Oracle (ORCL), NVIDIA Expanded Partnership Comes With AI Focus

Oracle ORCL announced an expanded, multiyear partnership with Nvidia NVDA at Oracle CloudWorld to help customers accelerate artificial intelligence (AI) adoption. The collaboration will bring Nvidia’s full accelerated computing stack — from GPUs to systems to software — to Oracle Cloud Infrastructure (OCI).

OCI will add tens of thousands of Nvidia GPUs, including the A100 and upcoming H100, to its capacity. Enterprises will also get a broad, accessible portfolio of options for AI training and deep learning.

Nvidia and Oracle plan to make an upcoming release of Nvidia AI Enterprise available on OCI, offering customers access to Nvidia’s accelerated, secure and scalable platform for end-to-end AI development and deployment.

Oracle is also offering early access to Nvidia RAPIDS acceleration for Apache Spark data, processing on the OCI Data Flow fully managed Apache Spark service.

Data processing is one of the top cloud computing workloads. To support this demand, OCI Data Science plans to offer support for OCI bare-metal shapes, including BM.GPU.GM4.8 with Nvidia A100 Tensor Core GPUs, across managed notebook sessions, jobs and model deployment.

The announcements fall into three broad categories. One is taking advantage of Nvidia AI software and layering it on to Oracle’s AI strategy. Oracle is focused on an Nvidia GPU solution that allows it to train AI models at scale. Lastly, Oracle is focusing on a real-time GPU, using the Nvidia MPI technology. The training and AI models at scale from a performance perspective allow Oracle to create an entire AI narrative.

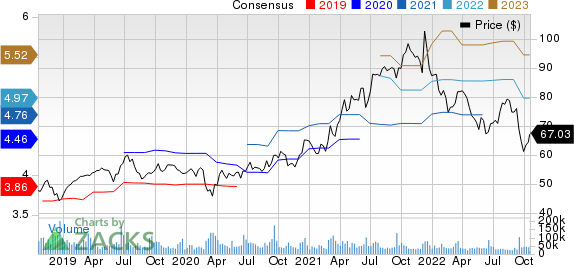

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

Is Oracle's Cloud Strategy Headed in the Right Direction?

Oracle is striving hard to strengthen its position in the lucrative cloud space. Oracle shares have declined 23.2% in the year-to-date period compared with the Zacks Computer - Software industry’s decline of 31.6%.

As part of Oracle’s planned expansion of its cloud region footprint to support strong customer demand for OCI and Oracle Fusion Cloud Applications services worldwide, Oracle aims to open additional cloud regions in Colombia, Chile, and Israel and plans to offer at least 44 cloud regions.

In first-quarter 2023, Oracle's total quarterly revenues were up 18% year over year, largely due to a 14% increase in cloud services and license support subscriptions. Total cloud services and license revenues for the quarter hit $8.4 billion — driven by Oracle Fusion Cloud, Oracle Autonomous Database and OCI Gen 2.

Nvidia Clara, a healthcare AI and HPC application framework for medical imaging, genomics, natural language processing and drug discovery, will be coming soon. Oracle and Nvidia are also collaborating on new AI-accelerated Oracle Cerner offerings for healthcare, spanning areas such as analytics, clinical solutions, operations and patient management systems.

An expanding clientele is enabling the company to maintain its leading position in the cloud ERP market. The healthy adoption of cloud-based applications, comprising NetSuite Enterprise Resource Planning (ERP), Fusion ERP and Fusion Human Capital Management (HCM), bode well for the long term.

Partnerships with Accenture, Microsoft MSFT and VMware VMW are helping Oracle to win new clientele. The company’s share buybacks and dividend policy are noteworthy.

Last quarter, Microsoft and Oracle delivered a high-speed interconnection between Azure and Oracle's cloud to give Azure customers direct access to Oracle databases. Multi-cloud interoperability is a major contributor to the growth of Oracle Database and Oracle's MySQL HeatWave database.

Oracle’s partnership with VMware for Oracle Cloud VMware Solution has been gaining prominence, which is expected to have aided customer growth in the to-be-reported quarter. The solution has gained popularity among leading enterprises in retail, telecommunication, finance and banking, manufacturing, government and others.

This Zacks Rank #4 (Sell) company’s higher spending on product enhancements, especially on the cloud platform, amid increasing competition, is likely to limit margin expansion in the near term.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

VMware, Inc. (VMW) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research