What analysts are saying about Wall Street's 2024 outlook

Note: A version of this article was published on Tker.co.

Stocks climbed last week, with the S&P 500 rising 0.8% to close at 4,594.63. The index is now up 19.7% year to date, up 28.4% from its Oct. 12, 2022, closing low of 3,577.03, and down 4.2% from its Jan. 3, 2022, record closing high of 4,796.56.

It’s that time of year when Wall Street’s top strategists tell clients where they see the stock market heading in the year ahead. Typically, the average forecast for the group predicts the S&P 500 climbing by about 10%, which is in line with historical averages.

This year, strategists are offering a pretty wide range of views. Some see weakness. Some see strength. The targets range from 4,200 to 5,500. This implies returns between -8.5% and +19.7% from Friday’s close. For what it’s worth, the forecasts aren’t as skewed to the downside as they were last year.

Before we move on, I’d caution against putting too much weight into one-year targets. It’s extremely difficult to predict short-term moves in the market with any accuracy. Few on Wall Street have ever been able to do this successfully. I do however think the research, analysis, and commentary behind these forecasts can be informative.

Read more: How to start investing: A step-by-step guide

That said, here’s what’s driving Wall Street’s views for 2024:

The economists that these stock market forecasters work with are split on whether the U.S. economy will go into recession sometime during the year, which has implications for revenue among other things. Those who are expecting continued expansion expect growth to be modest, and those looking for a recession expect any downturn to be brief and shallow. (Scroll down for: Wall Street’s 2024 U.S. economic outlook )

Interestingly, most strategists still expect S&P 500 earnings to grow in 2024 despite lackluster GDP growth forecasts. This may have to do with the expectation that consumer spending shifts back toward goods from services and the fact that the S&P has greater exposure to the goods sector, whereas U.S. GDP has greater exposure to the services sector. Analysts expect record earnings in 2024. (Source: FactSet)

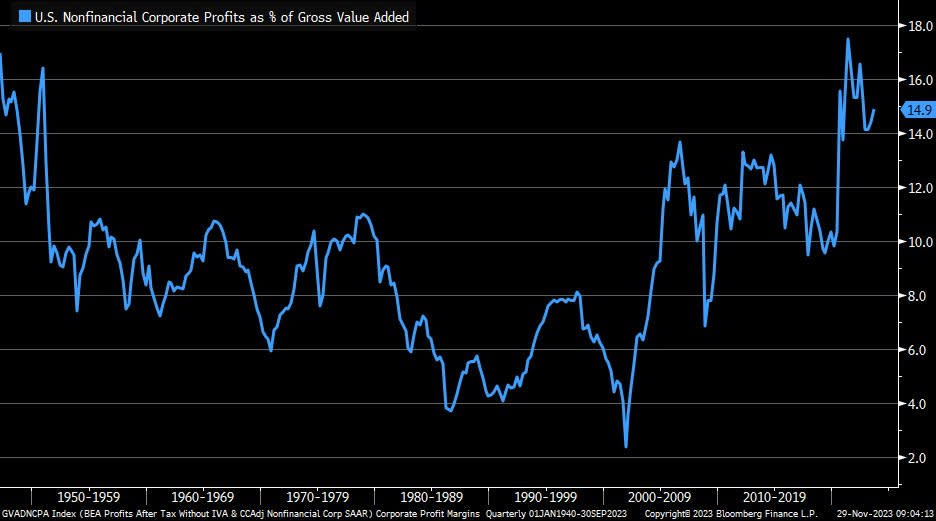

Thanks to improved operating efficiencies, many — but not all — strategists expect profit margins to stay high, which could help amplify earnings growth even with modest revenue growth. Profit margins have been holding up. (Source: BMO)

While most S&P 500 companies have low interest rates on their debts locked in for years, more and more firms will still have to refinance at market rates, which continue to hover at their highest levels in years. Higher interest expense is a headwind for earnings growth. Thanks to refinancing activity when rates were low, the interest large companies are paying remains low. (Source: BofA)

Most strategists agree that the worst of the inflation crisis is behind us. This means that should economic conditions deteriorate significantly, the Federal Reserve may once again find itself loosening financial conditions with interest rate cuts. While an economic downturn would be unwelcome, it’s nevertheless good news that the Fed seems to have room to stimulate the economy.

