3 Life Insurers With Decent Dividend for a Steady Return

The Zacks Life Insurance industry continues to grapple with issues like unfavorable foreign currency fluctuations that affect premium growth. Also, volatile global equity markets and low bond yields resulted in enormous pressure on the insurer’s capital position. Amid volatile market conditions, companies that have an impressive dividend history are always investors’ favorites.

Despite these challenges, the life insurance industry has gained 12.5% in the past year compared with the Finance sector’s increase of 7.3%.

Image Source: Zacks Investment Research

High-quality dividend stocks such as Manulife Financial Corp. MFC, Reinsurance Group of America, Incorporated RGA and Sun Life Financial Inc. SLF, with impressive dividend history, might fetch the investors promising returns.

The life insurance industry comprises companies that offer life insurance coverages and retirement benefits to individuals and groups. The products include annuities, whole and term-life insurance, accidental death insurance, health insurance, Medicare supplements and long-term healthcare policies. Sales benefit from the increasing demand for protection products. The industry also includes companies providing wealth and asset management solutions.

With a rise in the number of baby boomers, the demand for retirement benefits is increasing. Per a report by IBISWorld, the $1.1-trillion U.S. Life Insurance & Annuities Market is expected to grow 3.2% in 2023. Increased vaccinations and economic growth instill confidence. Rising mortality might impact the profitability of these life insurers.

An improving interest rate environment benefits life insurers as their products and investments are rate sensitive. A favorable interest rate thus impacts life insurers' earnings, capital and reserves, liquidity and competitiveness positively. With three rate hikes in 2023, investment income should improve further, as insurers are beneficiaries of a rising rate environment. As of now, Fed has held back the hiking cycle after 10 straight increases but expects two more rate hikes in future. An improving rate environment is favorable for insurers.

Industry players are resorting new solutions and ways to improve sales and profitability. Insurers are refraining from selling long-duration term life insurance. Also, life insurers continue to roll out investment products that provide bundled covers of guaranteed retirement income, life and healthcare to cater to customers preferring policies with “living” benefits more than those with death benefits. A compelling product portfolio will thus aid sales of life insurers. Per Deloitte Insights, life insurance premium is estimated to increase 1.9% in 2023. Per a report published in ReporterLinker, global life insurance gross written premium is expected to be $2.5 trillion by 2026.

The life insurance industry started witnessing accelerated adoption of technology in its operations. Carriers started selling policies online that appealed to the tech-savvy population. At the same time, the use of real-time data is making premium calculation easier and reducing risk. Increased automation is expected to drive premium growth and boost efficiency. Moreover, accelerated digitization, robotic process automation and blockchain should help life insurers curb operational costs and aid margin expansion.

Best 3 Dividend Stocks to Watch

To choose some of the best dividend stocks from the aforementioned industry, we have run the Zacks Stock Screener to identify stocks with a dividend yield in excess of 2% and a sustainable dividend payout ratio of less than 60%, reflecting enough room for future dividend increases. These stocks also have a five-year historical dividend growth rate of more than 2% and have a Zacks Rank #1 (Strong Buy) or #2 (Buy) or #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Manulife Financial, with a market capitalization of $33.4 billion, is one of the three dominant life insurers within its domestic market and has rapidly-growing operations in the United States and several Asian countries. The insurer’s strong Asia business and expanding wealth and asset management business poise it well for growth. The insurer carries a Zacks Rank #2.

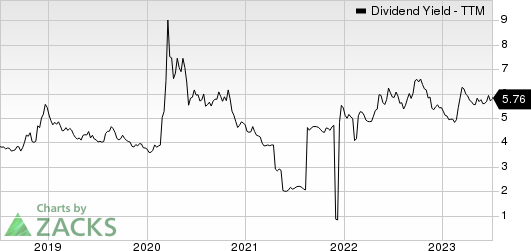

Its current dividend yield of 5.7% betters the industry average of 3.6%. Manulife has a strong track record of delivering progressive dividend increases. The life insurer’s payout ratio is 47, with a five-year annualized dividend growth rate of 9.5%. Manulife Financial increased its dividend 15 times in the last five years. (Check Manulife Financial’s dividend history here).

