Lockheed (LMT) Wins Contract to Support CH-53K Helicopters

Lockheed Martin Corp.’s LMT business unit, Sikorsky, secured a contract involving its CH-53K helicopter. The award has been offered by the Naval Supply Systems Command Weapon Systems Support, Philadelphia, PA.

Valued at $21.7 million, the contract is expected to be completed by March 2029. Per the terms of the deal, Lockheed will procure four swashplate assemblies and 28 rotary blade sleeves for CH-53K helicopters.

Work related to this contract will be carried out in Stratford, CT.

Significance of CH-53K Helicopter

CH-53K aircraft is designed to be intelligent, reliable, low maintenance and survivable in the most austere and remote forward operating bases. The helicopter has been designed and built to the exact standards of the U.S. Marine Corps and serves as the combat force’s critical land and sea-based logistics connector.

With its unrivaled speed, lift capacity and maneuverability, the CH-53K can complete the most demanding mission requirements in less time with fewer sorties than other helicopters in its class.

Such remarkable features have led to an increased demand for this helicopter, thereby resulting in a steady inflow of orders for LMT, like the latest one. This tends to boost the company’s revenue generation prospects.

Growth Prospects

Nations across the globe are increasingly focusing on enhancing their national security and investing heftily to keep their armed forces technologically advanced in order to make them capable of responding to evolving threats.

In this context, it is imperative to mention that military helicopters are witnessing significant demand lately owing to their adaptability, which makes them valuable in a wide range of military operations. Modern military helicopters are equipped with advanced sensors and communication system, which provide military missions with an added advantage.

Per a report from the Mordor Intelligence firm, the military rotorcraft market is likely to witness a CAGR of more than 4% during the 2023-2028 period. This should contribute to LMT’s growth prospects as the company enjoys a dominant position in the military rotorcraft market with its portfolio containing programs like Black Hawk, Seahawk and CH-53K King Stallion heavy-lift helicopters.

Other defense companies that may enjoy the perks of the expanding military rotorcraft market have been discussed below.

Boeing BA: The company’s military rotorcraft is renowned worldwide for its leading-edge, ready and relevant solutions that deliver proven capabilities. Boeing’s product portfolio includes combat helicopter and rotorcraft like CH-47 Chinook, AH-64 Apache, AH-6 Little Bird and V-22 Osprey.

Boeing has a long-term earnings growth rate of 4%. The stock gained 52.3% in the past year.

Airbus Group EADSY: It is one of the world's largest suppliers of advanced military helicopters. Its product portfolio includes the H135 combat helicopter, the H145M helicopter, AS565 MBe, H160M, H175M, H215M, H225M and a few more.

Airbus’ long-term earnings growth rate is 12.4%. Shares of EADSY returned 49.3% to its investors in the past year.

Textron TXT: Its Bell unit is one of the leading suppliers of helicopters to the U.S. government. In association with Boeing, this unit is the only supplier of military tiltrotor aircraft. Some of TXT’s key programs include the AH-1Z helicopter, V-22 tiltrotor, V-247, etc.

Textron boasts a long-term earnings growth rate of 11.7%. The TXT stock returned 31.1% to its investors in the past year.

Price Movement

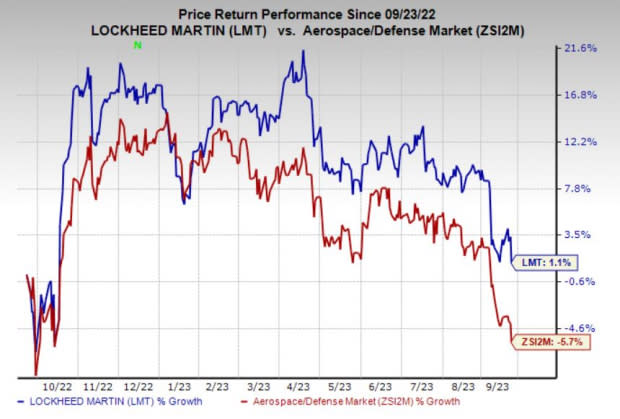

Shares of Lockheed rose 1.1% in the previous year against the industry’s 5.7% decline.

Image Source: Zacks Investment Research

Zacks Rank

Lockheed currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report