Strategists are also split on whether valuations are reasonable or whether they are a bit rich. This debate won’t go away anytime soon as valuations have historically signaled very little about short-term market moves. While most strategists agree that valuations are elevated, not all believe that will prevent prices from going higher. (Source: Deutsche Bank)

On valuations, at least one strategist argues that excitement for artificial intelligence technologies could persist into the new year, and the market could be in the early stages of a bubble.

The 2024 S&P 500 price targets

Below is a roundup of 12 of these 2024 forecasts for the S&P 500, including highlights from the strategists’ commentary.

JPMorgan: 4,200, $225 EPS (as of Nov. 29) "With a stepdown in economic growth next year (US growth to slow to 0.7% YoY by 4Q24 from 2.8% 4Q23), eroding household excess savings and liquidity, and tightening credit, we see 2024 consensus hockey-stick EPS growth of 11% as unrealistic… Negative corporate sentiment should be a catalyst for sharply lower estimates early next year."

Morgan Stanley: 4,500, $229 EPS (as of Nov. 13) "Near-term uncertainty should give way to an earnings recovery... Our 2024 EPS estimate [of $229] is consistent with output from our leading earnings models, which show a recovery in growth next year as well as our economists' expectations for growth next year... 2025 represents a strong earnings growth environment (+16%Y) as positive operating leverage and tech-driven productivity growth (AI) lead to margin expansion. On the valuation front, we forecast a 17.0x forward P/E multiple at the end of next year (20-year average P/E is 15.6x; currently 18.1x)."

UBS: 4,600, $228 EPS (as of Nov. 8) "Our 2024 target is based on a YE 2024E multiple of 18.5x (a -0.7x multiple point contraction) applied to 2025E EPS of $249. While UBS anticipates a steep decline in yields over this period, higher equity risk premiums should offset this benefit."

Wells Fargo: 4,625, $235 EPS (as of Nov. 27) "With VIX low, credit spreads tight, equities rallying, and cost of capital higher/volatile, it's time to downshift. Expect a volatile and ultimately flattish SPX in 2024 (4625), as valuation limits upside and rate uncertainty elevates downside risk."

Goldman Sachs: 4,700, $237 EPS (as of Nov. 15) "Our baseline assumption during the next year is the U.S. economy continues to expand at a modest pace and avoids a recession, earnings rise by 5%, and the valuation of the equity market equals 18x, close to the current P/E level. Our forecast falls slightly below the typical 8% return during presidential election years."

Societe Generale: 4,750, $230 EPS (as of Nov. 20) "The S&P 500 should be in ‘buy-the-dip’ territory, as leading indicators for profits continue to improve. Yet, the journey to the end of the year should be far from smooth, as we expect a mild recession in the middle of the year, a credit market sell-off in 2Q and ongoing quantitative tightening."

Barclays: 4,800, $233 (as of Nov. 28) "Whether ‘new normal’ or ‘old,’ a roller coaster 2023 proved that this cycle is anything but. We expect US equities to deliver single-digit returns next year as easing inflation is offset by modest economic deceleration."

Bank of America: 5,000, $235 EPS (as of Nov. 21) "The equity risk premium could fall further, especially ex-Tech: we are past maximum macro uncertainty. The market has absorbed significant geopolitical shocks already and the good news is we’re talking about the bad news. Macro signals are muddled, but idiosyncratic alpha increased this year. We’re bullish not because we expect the Fed to cut, but because of what the Fed has accomplished. Companies have adapted (as they are wont to do) to higher rates and inflation."

