Cadence (CDNS) Q3 Earnings & Revenues Top Estimates, Rise Y/Y

Cadence Design Systems CDNS posted non-GAAP earnings of $1.26 per share in third-quarter 2023, which beat the Zacks Consensus Estimate by 4.1% and increased 18.9% year over year.

Revenues of $1.023 billion surpassed the Zacks Consensus Estimate by 1.7% and rose 13.3% on a year-over-year basis. The top line benefited from continued strength across all segments driven by higher customer demand. CDNS ended the quarter with a backlog of $5.4 billion.

Management also raised full-year guidance on the back of strong third-quarter results. The company also highlighted that the design activity continued to be robust owing to transformative generational trends such as AI, hyperscale computing, 5G and autonomous driving. Management also noted that there is an increase in production of 3D-IC and chiplet designs, and more system companies are now building custom silicon, which bodes well.

Cadence added that its comprehensive JedAI Generative AI platform was witnessing continued momentum, with sales of its GenAI solutions having nearly tripled in the last year.

Revenues for 2023 are now projected in the range of $4.06-$4.1 billion. The Zacks Consensus Estimate is currently pegged at $4.08 billion, which indicates year-over-year growth of 14.5%. Earlier, management had suggested revenues in the $4.05-$4.09 billion band.

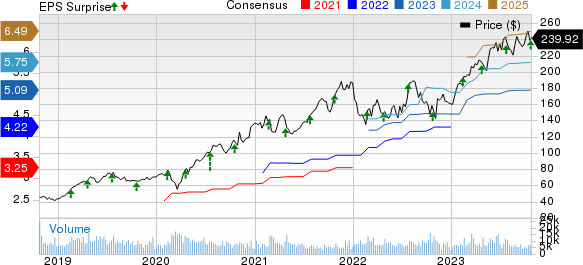

Cadence Design Systems, Inc. Price, Consensus and EPS Surprise

Cadence Design Systems, Inc. price-consensus-eps-surprise-chart | Cadence Design Systems, Inc. Quote

Non-GAAP earnings for 2023 are now expected to be between $5.07 per share and $5.13 per share. The Zacks Consensus Estimate is pegged at $5.09, which suggests year-over-year rise of 19.2%. Earlier, non-GAAP earnings were anticipated in the range of $5.05-$5.11 per share.

However, non-GAAP operating margin for 2023 is forecast in the range of 41.5-42% compared with 41.2-42.2% band projected earlier. Management continues to envision operating cash flow to be between $1.3 billion and $1.4 billion. CDNS expects to utilize 50% of the free cash flow to repurchase shares in 2023.

For fourth-quarter 2023, revenues are estimated in the $1.039-$1.079 billion band. The Zacks Consensus Estimate is currently pegged at $1.07 billion, suggesting a year-over-year improvement of 19.2%.

Non-GAAP earnings for fourth-quarter 2023 are anticipated to be between $1.30 per share and $1.36 per share. The Zacks Consensus Estimate is pegged at $1.38.

Non-GAAP operating margin is estimated to be nearly 31% for the fourth quarter. The company expects to repurchase shares worth approximately $125 million in the fourth quarter.

The stock was down 3.3% in the pre-market trading on Oct 24. Shares of Cadence have gained 51.6% compared with the sub-industry’s growth of 31% in the past year.

Image Source: Zacks Investment Research

Performance in Details

In the third quarter, Product & Maintenance revenues (94.4% of total revenues) of $966 million rose 14.2% year over year. Services revenues (5.6%) of $57 million came in line with the year-ago figure. Our estimate for revenues from the Product & Maintenance, and Service segments was $941.3 million and $58.7 million, respectively.

Geographically, the Americas, China, Other Asia, Europe, and the Middle East and Africa and Japan contributed 43%, 17%, 19%, 15% and 6%, respectively, to total revenues in the quarter under review.

Product-wise, Custom IC Design & Simulation, Digital IC Design & Signoff, Functional Verification, Intellectual Property, and Systems Design & Analysis accounted for 22%, 28%, 26%, 11% and 13% of total revenues, respectively.

Cadence Cerebrus AI-driven solution witnessed accelerating momentum and was deployed by several customers. Broadcom has leveraged Cadence Cerebrus across multiple business units, thereby achieving “impressive quality of results”, noted CDNS.

The Digital IC business witnessed 11 new wins in the reported quarter. The company further stated that Imagination Technologies used Cerebrus and other digital full-flow solutions on its latest 5nm GPU design in the cloud to achieve a 20% drop in leakage power.

The verification business increased 18% year over year due to rising complexity of system verification and software bring-up. Palladium and Protium (especially Z2 and X2) platforms witnessed continued traction with many deal wins.

The Custom IC business delivered 15% year-over-year revenue growth. The company further noted that Nisshinbo Micro Devices has utilized various Cadence tools, including AI-driven Virtuoso Studio custom IC design platform and Clarity 3D Solver, to enhance design efficiency and ensure consistent product delivery to the market.

Cadence’s System Design & Analysis Business segment reported 20% year-over-year rise as it expanded its presence beyond electronic design automation.

For the third quarter, total non-GAAP costs and expenses increased 10.2% year over year to $603 million.

Non-GAAP gross margin contracted 90 basis points (bps) to 90.6%. Non-GAAP operating margin expanded 170 bps on a year-over-year basis to 41.1%.

Balance Sheet & Cash Flow

As of Sep 30, 2023, CDNS had cash and cash equivalents of $962 million compared with $874 million as of Jun 30, 2023

Long-term debt was $648.8 million as of Sep 30, 2023, compared with $648.6 million as of Jun 30, 2023.

Cadence generated operating cash flow of $396 million in the reported quarter compared with the prior quarter’s $414 million. Free cash flow was $374 million compared with $394 million reported in the previous quarter.

It repurchased shares worth $185 million in the third quarter.

Zacks Rank & Other Key Picks

Cadence currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and VMware VMW. While Asure Software and VMware sport a Zacks Rank #1 (Strong Buy) each, Synopsys carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 earnings per share (EPS) has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 676.4%. Shares of ASUR have climbed 46.3% in the past year.

The Zacks Consensus Estimate for Synopsys’ fiscal 2023 EPS has gained 0.4% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.7%. Shares of SNPS have surged 56.4% in the past year.

The Zacks Consensus Estimate for VMware’s fiscal 2024 EPS has improved 5.9% in the past 60 days to $7.23.

VMware’s earnings outpaced the Zacks Consensus Estimate in two of the last four quarters while missing twice. The average earnings surprise is 1.2%. Shares of VMW have jumped 40.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VMware, Inc. (VMW) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report