Jounce (JNCE) SELECT Study Fails to Meet Goal, Stock Down

Shares of Jounce Therapeutics JNCE were down 15.85% after the company announced that the phase II SELECT trial was unsuccessful.

The mid-stage SELECT study is evaluating vopratelimab, Jounce’s inducible costimulator (ICOS) agonist, in combination with pimivalimab versus pimivalimab alone in immunotherapy naïve, second-line non-small cell lung cancer (NSCLC) patients.

Vopratelimab is a clinical-stage monoclonal antibody that binds to and activates ICOS, the Inducible T cell CO-Stimulator, a protein on the surface of certain T cells commonly found in many solid tumors. Pimivalimab (formerly JTX-4014) is a well-characterized fully human IgG4 monoclonal antibody designed to block binding to PD-L1 and PD-L2.

The study evaluated two pulsatile and differentiated doses of vopratelimab in the combination groups against pimivalimab monotherapy, using as the primary endpoint the mean percent change from baseline in tumor size in all measurable lesions, averaged over 9 and 18 weeks as assessed by central independent radiology review.

However, the SELECT study did not meet its primary endpoint as it was powered to detect a 20% absolute difference in the pooled combo doses compared to pimivalimab monotherapy. The actual difference was 7%.

Nevertheless, encouraging trends in improved mean tumor change over 9 and 18 weeks, and secondary endpoints of overall response rate (ORR) and progression-free survival (PFS) were observed in the low dose vopratelimab arm in combination with pimivalimab compared to pimivalimab alone.

Pimivalimab monotherapy continues to demonstrate safety and clinical activity.

Despite these observations, management decided that the SELECT results do not support moving into registration studies as had been their previous goal.

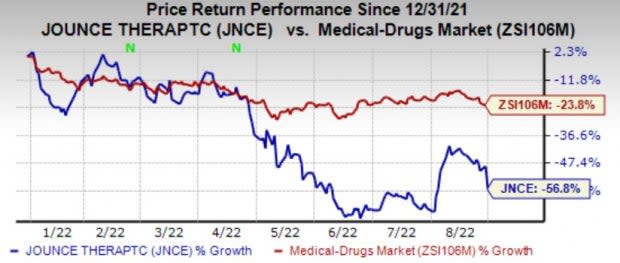

Investors were disappointed with the results as vopratelimab is Jounce’s most advanced product candidate. Shares of the company have plunged 56.8% compared with the industry’s decline of 23.8%.

Image Source: Zacks Investment Research

Jounce’s highest priority program, JTX-8064, is a LILRB2 (ILT4) receptor antagonist shown to reprogram immune-suppressive tumor-associated macrophages to an anti-tumor state in preclinical studies.

JTX-8064 is being evaluated alone and in combination with pimivalimabp in one monotherapy and seven indication-specific combination therapy cohorts in the phase I/II INNATE study. It is currently enrolling patients with advanced solid tumors in the phase II portion of the study.

In 2020, Jounce entered into a license agreement with biotech bigwig Gilead Sciences, Inc. GILD whereby it out-licensed GS-1811 (formerly JTX-1811) program to GILD. Jounce and Gilead also entered into a stock purchase agreement.

In exchange, Gilead paid Jounce a one-time, non-refundable upfront payment of $85.0 million.

Zacks Rank & Stocks to Consider

Jounce currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the sector are Bolt Pharmaceuticals BOLT and Dynavax DVAX. Both carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Loss estimates for BOLT have narrowed to $2.54 from $2.87 in the past 60 days. BOLT surpassed earnings in three of the trailing four quarters, the average being 2.39%.

Dynavax’s earnings estimates have increased to $1.73 from $1.14 for 2022 over the past 60 days. Earnings of Dynavax have surpassed estimates in two of the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Jounce Therapeutics, Inc. (JNCE) : Free Stock Analysis Report

Bolt Biotherapeutics, Inc. (BOLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research