Is it Wise to Retain Welltower (WELL) Stock in Your Portfolio?

Welltower Inc. WELL is well-poised to benefit from its diversified portfolio of healthcare real estate assets amid favorable industry fundamentals. An aging population and a rise in healthcare expenditure by senior citizens are likely to aid the senior housing operating (SHO) portfolio’s growth. Moreover, portfolio restructuring initiatives and capital-recycling efforts augur well. However, competition in the senior housing market and high interest rates pose key concerns.

What’s Aiding it?

The senior citizen population is expected to escalate in the coming years. This age cohort constitutes a major customer base of healthcare services and incurs higher healthcare expenditures than the average population. Hence, given the expected rise, they are likely to end up spending more on healthcare services in the upcoming period, poising Welltower’s SHO portfolio well to capitalize on this positive trend.

Muted new supply has also been a tailwind for the senior housing industry. Hence, given these circumstances, Welltower’s SHO portfolio remains well-poised to benefit, boosting the segment’s performance. With a supply-demand imbalance, the portfolio is expected to experience sustained occupancy growth in 2024 and the coming years.

Capitalizing on these positive aspects, Welltower’s SHO portfolio is well-prepared for compelling multiyear revenue growth. In 2024, management anticipates the same-store SHO NOI to grow at the midpoint of 19.5%, driven by favorable revenue and expense trends.

With respect to Welltower’s outpatient medical portfolio, its efforts to leverage the favorable outpatient visit trend compared with in-patient admissions, expand relationships with health system partners and deploy capital in strategic acquisitions are encouraging.

Welltower’s strategic portfolio restructuring initiatives over the recent years have benefited the company in terms of attracting top-class operators and improving the quality of its cash flows. Per the June business update, WELL reached an agreement with Atria Senior Living to transition 89 Holiday by Atria communities to six of Welltower’s existing operating partners, including Arrow, Cogir US, Discovery, QSL, Sagora and StoryPoint.

WELL’s capital-recycling efforts to finance near-term investment and development opportunities highlight its prudent capital management practices and pave the way for long-term growth. In the first quarter of 2024, Welltower completed $449.2 million of pro-rata gross investments, including $207.9 million in acquisitions and loan funding and $241.3 million in development funding. Pro rata property dispositions and loan payoffs during this period totaled $107 million.

This healthcare real estate investment trust (REIT) maintains a healthy balance sheet position and has $6.5 billion of available liquidity as of Mar 31, 2024. It enjoys investment-grade credit ratings of BBB+ and Baa1 from S&P Global Ratings and Moody’s, respectively, rendering it access to the debt market at favorable rates. Therefore, with a well-laddered debt maturity schedule and enough financial flexibility, Welltower is well-positioned to meet its near-term obligations and fund its development pipeline.

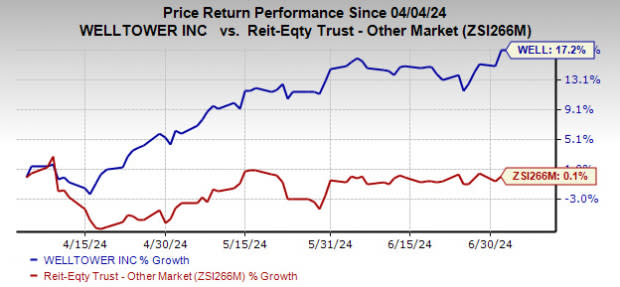

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 17.2% compared with the industry's upside of 0.1%.

Image Source: Zacks Investment Research

What’s Hurting it?

Welltower faces competition from national and local healthcare operators regarding factors such as quality, price and the range of services provided. It also competes with respect to reputation, location and demographics of the population in the surrounding area, and the financial condition of its tenants and operators. Such competition is likely to limit the company’s pricing power and ink deals at attractive rates. Also, tenant concentration in the triple-net portfolio is concerning.

Given a high interest rate environment, Welltower may find it difficult to purchase or develop real estate with borrowed funds as the cost of borrowing will likely be on the higher side. Further, the dividend payout may seem less attractive than the yields on fixed-income and money-market accounts due to the high interest rates still in place.

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Alexandria Real Estate Equities ARE and Americold Realty Trust COLD, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for ARE’s 2024 FFO per share stands at $9.49, indicating an increase of 5.8% from the year-ago reported figure.

The Zacks Consensus Estimate for COLD’s 2024 FFO per share is pinned at $1.44, suggesting year-over-year growth of 13.4%.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Americold Realty Trust Inc. (COLD) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report