Manulife Financial Corp Dividend Yield (TTM)

Manulife Financial Corp dividend-yield-ttm | Manulife Financial Corp Quote

A solid balance sheet and strong operational performance and the life insurer’s outlook for growth in the future enabled it to hike its dividend payout. Its Asia business is the major contributor to its earnings. New business growth in Asia has been aiding the operational results. Manulife has grown its dividend at a six-year (2018-2023) CAGR of 8.5%. The board also approved an 11% increase in dividend for 2023. It targets 35-45% dividend payout over the medium term. In the first quarter, Manulife returned $1.1 billion of capital to shareholders through dividends and share buybacks. MFC repurchased 0.8% of outstanding common shares for $400 million in the first quarter.

Reinsurance Group of America, with a market capitalization of $9.2 billion, is a leading global provider of traditional life and health reinsurance and financial solutions with operations in the United States, Latin America, Canada, Europe, the Middle East, Africa, Asia and Australia. This Zacks Rank #2 insurer is set to benefit from the changing life reinsurance pricing environment, expanding business in the pension risk transfer market and disciplined capital management.

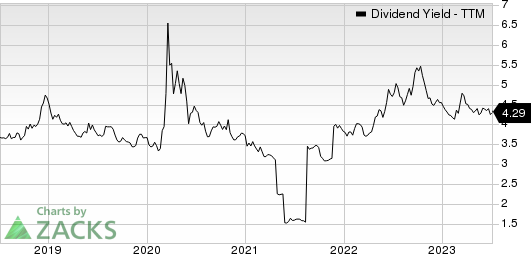

Reinsurance Group has also been managing capital effectively via share buybacks and dividend payments and prudent investments. The insurer’s quarterly dividend payment witnessed an eight-year CAGR (2016-2023) of 10.1%. Its current dividend yields 2.2%. The insurer’s payout ratio is 17, with a five-year annualized dividend growth rate of 7.3%. (Check Reinsurance Group of America’s dividend history here).

Reinsurance Group of America, Incorporated Dividend Yield (TTM)

Reinsurance Group of America, Incorporated dividend-yield-ttm | Reinsurance Group of America, Incorporated Quote

Reinsurance Group’s capital and liquidity positions remain strong and it ended the quarter with excess capital of approximately $1.4 billion. In the first quarter of 2023, RGA deployed $194 million of capital into in-force and other transactions and continue to see a very healthy pipeline. The insurer also returned a total of $103 million of capital to shareholders through $50 million of share repurchases and $53 million in dividends. This quarter highlights balanced approach to capital management and the ability to deploy capital into transactions and return capital through share repurchases and dividends. RGA expects to remain active in deploying capital into in-force and other transactions and returning excess capital to shareholders through dividends and share repurchases.

Sun Life Financial, with a market capitalization of $30.5 billion, is the third largest insurer in Canada. Its focus on growth in Asia operations, the expansion of its asset management businesses and strong financial position contribute to this life insurer’s performance. Sun Life is improving its business mix and thus shifting its growth focus toward products that park lower capital and offer more predictable earnings.

Backed by a solid capital position and operational excellence, the insurer announced a 4.2% increase to the dividend in May 2023 to reinforce the commitment to provide strong returns to shareholders. The current dividend yield of 4.2%, is better than the industry average of 3.6%. The insurer’s payout ratio is 44, with a five-year annualized dividend growth rate of 9.2%. (Check Sun Life Financial’s dividend history here).

Sun Life Financial Inc. Dividend Yield (TTM)

Sun Life Financial Inc. dividend-yield-ttm | Sun Life Financial Inc. Quote

Sun Life’s capital position remains strong, with Sun Life Assurance’s Minimum Continuing Capital and Surplus Requirements (LICAT) ratio of 148% at the first-quarter end. Its capital and cash positions remain healthy. These and a low leverage ratio provide flexibility and opportunity for further capital deployment. Given the company’s ongoing shift to fee-based capital-light businesses, it reiterates medium-term ROE objectives of 18% from 16% guided earnings. Its dividend payout ratio is targeted within the 40-50% range. SLF also repurchases shares, reflecting its strong cash and capital generation in its businesses. The insurer is focused on improving ROE and retention of flexibility for future growth opportunities.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Manulife Financial Corp (MFC) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Sun Life Financial Inc. (SLF) : Free Stock Analysis Report