Danaher (DHR) Provides Improved Q4 Core Revenue Growth Guidance

Danaher Corporation DHR is set to provide an update on its fourth-quarter 2022 guidance at the J.P. Morgan Healthcare Conference today.

For the fourth quarter, the company expects revenues to increase in the low-single-digit percent range from the year-ago quarter’s level. Adjusted core revenue growth is anticipated to be in the high-single-digit percent range against the flat to a low-single-digit percent decline stated earlier. Danaher maintains its adjusted base business core revenue growth in the high-single digit percent range for the fourth quarter.

DHR’s president and chief executive officer, Rainer M. Blair said that the company’s fourth-quarter performance benefited from strong growth in the Cepheid's molecular diagnostics business, thanks to respiratory testing revenues of more than $1 billion.

Strength in the Life Sciences segment owing to robust activity in the bioprocessing business and growth in instrument businesses are likely to have aided Danaher’s fourth-quarter performance. However, high raw material and freight costs, and supply chain disruptions are likely to have affected DHR’s margin performance in the quarter.

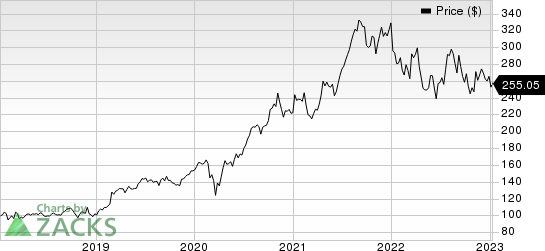

Danaher Corporation Price

Danaher Corporation price | Danaher Corporation Quote

Danaher is scheduled to release fourth-quarter 2022 earnings numbers on Jan 24.

Zacks Rank & Stocks to Consider

DHR currently carries a Zacks Rank #4 (Sell).

Some better-ranked companies are discussed below:

Xylem Inc. XYL presently sports a Zacks Rank of #1 (Strong Buy). XYL’s earnings surprise in the last four quarters was 13.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

In the past 60 days, Xylem’s earnings estimates have increased 0.1% for 2022. The stock has gained 43% in the past six months.

MRC Global Inc. MRC presently has a Zacks Rank #2 (Buy). MRC’s earnings surprise in the last four quarters was 103%, on average.

In the past 60 days, MRC Global’s earnings estimates have increased 16.2% for 2022. The stock has gained 13.4% in the past six months.

EnerSys ENS delivered an average four-quarter earnings surprise of 2.1%. ENS presently carries a Zacks Rank of 2.

ENS’ earnings estimates have increased 0.6% for fiscal 2023 in the past 60 days. The stock has gained 30.6% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Danaher Corporation (DHR) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

Xylem Inc. (XYL) : Free Stock Analysis Report