In SRC’s US$1.1b suit against Najib, ex-banker says doubted if firm’s directors knew about money being moved around

KUALA LUMPUR, March 6 — Former Singapore-based banker Kevin Michael Swampillai said one of the suspicions raised by BSI Bank Singapore’s compliance department was whether SRC International (Malaysia) Limited’s (SRC BVI) board was truly informed of the millions being funnelled through the bank.

Swampillai was testifying as the first witness in SRC International Sdn Bhd’s US$1.18 billion (RM5.58 billion) civil suit against former prime minister Datuk Seri Najib Razak.

Under cross-examination by Najib’s counsel Harvinderjit Singh, Swampillai insisted he had escalated his suspicions to his superiors on the purportedly fraudulent transactions executed by SRC International (Malaysia) Limited totalling US$864.5 million between November 2011 and April 2012.

When asked if he had knowledge of what the entity was about, Swampillai replied in the affirmative.

Having said that, Swampillai said suspicious transaction reports (STR) were the responsibilities of the bank’s compliance department and the Client Acceptance Committee (CAC)

“The CAC has the responsibility, and in the case of politically exposed clients, to monitor their transactions and activities.

“Having said that, I did raise my suspicion about these transactions to my supervisor, which was tendered as evidence in court (in another trial).

“I was concerned because we did not know where the money was going and had no visibility where they ended up, and my concerns were raised because the number of transactions undertaken by SRC were going to be quite frequent, but no action was taken by the senior management of the bank,” he said.

As for the bank’s standard operating procedure of conducting the relevant know-your-client (KYC) and anti-money-laundering (AML) checks, Swampillai said the matter was not within his job responsibilities and thus ‘completely outside of his purview’.

Yesterday, Swampillai testified that the now-shuttered BSI Bank Singapore had failed to comply with their legal obligations to disclose sham transactions from SRC International (Malaysia) Limited to Singaporean authorities, attributing their oversight to being “seduced” by the fees it was earning.

He admitted that the bank had indeed failed to report to the Commercial Affairs Department of the Singapore Police Force and Monetary Authority of Singapore (MAS) at the material time pertaining to said sham transactions totalling US$864.5 million between November 2011 and April 2012.

Swampillai also testified that to his knowledge, Malaysian businessman-turned-fugitive Low Taek Jho or Jho Low had rendered instructions to his former subordinate Yak Yew Chee and written instructions from SRC BVI’s authorised signatories in dealing with any transactions.

In his witness statement, Swampillai described Yak as the relationship manager at BSI for several clients including Low and 1MDB-related entities such as SRC BVI, 1MDB Global Investment Limited, Brazen Sky Limited and Aabar Investments PJS Limited which engaged BSI’s services to structure pass-through transactions and to layer substantial sums of monies through the use of intermediary fund management companies between 2011 and 2014.

To a question whether he had met any of SRC BVI’s board of directors or had any intentions to do so at the material time, Swampillai replied to both in the negative.

He also agreed to Harvinderjit’s suggestion that such unusualness in the transactions would elicit some form of reasonable endeavours by the board to enquire into it, adding that he had always assumed there was already an existing governance structure within the company.

Former prime minister Datuk Seri Najib Razak arrives at the Kuala Lumpur High Court Complex March 6, 2024. — Picture by Yusof Mat Isa

