Reasons Why Genpact (G) Stock Should be Retained Right Now

Genpact G holds a prominent position in the BPO services market, leveraging expertise in business analytics, digital and consulting services. The company recognizes a substantial growth opportunity in Artificial Intelligence. Genpact's commitment to consistently rewarding shareholders through dividends and share repurchases enhances investor confidence and positively influences earnings per share.

Genpact has an impressive Value Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

Factors in Favor

Genpact stands out in the BPO services market due to its expertise in business analytics, digital solutions and consulting. As a prominent provider, the company delivers specialized solutions for the Industrial Internet of Things, user experience, supply-chain management, data engineering, risk management and more. Genpact's success lies in integrating processes, analytics and digital technologies, thus attracting a growing customer base. Anticipating continued growth, we foresee an expansion in clientele, rigorous cost management, strategic acquisitions and proactive share repurchases contributing to long-term success. In 2023, we projected a 1.8% year-over-year increase in the company's revenues.

We appreciate Genpact's commitment to enhancing shareholder value through share repurchases and dividend payments. In 2022, 2021 and 2020, the company bought back shares amounting to $214.1 million, $298.2 million and $137.1 million, respectively. Additionally, dividends paid to shareholders in 2022, 2021 and 2020 were $91.8 million, $80.5 million and $74.2 million, respectively. These shareholder-friendly initiatives underscore Genpact's dedication to creating value and demonstrating confidence in its business.

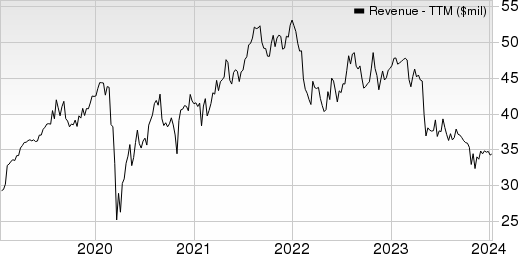

Genpact Limited Revenue (TTM)

Genpact Limited revenue-ttm | Genpact Limited Quote

Artificial Intelligence (AI) has emerged as a key growth prospect for Genpact. The integration of generative AI into its Enterprise360 intelligence platform is elevating operational efficiency for global clients. This platform seamlessly blends digital tools and standardized processes, providing businesses with the capability to tackle operational challenges and optimize overall performance.

Genpact's playbook, titled "FMOps – The Generative AI Imperative for Production," provides practical guidance on developing ethical and scalable generative AI solutions. This guide facilitates the transition from experimental pilot projects to full-scale production. The initiative underscores Genpact's dedication to instigating transformative change and delivering substantial value through the strategic incorporation of generative AI across various industries.

Some Risks

The outsourcing sector, characterized by its reliance on foreign talent, is labor-intensive. The industry's growth may face constraints as increasing competition elevates talent costs. Genpact, as a key player in this sector, is anticipated to be impacted by these developments.

Genpact encounters notable client concentration concerning geographic locations. In 2022, more than 50% of the company's revenues originated from clients in India, while more than 20% of clients were from North and Latin America. Furthermore, more than 35% of Genpact's revenues in 2022 came from clients in the High Tech and Manufacturing industry. This reliance on a specific industry poses a long-term concern for investors, in our view.

G currently has Zacks Rank #3 (Hold).

Stocks to Consider

The following stocks from the broader Business Services sector are worth consideration:

Clean Harbors CLH carries a current Zacks Rank of 2 and a VGM Score of A. The Zacks Consensus Estimate of the company’s revenues for 2023 is pegged at $5.42 billion, up 5% from the year-ago figure. The consensus mark for earnings is pegged at $6.81 per share, which indicates a decline of 4.8%.

CLH beat the Zacks Consensus Estimate in three of the past four quarters and missed on one instance, with an average surprise of 3.2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Broadridge Financial Solutions BR carries a current Zacks Rank of 2. The Zacks Consensus Estimate of the company’s revenues for 2023 is pegged at $6.53 billion, up 7.7% from the year-ago figure. The consensus mark for earnings is pegged at $7.72 per share, which indicates an increase of 10.1%.

BR beat the Zacks Consensus Estimate in three of the past four quarters and matched on one instance, with an average surprise of 3.2%.

ABM Industries ABM carries a current Zacks Rank of 2 and a VGM Score of 2. The Zacks Consensus Estimate of the company’s revenues for 2023 is pegged at $8.14 billion, slightly higher than the year-ago figure. The consensus mark for earnings is pegged at $3.32 per share, which indicates a decline of 5.1%.

ABM beat the Zacks Consensus Estimate in three of the past four quarters and missed on one instance, with an average surprise of 1.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

ABM Industries Incorporated (ABM) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report