What's in Store for Boston Properties' (BXP) Q4 Earnings?

Boston Properties, Inc. BXP is scheduled to report fourth-quarter and 2020 results on Jan 26, after market close. The company’s results are expected to reflect year-over-year declines in quarterly funds from operations (FFO) per share and revenues.

In the last reported quarter, this office real estate investment trust’s (REIT) FFO per share of $1.57 missed the Zacks Consensus Estimate by 4.3%. Results were affected by a year-over-year decline in revenues.

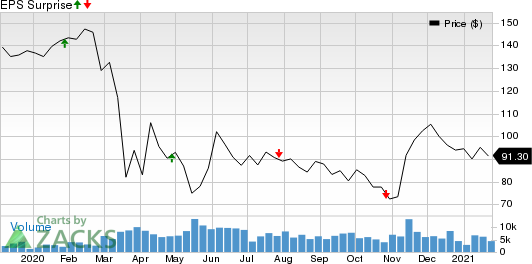

Over the preceding four quarters, the company beat the FFO per share estimates on two occasions and missed in the others, the average negative surprise being 3.5%. This is depicted in the graph below:

Boston Properties, Inc. Price and EPS Surprise

Boston Properties, Inc. price-eps-surprise | Boston Properties, Inc. Quote

Let’s see how things have shaped up for this announcement.

Office occupiers continued to shed their space in fourth-quarter 2020. The decline in demand along with increased supply led to a notable surge in vacancy rates and affected net absorption.

Specifically, going by a Cushman & Wakefield CWK report, net absorption aggregated negative 43 million square feet, marking the third consecutive quarter of negative absorption. Further, vacancy increased to 15.5% in the December-end quarter from 14.4% in the third quarter. This was the largest vacancy increase in a quarter since first-quarter 2002.

Nonetheless, resilience in asking rents continued to support office real estate fundamentals. In fact, asking rents increased 5.6% to $35.10 per square foot during the fourth quarter.

In the third quarter, occupancy at the company’s in-service office portfolio was 91.1%, marking a contraction of 90 basis points from second-quarter 2020. Given the lackluster environment in the office real estate market, the occupancy trend for Boston Properties is likely to have remained unimpressive despite its leasing initiatives during the quarter.

Notably, in November, the companyinked a long-term lease with Translate Bio, a clinical-stage messenger RNA therapeutics company, for 138,000 square feet of space at 200 West Street in Waltham, MA. Following the deal, the property is fully leased.

Further, the company’s footprint in markets, which are currently under stress due to the pandemic, is likely to have hindered its performance. Notably, as New York witnessed a second wave of COVID-19 in the fourth quarter, leasing is expected to have been subdued along with rising concessions. Hence, with a decent presence in the region (as of the third-quarter end, 27% of its net operating income (NOI) came from properties in New York), Boston Properties is expected to have seen a decline in rents and occupancy.

Also, with continued remote working, fourth-quarter parking and other revenues are expected to have declined. In fact, the Zacks Consensus Estimate for the same is pegged at $18.2 million, indicating a 32% decline from the year-ago reported figure.

Overall, the Zacks Consensus Estimate for fourth-quarter revenues is pinned at $667.4 million, indicating a year-over-year decline of 5.5%.

Prior to the fourth-quarter earnings release, there is a lack of any solid catalyst for becoming optimistic about the company’s business activities and prospects. The Zacks Consensus Estimate for fourth-quarter FFO per share has been unchanged at $1.6 over the past month. Also, the figure suggests a year-over-year fall of 14.4%. For 2020, FFO per share is pinned at $6.52, indicating a year-over-year decline of 7%.

Earnings Whispers

Our proven model doesn’t conclusively predict a surprise in terms of FFO per share for Boston Properties this time around. The combination of a positive Earnings ESP and Zacks Rank #3 (Hold) or better increases the odds of a FFO beat. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Boston Properties has an Earnings ESP of -0.16%.

Zacks Rank: It currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks That Warrant a Look

Here are some stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a surprise for the fourth quarter:

Healthpeak Properties, Inc. PEAK, set to report quarterly numbers on Feb 9, currently has an Earnings ESP of +4.40% and a Zacks Rank of 3.

WashREIT WRE, slated to release quarterly earnings on Feb 11, has an Earnings ESP of +0.59% and a Zacks Rank of 3 at present.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Washington Real Estate Investment Trust (WRE) : Free Stock Analysis Report

Cushman & Wakefield PLC (CWK) : Free Stock Analysis Report

Healthpeak Properties, Inc. (PEAK) : Free Stock Analysis Report

To read this article on Zacks.com click here.