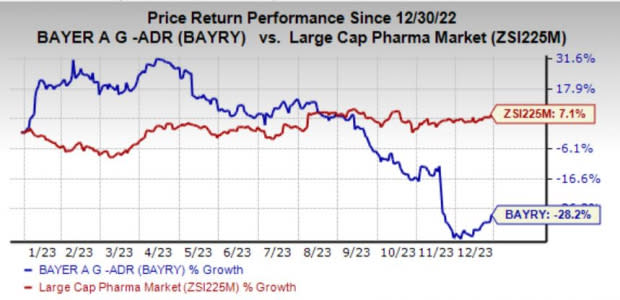

Bayer (BAYRY) Loses 28% in 2023: What to Expect in 2024?

Bayer AG BAYRY put up a dismal performance in 2023, even though other players in the large-cap pharma industry performed well.

Shares of Bayer have lost 28.2% in 2023 against the industry’s growth of 7.1%.

Image Source: Zacks Investment Research

The going has been challenging for Bayer of late. Sales in the Crop Science division have declined significantly in 2023 due to lower volumes and prices of glyphosate-based products. The decline came mainly in the United States, where Bayer experienced general inventory de-stocking efforts from its retail partners as well as reduced weed pressure due to the drought conditions in a significant portion of the corn and soybean growing regions. Consequently, the company lowered its outlook for 2023 due to a further significant decrease in sales of glyphosate-based products.

Pipeline setbacks also weigh on the company. The late-stage study, OCEANIC-AF, investigating asundexian compared with direct oral anticoagulant Eliquis (apixaban) in patients with atrial fibrillation (AF) and at risk for stroke was stopped early due to the lack of efficacy. This is a major setback, given the candidate’s potential.

The decision to stop the OCEANIC-AF study was based on the recommendation of the study’s Independent Data Monitoring Committee (“IDMC”) as part of the ongoing surveillance, which showed an inferior efficacy of asundexian versus the control arm. Nevertheless, IDMC recommends continuing the phase III OCEANIC-STROKE study as planned.

OCEANIC-STROKE is a phase III multicenter, international, randomized, placebo-controlled, double-blind, parallel-group and event-driven study, evaluating the efficacy and safety of asundexian for the prevention of ischemic stroke compared with placebo on top of standard-of-care antiplatelet therapy in patients after an acute non-cardioembolic ischemic stroke or high-risk transient ischemic attack/mini-stroke.

The failure of the study disappointed the investors.

The ongoing glyphosate litigation in the United States is also an overhang on the shares. Bayer acquired Roundup weedkiller through Monsanto’s buyout in 2018.

Moreover, one of the top drugs in the pharmaceutical division, Xarelto, is facing generic competition.

As of Sep 30, 2023, the company’s net financial debt (debt less cash and cash equivalents and current financial assets) was a staggering €38.7 billion. Such a huge level of debt is a matter of significant concern.

Amid all these challenges, the strong uptake of Nubeqa (darolutamide), a non-steroidal androgen receptor inhibitor, for treating patients with non-metastatic castration-resistant prostate cancer is a positive. The label expansion of Nubeqa, in combination with docetaxel, for treating patients with metastatic hormone-sensitive prostate cancer will further boost the company’s sales.

Kerendia, for treating chronic kidney disease associated with type 2 diabetes, was successfully launched in the United States, Europe and Japan, and obtained marketing authorization in China. The label expansion of the drug for early stages of chronic kidney disease and type 2 diabetes in May expands the targeted market.

The Committee for Medicinal Products for Human Use of the European Medicines Agency has adopted a positive opinion, recommending aflibercept 8 mg with extended treatment intervals in two major retinal eye diseases — neovascular (wet) age-related macular degeneration and diabetic macular edema — for approval. A lower dose of the drug is approved under the brand name Eylea.

Please note that Regeneron REGN co-developed Eylea with Bayer.

Regeneron records net product sales of Eylea in the United States, and Bayer records net product sales of Eylea outside the country. Regeneron records its share of profits/losses in connection with sales of Eylea outside the United States.

In brief, Bayer is expected to be under pressure despite these positives. It remains to be seen what strategic steps the company undertakes to overcome these challenges.

Zacks Rank & Stocks to Consider

Bayer currently has a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the overall healthcare sector are Entrada Therapeutics TRDA and Dynavax Technologies DVAX. TRDA sports a Zacks Rank #1 (Strong Buy) and DVAX carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Entrada’s loss per share estimate for 2023 has narrowed from $2.07 to 9 cents in the past 60 days. The same for 2024 has narrowed from $2.35 to $2.04 during the same time frame.

Dynavax’s loss per share estimate for 2023 has narrowed from 23 cents to 12 cents in the past 90 days. The bottom-line estimate for 2024 rose from 3 cents to 18 cents during the same period. Shares of DVAX have risen 33.7% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY) : Free Stock Analysis Report

Entrada Therapeutics, Inc. (TRDA) : Free Stock Analysis Report