What's in the Cards for Capital One (COF) in Q3 Earnings?

Capital One COF is slated to report third-quarter 2020 results on Oct 22, after market close. Its earnings and revenues in the quarter are expected to have declined on a year-over-year basis.

In the last reported quarter, the company recorded an adjusted loss per share of $1.61. Results were hurt by a drastic surge in provisions, lower interest rates and weak consumer activity.

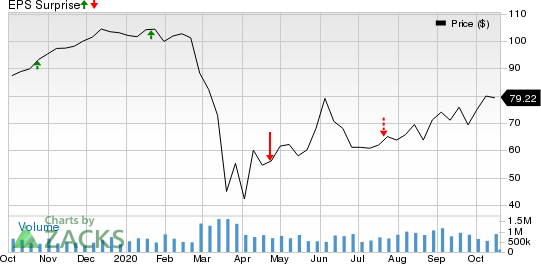

Capital One does not have an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in two and lagged in two of the trailing four quarters.

Capital One Financial Corporation Price and EPS Surprise

Capital One Financial Corporation price-eps-surprise | Capital One Financial Corporation Quote

Nevertheless, activities of the company during the third quarter encouraged analysts to revise estimates upward. The Zacks Consensus Estimate for Capital One’s earnings for the to-be-reported quarter has been revised upward by 22% to $2.00 per share. However, the figure indicates a decline of 39.8% from the prior-year quarter’s reported number.

The consensus estimate for sales is pegged at $6.74 billion, suggesting a year-over-year decline of 3.1%.

Before we take a look at what our quantitative model predicts, let’s check the factors that are expected to have influenced Capital One’s third-quarter performance.

Key Factors to Note

Net interest income (NII): Per the Fed’s latest data, consumer loan balances, specifically credit card loans, witnessed a decline in the third quarter. However, the Zacks Consensus Estimate for total average earning assets for Capital One is pegged at $384.8 billion for the to-be-reported quarter, which indicates a rise of 1.8% from the prior quarter’s reported figure.

While the overall demand for credit card loans remained weak in the quarter due to continued uncertainties related to the coronavirus pandemic, Capital One’s efforts to strengthen its card operations are expected to have provided some support to loan growth.

Thus, despite near-zero interest rates, the company’s NII is expected to have been positively impacted. The consensus estimate for NII of $5.6 billion for the third quarter indicates an increase of 2.4% sequentially.

Fee income: Although the overall demand for credit card loans was not very impressive in the third quarter, card usage increased to an extent. Thus, on the expectation of a rise in card usage, the company’s interchange fee (constituting more than 60% of fee income) is likely to have increased. The Zacks Consensus Estimate for the same is pegged at $711 million, indicating a rise of 5.8% from the prior quarter’s reported number.

The consensus estimate for service charges and other customer-related fees (constituting more than 20% of fee income) of $285 million suggests 10.5% growth sequentially.

Thus, driven by a rise in the above-mentioned components of fee income, total fee income is expected to have improved in the quarter. The consensus estimate for total non-interest income of $1.2 billion suggests a rise of 6.6% sequentially.

Expenses: Capital One has been witnessing a persistent rise in expenses over the past several years because of higher marketing costs. Despite the company’s investment in technology upgrades, overall costs are expected to have remained manageable in the third quarter.

Asset quality: The consensus estimate for net charge-offs is pegged at $1.8 billion for the to-be-reported quarter, indicating a rise of 17.5% from the previous quarter.

Now, let’s have a look at what our quantitative model predicts:

The chances of Capital One beating the Zacks Consensus Estimate this time are high. This is because it has the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Capital One is +11.31%.

Zacks Rank: The company currently carries a Zacks Rank #3.

Other Stocks That Warrant a Look

Here are some other finance stocks that you may want to consider as these too have the right combination of elements to post an earnings beat in their upcoming releases, per our model.

The Earnings ESP for CullenFrost Bankers, Inc. CFR is +2.61% and the company carries a Zacks Rank of 3, at present. It is slated to report quarterly results on Oct 29. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Huntington Bancshares Incorporated HBAN is set to release earnings figures on Oct 22. The company, which carries a Zacks Rank of 3 at present, has an Earnings ESP of +3.47%.

The Earnings ESP for Civista Bancshares, Inc. CIVB is +26.31% and the company carries a Zacks Rank #2 (Buy), currently. It is scheduled to report quarterly numbers on Oct 23.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

CullenFrost Bankers, Inc. (CFR) : Free Stock Analysis Report

Civista Bancshares, Inc. (CIVB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research