RBC: 5,000, $232 EPS (as of Nov. 22) "While the November rally has likely pulled forward some of 2024’s gains, we remain constructive on the U.S. equity market in the year ahead. Our valuation and sentiment work are sending constructive signals, partially offset by headwinds from a sluggish economy and uncertainty around the 2024 Presidential election. Our work also suggests that the greater appeal of bonds may end up being a dampener of US equity market returns but not necessarily a derailer of them."

Deutsche Bank: 5,100, $250 (as of Nov. 27) "Are valuations high? We don’t think so. If inflation returns to 2%, as economists forecast and is priced in across asset classes, while payout ratios remain elevated, fair value in our reading is 18x, with a range of 16x-20x, which they have been in for the last 2 years. If earnings growth continues to recover as we forecast, valuations will remain well supported."

BMO: 5,100, $250 EPS (as of Nov. 27) "[W]e believe U.S. stocks will attain another year of positive returns in 2024, albeit while demonstrating more sanguine, broadly distributed, and fundamentally defined performance relative to the last decade or so. In other words, normal and typical."

Capital Economics: 5,500 (as of Dec. 1) "Still time for the S&P 500 to party like it’s 1999 …it has come a long way lately, thanks both to a rise in its valuation and to an increase in expectations for future earnings. …This partly reflects investors’ enthusiasm about AI technology. …if AI enthusiasm is inflating a bubble in the S&P 500, it’s one that is still in its early stages. We think the index could therefore make further gains: our end-2024 forecast is 5,500, ~20% above its current level."

Two things about one-year price targets

Most of the equity strategists TKer follows produce incredibly rigorous, high-quality research that reflects a deep understanding of what drives markets. Consequently, the most valuable things these pros have to offer have little to do with one-year targets. (And in my years of interacting with many of these folks, at least a few of them don’t care for the exercise of publishing one-year targets. They do it because it’s popular with clients.)

So first off, don’t dismiss their work just because their one-year target is off the mark.

Second, I’ll repeat what I always say when discussing short-term forecasts for the stock market:

It’s incredibly difficult to predict with any accuracy where the stock market will be in a year. In addition to the countless number of variables to consider, there are also the totally unpredictable developments that occur along the way. Strategists will often revise their targets as new information comes in. In fact, some of the numbers you see above represent revisions from prior forecasts. For most of y’all, it’s probably ill-advised to overhaul your entire investment strategy based on a one-year stock market forecast. Nevertheless, it can be fun to follow these targets. It helps you get a sense of the various Wall Street firms’ level of bullishness or bearishness.

Good luck in 2024!

For older forecasts, read: Wall Street's 2023 outlook for stocks 🔭. and Wall Street's 2022 outlook for stocks

Wall Street’s 2024 U.S. economic outlook

Below is a sampling of what Wall Street is saying about the economy in 2024.

JPMorgan: "Although the economy has apparently managed to escape recession this year, we believe the risk of a downturn in ‘24 remains elevated. Fading post-pandemic tailwinds, building monetary headwinds, and dwindling fiscal offsets should all contribute to holding growth below trend, and we project real GDP to expand 0.7% in the coming year (4Q/4Q)."

Morgan Stanley: "High rates for longer cause a persistent drag, more than offsetting the fiscal impulse and bringing growth sustainably below potential from 3Q24. We maintain our view that the Fed will achieve a soft landing, but weakening growth will keep recession fears alive. We forecast that GDP slows from an estimated 2.5% 4Q/4Q (2.4%Y) in 2023 to 1.6% (1.9%) in 2024, and 1.4% (1.4%) in 2025."

UBS: "We expect economic growth to slow sharply in the next few quarters, with a mild contraction worth half a percentage point in the middle of the year."

Wells Fargo: "There already are some cracks that are beginning to appear in the economy, and these strains likely will intensify in the coming months as monetary restraint remains in place. Our base case is that real GDP will contract modestly starting in mid-2024."

