Why Hold is Your Best Bet for Western Union (WU) Stock Now

The Western Union Company WU, a stalwart in the global payments industry, offers robust services in money transfer and payment solutions. Leveraging increasing transaction volumes and resilience in its Branded Digital business, the company is poised for growth. Strong Latin American, Caribbean, the Middle East, Africa, South Asia and North America performance are supporting its Consumer Money Transfer segment growth.

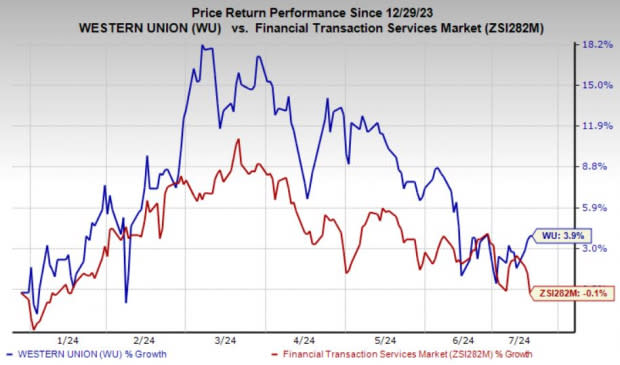

Headquartered in Denver, CO, WU currently has a market cap of $4.2 billion. Over the year-to-date period, Western Union shares have gained 3.9% against the industry's 0.1% decrease. Notably, its forward 12-month price-to-earnings ratio of 6.85X is significantly lower than the industry average of 20.83X, indicating that the stock is more affordable.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Western Union’s current-year earnings is pegged at $1.76 per share, indicating an increase of 1.2% from the year-ago period. WU beat on earnings in all the last four quarters, the average surprise being 15.7%.

The consensus estimate for Western Union’s current-year revenues stands at nearly $4.2 billion. We expect its Consumer Services business to play a significant role in revenue generation. Our model suggests that revenues from the unit will jump 10% year over year in 2024.

Collaborations with fintechs and financial institutions are enhancing Western Union's service offerings. Innovations like Send Now, Pay Later, which integrate lending and remittance, are expected to help the company better penetrate new and existing markets. Its extensive global network, spanning over 200 countries and territories, further strengthens its market position and accessibility.

Western Union's attractive dividend yield, currently at 7.6% compared to the industry average of 0.8%, is likely to garner significant investor interest. In the first quarter, the company rewarded its shareholders with $80 million in dividend payments and share buybacks totaling $150 million.

As of Mar 31, 2024, WU had $198.2 million remaining in share repurchase authorization through the end of the year. Last year, it returned $646 million to shareholders through buybacks and dividends, highlighting its commitment to shareholder value. Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth holding on to at the moment.

Some Risks

However, there are some factors that investors should keep a careful eye on.

WU’s levered balance sheet is concerning. Its total debt-to-total capital of 86.5% at the first-quarter end is significantly higher than the industry’s figure of 40.6%. Also, intensifying competition in the money transfer market with the rise of low-cost digital payment platforms is posing a significant threat to the company’s growth prospects. Nevertheless, we believe that its systematic and strategic plan of action will drive growth and improve profitability further in the long term.

Key Picks

Investors interested in the broader Business Services space can look at some better-ranked stocks like Global Payments Inc. GPN, Paysafe Limited PSFE and Fiserv, Inc. FI, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Global Payments’ 2024 earnings is currently pegged at $11.64 per share, indicating 11.7% year-over-year growth. It beat estimates in each of the past four quarters with an average surprise of 1.1%. The consensus mark for GPN’s revenues of $9.2 billion suggests a 6.4% increase from the year-ago level.

The Zacks Consensus Estimate for Paysafe’s current-year earnings is now pegged at $2.46 per share, indicating 5.6% year-over-year growth. It beat earnings estimates thrice in the past four quarters and missed once, with an average surprise of 18.3%. The consensus mark for PSFE’s revenues of $1.7 billion suggests a 6.5% increase from the year-ago level.

The Zacks Consensus Estimate for Fiserv’s 2024 earnings of $8.69 per share suggests 15.6% year-over-year growth. It beat earnings estimates thrice in the past four quarters and met once, with an average surprise of 2.3%. The consensus estimate for FI’s current year revenues is pegged at $19.3 billion, indicating a 7.2% increase from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Western Union Company (WU) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

Fiserv, Inc. (FI) : Free Stock Analysis Report

Paysafe Limited (PSFE) : Free Stock Analysis Report