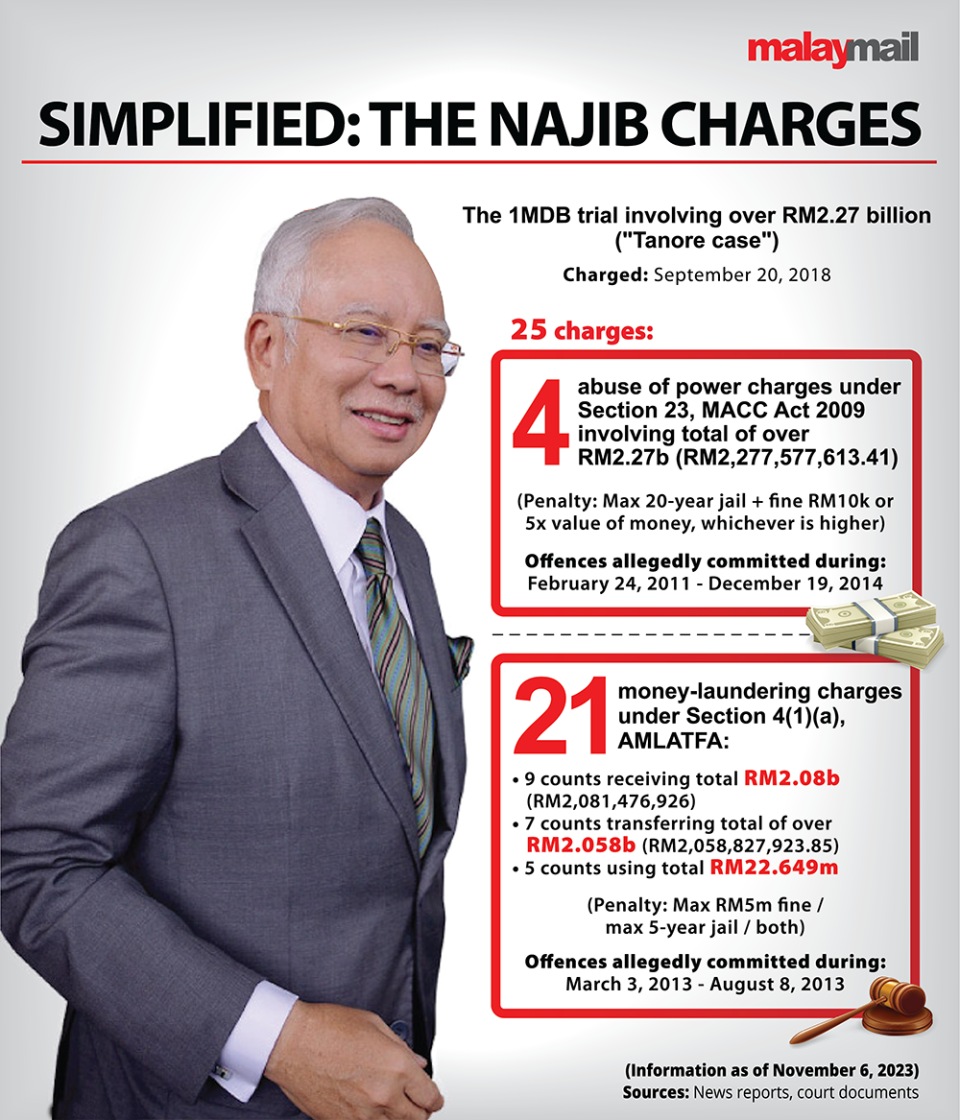

Imprisoned since August 23, 2022, Najib is serving his 12-year jail sentence and RM210 million fine for his conviction over the misappropriation of SRC International’s RM42 million funds, which has recently been reduced to six years of jail and RM50 million fine by the Pardons Board.

SRC, under its new management, had filed legal action against Najib and its former directors Datuk Suboh Md Yassin, Datuk Mohammed Azhar Osman Khairuddin, Nik Faisal Ariff Kamil, Datuk Che Abdullah @ Rashidi Che Omar, Datuk Shahrol Azral Ibrahim Halmi and Tan Sri Ismee Ismail in May 2021.

However, later, it removed six names from the suit and retained Najib as defendant.

Additionally, Najib has brought the former named SRC International directors as third-party respondents.

SRC as a plaintiff in the writ of summons had alleged that Najib had abused his power and obtained personal benefits from SRC International’s funds as well as misappropriated the funds. Najib was SRC’s Emeritus Advisor from May 1, 2012, until March 4, 2019.

SRC International, which is now wholly owned by the Ministry of Finance Incorporated (MoF Inc), is seeking general damages, exemplary, additional and interest, costs and other appropriate relief provided by the court.

SRC International is currently seeking a declaration from the court that Naijib is liable to account for the company’s losses due to his breach of duties and trust.

The company is also seeking an order that Najib pay the US$1.18 billion in losses it suffered, and damages for breach of duties and trust; including an order that Najib compensate the sum of US$120 million as well.