Amdocs (DOX) to Support PLDT & Smart in IT Modernization Journey

Amdocs Limited DOX recently announced that Philippines-based PLDT Inc. and its mobile unit subsidiary, Smart Communications, Inc., have selected it to accelerate their cloud modernization on Amazon’s AMZN AWS (“Amazon Web Services”).

Through modernizing its IT infrastructure, PLDT intends to improve business agility and respond faster to market dynamics, drive innovations and provide an enhanced connected customer experience.

Per the latest multi-year collaboration agreement, Amdocs will seamlessly migrate the select business-critical systems and applications of PLDT and Smart to AWS. The company will use its new artificial intelligence (AI)-driven cloud operations platform to provide cloud strategy, planning consultancy, and cloud security and operations services.

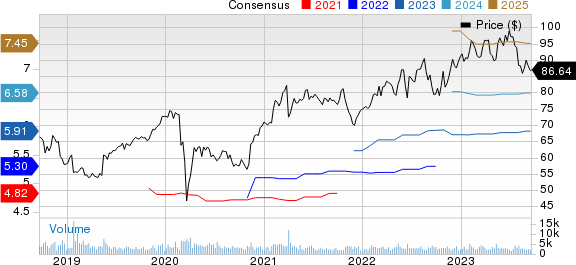

Amdocs Limited Price and Consensus

Amdocs Limited price-consensus-chart | Amdocs Limited Quote

The migration of critical systems and applications to AWS will help PLDT and Smart optimize and scale infrastructure performance and resources as needed. Additionally, the Philippines-based company and its subsidiary will benefit from the elasticity, agility, automation and performance of Amazon’s AWS cloud. The latest agreement also allows PLDT and Smart to use AWS’ breadth and depth of cloud services to build applications and manage their infrastructure.

Amdocs continues to expand its global client base by signing long-term contracts and collaborating with major telecom industry players worldwide. The company ended the third quarter of fiscal 2023 with a 12-month backlog of $4.14 billion, up $30 million sequentially and $190 million year over year.

Currently, Amdocs' growth momentum is anticipated to continue due to its initiatives aimed at aiding digital, media, and network and cloud transformations of its clients. Our estimate for Amdocs’ top line suggests a CAGR of 7.2% over the next three fiscal years.

However, the company is highly susceptible to foreign currency exchange rate risks. It expects foreign exchange fluctuations to continue affecting top-line performance in the near term. Economic and political uncertainty remains an overhang on Amdocs’ financials.

Zacks Rank & Stocks to Consider

Amdocs currently carries a Zacks Rank #4 (Sell), while Amazon sports a Zacks Rank #1 (Strong Buy). Shares of DOX have declined 4.7% year to date (YTD), while AMZN stock has surged 66.7%.

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA and Manhattan Associates MANH, each sporting a Zacks Rank #1. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA's third-quarter fiscal 2024 earnings has been revised upward by 48.2% to $3.32 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 36.3% cents to $10.67 per share in the past 30 days.

NVIDIA’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing on one occasion, the average surprise being 9.8%. Shares of NVDA have surged 200.9% YTD.

The Zacks Consensus Estimate for Manhattan Associates’ third-quarter 2023 earnings has been revised 5 cents northward to 77 cents per share in the past 60 days. For 2023, earnings estimates have moved 22 cents upward to $3.09 per share in the past 60 days.

Manhattan Associates’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 31.6%. Shares of MANH have surged 66.4% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Amdocs Limited (DOX) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report