Why Should Investors Approach Marathon (MPC) With Caution?

Marathon Petroleum MPC stock has been in breakneck mode over the past 12 months, notching up a series of all-time highs, as the refiner and marketer of crude oil has benefited from strength in the Energy space.

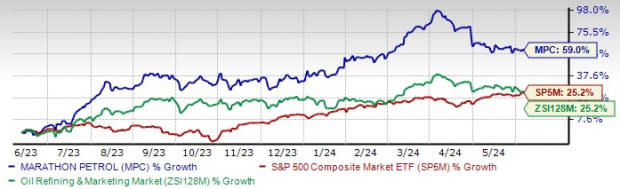

Let’s see if it’s time to buy into Marathon Petroleum’s momentum with MPC shares soaring around 59% in the past year to easily top the S&P 500 and the Zacks Oil and Gas - Refining & Marketing industry.

Image Source: Zacks Investment Research

Company Description

Findlay, OH-based Marathon Petroleum Corporation is a leading independent refiner, transporter and marketer of petroleum products. The company operates in two segments: Refining and Marketing, and Pipeline Transportation.

Catalysts for MPC

Marathon Petroleum’s portfolio of midstream operations bodes well, somewhat reducing its exposure to volatile commodity price fluctuations. While the company’s refining profitability continues to be highly volatile, Marathon Petroleum’s midstream arm, MPLX, is providing the necessary cushion. MPLX’s robust portfolio of projects in the Permian, Marcellus and STACK shale plays offers significant growth opportunities along with a fee-based stable revenue stream, which is reflected in the parent’s company overall results.

Further, the company's strategic investment in MPLX allows it to allocate a significant portion of its free cash flow to investor returns, including share buybacks. With MPLX covering the entire dividend and a portion of capital spending, MPC can maintain its share repurchase program, regardless of refining business cyclicality. This indicates potential for sustained profitability and shareholder value enhancement.

Talking about shareholder commitment, MPC recently increased its quarterly dividend by 10% to 82.50 cents per share. This dividend is well-supported by cash distributions from its midstream segment. However, the company is better known for its share repurchase program.

Since May 2021, Marathon Petroleum has executed $35 billion in buybacks, reducing its share count by nearly 50%. This significant reduction, coupled with the newly authorized $5 billion buyback plan, not only underscores the company's confidence in its prospects but also makes it a compelling buy for investors seeking strong capital returns.

Exemplary Historical Performance

The company has exceeded the earnings mark in each of the past four quarters, delivering an average earnings surprise of 25% over that timeframe. As a matter of fact, MPC has established a long history of beating earnings estimates, with the last miss seen way back in the second quarter of 2019.

Expensive Valuation

Trading at a little over $175 per share and 9.08X forward price-to-earnings, Marathon Petroleum has a VGM Score of A. However, the company seems a little pricey as it trades significantly above its five-year median of 7.62X and at a 6% premium to the subindustry's 8.58X. Further, MPC trades with a forward P/S of 0.48, which is higher than the five-year median of 0.37.

Other Points to Consider

Despite positive financial results, operational risks are apparent. These are highlighted by the heavy planned turnaround activity that significantly reduced refinery throughput by 270,000 barrels per day in the first quarter of 2024, leading to a $300 million decrease in adjusted EBITDA. Further, operating costs rose to $6.14 per barrel, reflecting lower utilization rates and higher maintenance expenses. This combination of lower margin capture and increased costs, alongside seasonal product inventory builds, indicates potential challenges in maintaining profitability.

Marathon Petroleum also faces significant risks from macroeconomic factors such as fluctuating energy prices, supply disruptions, and economic downturns. Recent declines in gasoline and diesel demand, coupled with a projected increase in global refinery capacity, could pressure margins, presenting a challenging environment for Marathon Petroleum in the near term.

Final Words

Considering the aforementioned factors, we believe investors should proceed with caution. Further, Marathon Petroleum is in the midst of declining top and bottom line, with consensus expectations for its current year suggesting an 18.4% pullback in earnings on 14% lower sales. However, if you are already holding MPC stock, it deserves to remain in your portfolio. Our investment thesis is supported by a Zacks Rank #3 (Hold).

2 Energy Stocks to Buy

While we view Marathon Petroleum as a core holding in the Oil/Energy space, investors might want to accumulate stocks like Sunoco LP SUN and SM Energy Company SM. Sunoco currently sports a Zacks Rank #1 (Strong Buy), while SM Energy carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Sunoco LP: The Zacks Consensus Estimate for 2024 earnings of Sunoco indicates 41.1% growth.

SUN is valued at around $5.1 billion. Sunoco has seen its stock rise 23.6% in a year.

SM Energy Company: SM beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters. SM Energy has a trailing four-quarter earnings surprise of 13.8%, on average.

SM is valued at around $5.8 billion. SM Energy has seen its shares increase 81.8% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sunoco LP (SUN) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report