ExxonMobil (XOM) Enters Deal to Divest Fayetteville Assets

Exxon Mobil Corporation XOM entered an agreement to divest its Fayetteville Shale assets in Arkansas to Flywheel Energy, per a report by Reuters.

Flywheel Energy is an upstream energy company formed to acquire and operate onshore oil and gas assets in the United States, with a strong focus on the Fayetteville Shale.

In 2010, ExxonMobil acquired Fayetteville assets during a boom in oil and gas production from shale formations that reshaped the U.S. energy landscape.

Per the terms of the deal, the divested assets involve almost 5,000 natural gas wells, of which 850 are operated and 4,100 are non-operated. The assets under the agreement also involve related pipeline and processing properties across 381,000 acres.

In 2020, ExxonMobil announced plans to offer its Fayetteville and other U.S. shale assets aside from the Permian Basin. Last year, the company restarted its asset divestment program as energy prices regained from the recovery in energy demand following the easing of lockdown measures.

ExxonMobil has been offloading assets in Asia, Africa and Europe for offshore Guyana and Brazil, and shale oil in the Permian Basin of West Texas and New Mexico. Earlier this year, the company divested its operated and non-operated Barnett Shale gas assets in Texas to Denver-based BKV Corporation for $750 million. The divestment supports its strategy to focus on more profitable assets with the lowest supply costs.

Asset divestments are crucial components of ExxonMobil’s strategy to optimize cash management. The sale of the Fayetteville Shale assets brings it closer to its goal of raising $15 billion from asset divestments to reduce debt and focus on low-cost oil production. Notably, the value of the agreement has not yet been determined.

The divestment, subject to regulatory and other approvals, is expected to close by the end of October this year.

Company Profile & Price Performance

Headquartered in Irving, TX, ExxonMobil is one of the leading integrated energy companies in the world.

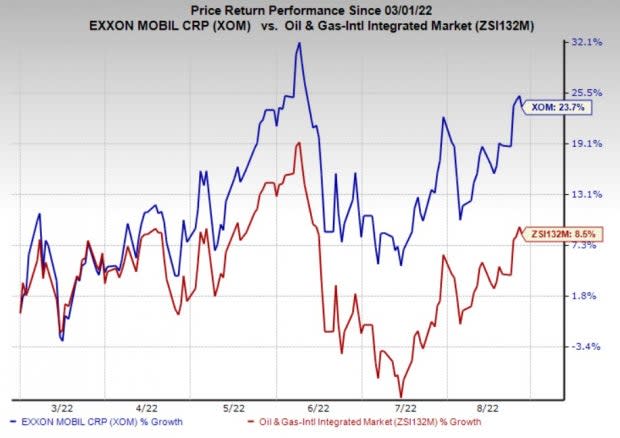

Shares of ExxonMobil have outperformed the industry in the past six months. The stock has gained 23.7% compared with the industry’s 8.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

ExxonMobil currently sports a Zack Rank #1 (Strong Buy).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Liberty Energy LBRT offers hydraulic fracturing services to onshore upstream energy companies across multiple basins in North America. LBRT’s debt-to-capitalization stands at just 16% compared with many of its peers that are hugely burdened with debts, accounting for around 50% of their total capital structure.

Liberty Energy has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Growth and B for Value. LBRT is expected to see earnings growth of 266.7% for 2022.

Equinor ASA EQNR is one of the premier integrated energy companies in the world. For 2022, Equinor announced the increase of the share buy-back program of up to $6 billion from the prior stated $5 billion. This reflects the firm’s strong commitment to returning capital to shareholders.

Equinor has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Growth and Value. EQNR is expected to see earnings growth of 104.9% for 2022.

Petrobras S.A. PBR is the largest integrated energy firm in Brazil. As the company focuses on regaining its financial footing by selling assets and curtailing debt load, it successfully managed to lower gross debt below its 2022 target of $60 billion in the third quarter of 2021, well ahead of time. Post the latest quarterly earnings, the figure stands at $53.6 billion.

Petrobras has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Value and B for Growth. PBR is expected to see earnings growth of 128.2% for 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Equinor ASA (EQNR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research