilizing a picks and axes approach to investing in the sector may be the way to catch the next major leg higher.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report