Goldman Sachs: "With the more daunting problems largely solved, the conditions for inflation to return to target in place, and the heaviest blows from monetary and fiscal tightening well behind us, we now see only a historically average 15% probability of recession over the next 12 months."

Societe Generale: "In the US, the long-predicted recession will in our view belatedly materialise in 2024, most likely during the middle quarters of the year, though it stands to be brief and shallow."

Barclays: "Base Case: Soft Landing"

BofA: "We see a soft landing – a period of positive but below-trend growth – as the most likely scenario"

RBC: "Inflation data is on the right track. Mounting headwinds should lead to slower growth and softer labor markets but stop short of recession."

BMO: "But if [a recession] does occur, we would borrow an acronym from the political lexicon to describe its likely severity – RINO or recession in name only since labor market data continues to remain remarkably resilient and employment levels are what almost always determine how good or bad things get in the economy from our perspective."

Deutsche Bank: "Our forecast of a mild recession in H1 2024 is thus little changed since our last update in October."

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

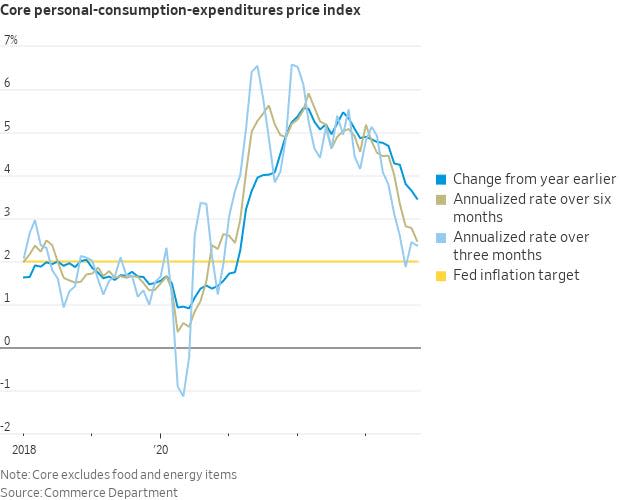

Inflation rates cool. The personal consumption expenditures (PCE) price index in October was up 3.0% from a year ago, down from the 3.4% increase in September. The core PCE price index — the Federal Reserve’s preferred measure of inflation — was up 3.5% during the month after coming in at 3.7% higher in the prior month.

On a month-over-month basis, the core PCE price index was up 0.16%. If you annualized the rolling three-month and six-month figures, the core PCE price index was up 2.4% and 2.5%, respectively.

While inflation rates remain above the Federal Reserve’s 2% target, they are clearly trending in that direction.

