3 Stocks Making News Thursday

Early Thursday morning, U.S. December Core CPI Inflation numbers were released. Inflation grew 5.7% year over year, matching expectations. In reaction, stocks initially fell but proceeded to rally higher. Overall, the market reaction was mute compared to recent readings. Beyond CPI, there were some big news items in individual stocks:

1. Proxy Battle at Disney?

Late last night, news broke that activist investor Nelson Peltz plans to attempt a proxy war to gain a seat on Walt Disney Co’s DIS board. A proxy fight is a corporate action in which a group of shareholders, known as a “proxy group,” attempts to gain control of a publicly traded company by convincing shareholders to vote in favor of their nominees for the board of directors. The end goal, in this case, is to change the company’s direction through cost-cutting measures and unlock shareholder value.

Image Source: Zacks Investment Research

Pictured: Disney is close to its pandemic crash lows. Can managemenet changes bring about changes in the share price?

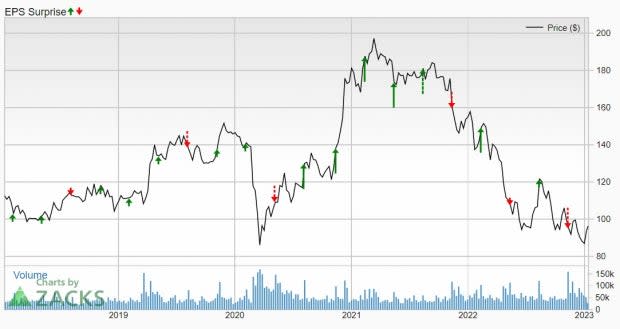

Shares of the worldwide entertainment and theme park operator have been falling steadily since hitting a record high back in March 2021. A few weeks back, news that former CEO Bob Iger would be returning to the company breathed life into shares. Before returning recently, Iger had been at the helm since 2005 and stepped down in 2020. Early Thursday, investors welcomed the changes to Disney and sent shares higher. At present, Disney remains stuck in a downtrend, with an uncertain future and a lackluster Zack’s Ranking of 4. Recent quarterly earnings have been spotty.

Image Source: Zacks Investment Research

Pictured: Earnings surprise chart for DIS. DIS earnings have been spotty in recent quarters.

Investors should be watching developments in the company to see what changes come about; however, they should not rush to grab shares until earnings momentum gets back on track. Disney is set to report on February 8th.

2. Signs of Life in the Semiconductor Space

Shares of Taiwan Semiconductor TSM shot higher early Thursday after beating on earnings. TSM’s net revenue popped 26.7% year on year, meeting low-end guidance expectations. Meanwhile, net profit grew 78% while gross margins beat expectations and grew to 62.2%. Because Taiwan Semiconductor is a bellwether in the semiconductor space, prospective semiconductor investors and tech investors of all kinds tend to pay attention to their earnings. Group peers such as Nvidia NVDA and Advanced Micro Devices AMD rose in sympathy on the news. Shares of TSM are fighting to retake their 200-day moving average for the first time since falling below the line in early 2022.

Image Source: Zacks Investment Research

Pictured: TSM is trying to clear its 200-day moving average post EPS.

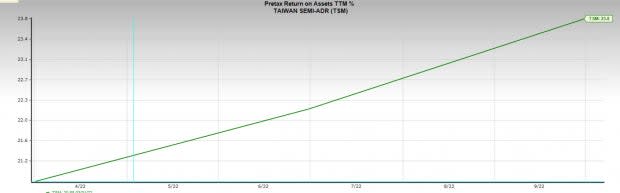

Despite the challenging macroeconomic and tech environment, Taiwan Semi continues to operate a highly efficient business. While its stock has fallen, pretax return on assets is rising.

Image Source: Zacks Investment Research

Pictured: TSM Pretax return on assets. Despite the challenging tech environment, the company is firing on all cylinders.

In the earnings call, the CEO of TSM said, “We expect the whole industry to drop slightly, but TSMC to grow slightly.” TSM is expanding its production to places like Arizona as mounting concerns build over a Taiwan-China power struggle for control over the self-ruled island.

3. Airlines Fly High

One week before American Airlines AAL is expected to report earnings, the company surprised investors by raising guidance for the fourth quarter on more robust demand. Previous EPS guidance expected EPS of $0.50-$0.70, while new guidance is $1.12 to $1.17 – a double in expectations. In other positive news, seat capacity is merely off 6% from pre-pandemic levels. The industry group has been on a tear recently – even shaking off news that all flights were grounded earlier in the week due to a computer glitch. Industry group peer Delta Airlines DAL rose after the news broke. Delta is slated to report earnings tomorrow.

Image Source: Zacks Investment Research

Pictured: American Airlines is continuing its winning streak after clearing the 200-day moving average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report