Kroger Q2 Preview: Can Shares Stay Hot?

Year-to-date, the Zacks Retail and Wholesale Sector has been hit hard, down more than 20% and widely lagging behind the S&P 500.

Image Source: Zacks Investment Research

A company in the sector, The Kroger Co. KR, is on deck to unveil Q2 earnings on Friday, September 9th, before the market open.

Founded in 1883, the long-time retailer operates approximately 2,700 retail stores under its various banners and divisions in 35 states.

In addition, Kroger has undergone an extensive makeover, not only regarding products but also in terms of how consumers prefer shopping for groceries.

As it stands, KR sports a Zacks Rank #2 (Buy) with an overall VGM Score of an A. Right off the bat, this is a pairing that you love to see.

Still, how does the grocery titan stack up heading into the print? Let’s dive in and find out.

Share Performance & Valuation

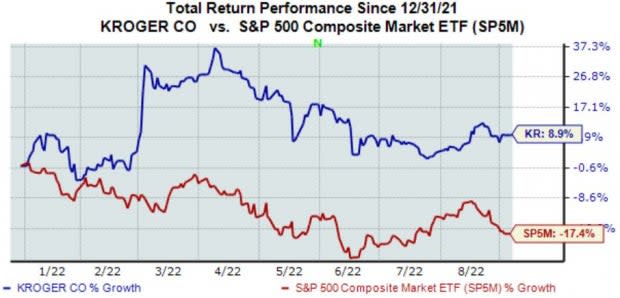

KR shares have been notably hot in 2022, up nearly 9% and crushing the S&P 500’s decline of more than 17%.

Image Source: Zacks Investment Research

Over the last month, Kroger shares have continued on their market-beating trajectory, tacking on nearly 4% in value vs. the S&P 500’s decline of 5%.

Image Source: Zacks Investment Research

The immense relative strength that Kroger shares have displayed tells us that buyers have defended the stock at a much higher level than most, which is certainly not true for the majority of stocks in 2022.

In addition, KR shares trade at enticing valuation levels, further bolstered by its Style Score of an A for Value.

KR’s 12.3X forward earnings multiple resides just below its five-year median of 12.6X and represents a rich 51% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Quarterly Estimates

A singular analyst has raised their earnings outlook over the last 60 days, with the Consensus Estimate Trend inching up a marginal 1.3%. The Zacks Consensus EPS Estimate of $0.81 reflects a respectable 1.3% Y/Y uptick in earnings.

Image Source: Zacks Investment Research

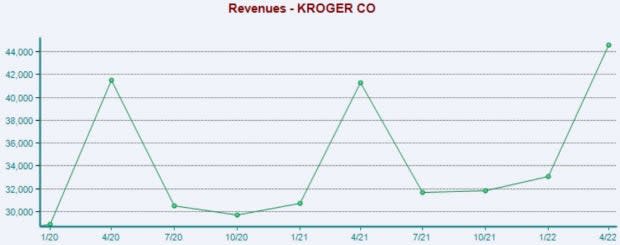

The company’s top-line is also in fantastic shape – Kroger is forecasted to have generated a mighty $34.4 billion in quarterly revenue, penciling in a robust 8.5% uptick from year-ago quarterly sales of $31.7 billion.

Quarterly Performance & Market Reactions

KR has consistently exceeded bottom-line estimates, surpassing the Zacks Consensus EPS Estimate in ten consecutive quarters. Just in its latest print, the company penciled in a strong 13% bottom-line beat in the face of adverse business conditions.

Top-line results have also been mighty strong, with Kroger exceeding revenue estimates in five consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, KR shares have moved upwards following four of its last six quarterly prints. However, shares fell 9% following its most recent release.

Putting Everything Together

Kroger shares have provided market-beating returns across several timeframes, indicating that buyers have been busy.

The company carries solid valuation levels, held down by its Style Score of an A for Value.

A singular analyst has upped their earnings outlook for the quarter, and estimates reflect solid growth within both revenue and earnings.

Further, Kroger has consistently exceeded quarterly estimates, and the market has liked what it’s seen from the majority of its previous six releases.

Heading into the print, The Kroger Co. KR carries a Zacks Rank #2 (Buy) with an Earnings ESP Score of 4.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Kroger Co. (KR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research