Zscaler (ZS) Announces New Zero-Trust Security Solution

Zscaler ZS recently announced that it has collaborated with CrowdStrike CRWD and Imprivata to provide a zero-trust security solution that is specifically designed for healthcare organizations. This solution will cover devices as well as the cloud.

Healthcare institutions now need enhanced cybersecurity to protect patient data from ransomware threats. They require stronger security measures beyond the simple username and password verification used in legacy network security.

This new solution, incorporating the Zscaler Zero Trust Exchange platform, Imprivata Digital Identity Platform and the CrowdStrike Falcon, will provide an added layer of security for both internal and external users. With this collaboration, Zscaler will have access to Imprivata context and can leverage the CrowdStrike Falcon Zero Trust Assessment (ZTA) score through which it can control access to applications with adaptive and risk-based policies.

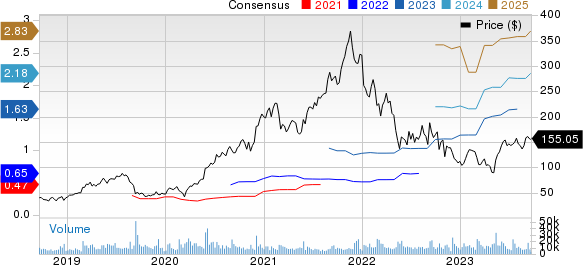

Zscaler, Inc. Price and Consensus

Zscaler, Inc. price-consensus-chart | Zscaler, Inc. Quote

Zscaler Zero Trust Exchange makes applications hidden from the Internet, similar to Virtual Private Networks (VPNs). However, it is different from regular VPNs because it constantly checks and approves users and devices for specific authorized apps, whereas VPNs authenticate users once and connect them to the network.

The CrowdStrike Falcon ZTA Score delivers instant security and compliance assessments, offering users a unified metric to evaluate the overall status of their security.

The Imprivata Digital Identity Platform ensures secure digital access for users, allowing them to authenticate their identity when accessing applications and data. Imprivata Context is a Health Insurance Portability and Accountability Act (HIPAA)-authorized secure communication platform for healthcare professionals and patients and is accessible across various devices.

The integration of all these platforms will ensure the enforcement of a shared workstation policy for multiple users, a zero trust security framework to protect patient data and compliance with HIPAA and Health Information Technology for Economic and Clinical Health policies for the visibility, threat protection and traceability of healthcare data.

Zscaler Benefits From a Robust Product Portfolio

Shares of ZScaler have risen by 38.6% year to date compared with the Computer and Technology Sector’s increase of 38.1% in the same time frame.

The company is capitalizing on the shift of IT leaders toward Zero Trust Architecture. ZS has experienced a significant increase in demand for its Zscaler for Users offerings, which include solutions, such as Zscaler Internet Access (ZIA), Zscaler Private Access (ZPA), Zscaler Data Experience (ZDX) and data protection.

Zscaler is also gaining momentum in workload protection, driven by ZIA and ZPA, which primarily contributed to the 37% year-over-year growth in customers with an Annual Recurring Revenue exceeding $1 million in fourth-quarter fiscal 2023.

Furthermore, the company has been witnessing a surge in demand for its newer products, such as Zscaler for Workloads and ZDX. These two products accounted for approximately 18% of ZS’ new business in the fiscal 2023.

Zacks Rank & Stocks to Consider

Zscaler and CrowdStrike carry a Zacks Rank #3 (Hold) each. Shares of ZS and CRWD have rallied 38.5% and 57.2%, respectively, year to date.

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA and Manhattan Associates MANH, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA's third-quarter fiscal 2024 earnings has been revised upward by 47.6% to $3.32 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 36.1% to $10.67 per share in the past 30 days.

NVIDIA’s earnings beat the Zacks Consensus Estimate thrice in the preceding four quarters while missing on one occasion, the average surprise being 9.8%. Shares of NVDA have surged 197.8% year to date.

The Zacks Consensus Estimate for Manhattan Associates’ third-quarter 2023 earnings has been revised 5 cents northward to 77 cents per share in the past 60 days. For 2023, earnings estimates have moved 22 cents upward to $3.09 per share in the past 60 days.

Manhattan Associates’ earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 31.6%. Shares of MANH have surged 66.8% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report