Danaher (DHR) to Spin-Off Environmental Unit, Shares Pop

Danaher Corporation DHR has announced that it will separate its Environmental & Applied Solutions ("EAS") segment into an independent public company. The spin-off will help the company focus on its Life Sciences (major revenue generator) and Diagnostics segments. Following this news, shares of the company popped 4.4% in after-hours trading on Sep 14.

The new EAS company will comprise the operations of Danaher’s Water Quality and Product Identification businesses. It will include the existing Environmental & Applied Solutions segment’s companies such as Hach, ChemTreat, Trojan, OTT and McCrometer in Water Quality and Videojet, X-Rite Pantone, Esko and Linx in Product Identification. The unit generated revenues of approximately $4.7 billion (around 16% of the top line) in 2021.

Rainer M. Blair, president and chief executive officer of Danaher, said, "We believe that EAS will be advantaged as a standalone company with greater opportunities to pursue high-impact organic and inorganic investments." The tax-free spin-off is expected to be completed in the fourth quarter of 2023.

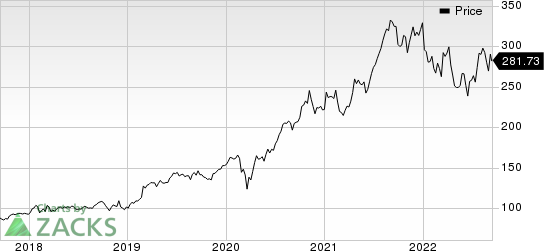

Danaher Corporation Price

Danaher Corporation price | Danaher Corporation Quote

Jennifer L. Honeycutt will head EAS as its president and chief executive officer. Currently serving as the executive vice president of Danaher, Honeycutt also oversees the Environmental & Applied Solutions segment.

On a separate note, Danaher said that it will provide an update on its third-quarter 2022 performance at an investor and analyst event today. Blair is expected to communicate that the company anticipates core revenue growth above the prior guidance of low-single digits for the third quarter.

The improvement is due to expectations of higher Cepheid respiratory testing revenues of more than $500 million in the third quarter compared with the prior view of approximately $325 million. DHR continues to expect base business core revenue growth of high-single digits for the third quarter.

Zacks Rank & Key Picks

Danaher presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the Conglomerates sector are as follows:

Carlisle Companies CSL currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for CSL’s 2022 earnings has been revised upward by 14.6% in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks.

Carlisle has an estimated earnings growth rate of 114.4% for the current year. Shares of CSL have rallied 30% in the past three months.

Icahn Enterprises IEP presently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for IEP’s 2022 earnings has been revised upward by more than 100% in the past 60 days.

Icahn Enterprises has an estimated earnings growth rate of 144.4% for the current year. Shares of IEP have gained 6% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Danaher Corporation (DHR) : Free Stock Analysis Report

Icahn Enterprises L.P. (IEP) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research