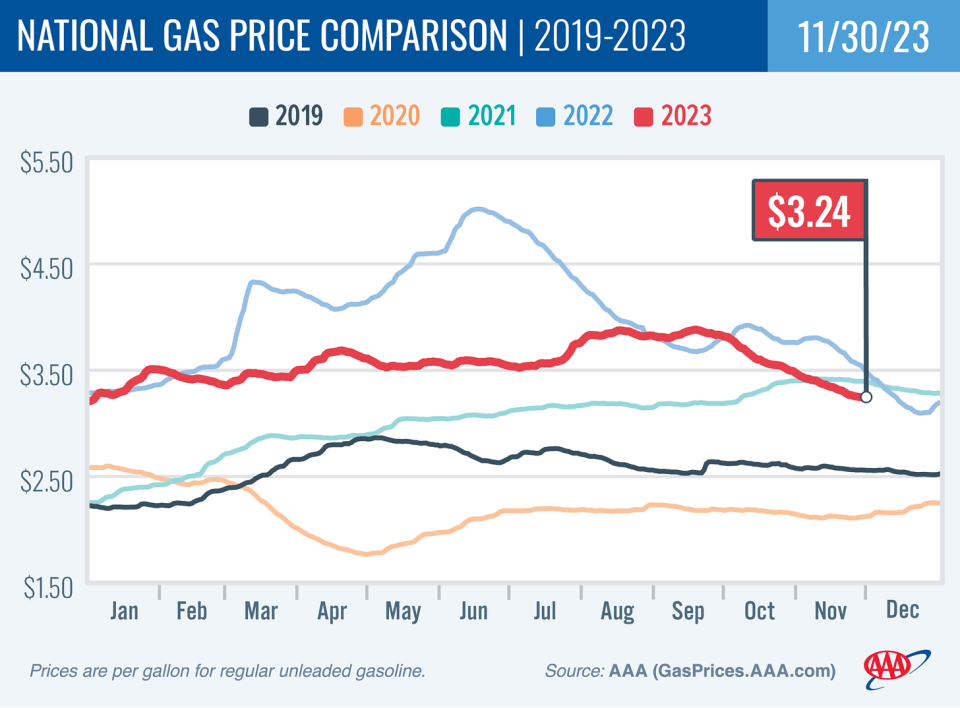

Gas prices are down. From AAA: "Despite less than stellar domestic demand, the national average for a gallon of gas fell only two cents since last week. The primary culprit is the cost of oil, which is creeping closer to $80 a barrel. Since oil is the main ingredient in gasoline, higher oil costs tend to put upward pressure on pump prices… Today’s national average of $3.24 is 26 cents less than a month ago and 26 cents less than a year ago."

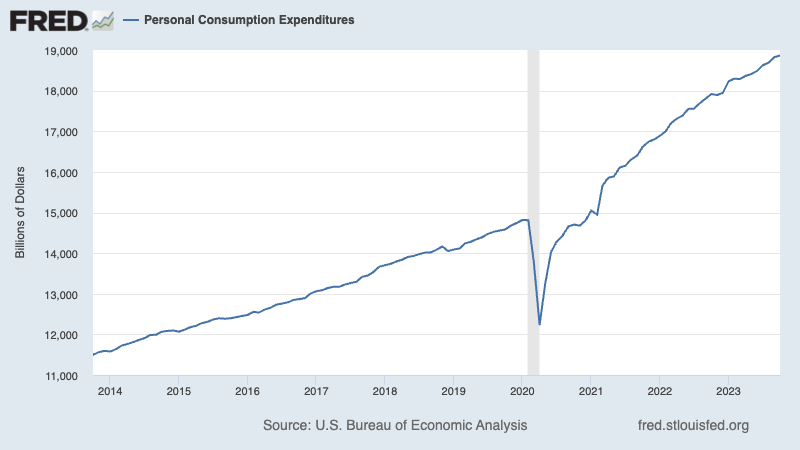

Consumers are spending. According to BEA data, personal consumption expenditures increased 0.2% month over month in October to a record annual rate of $18.86 trillion.

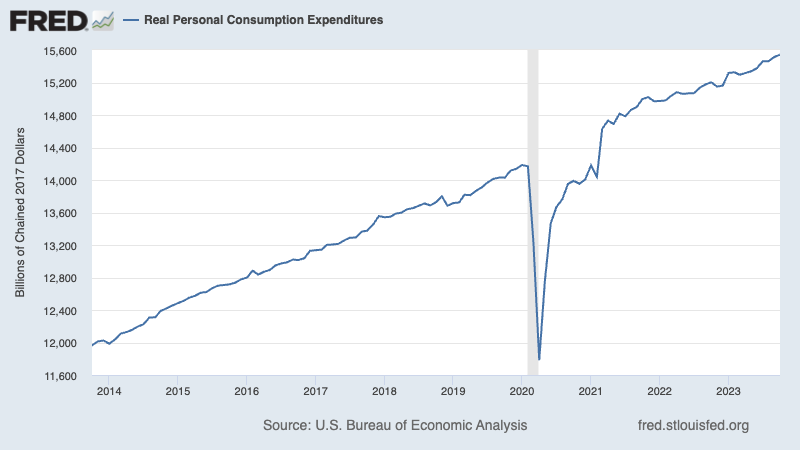

Adjusted for inflation, real personal consumption expenditures also rose to a new record.

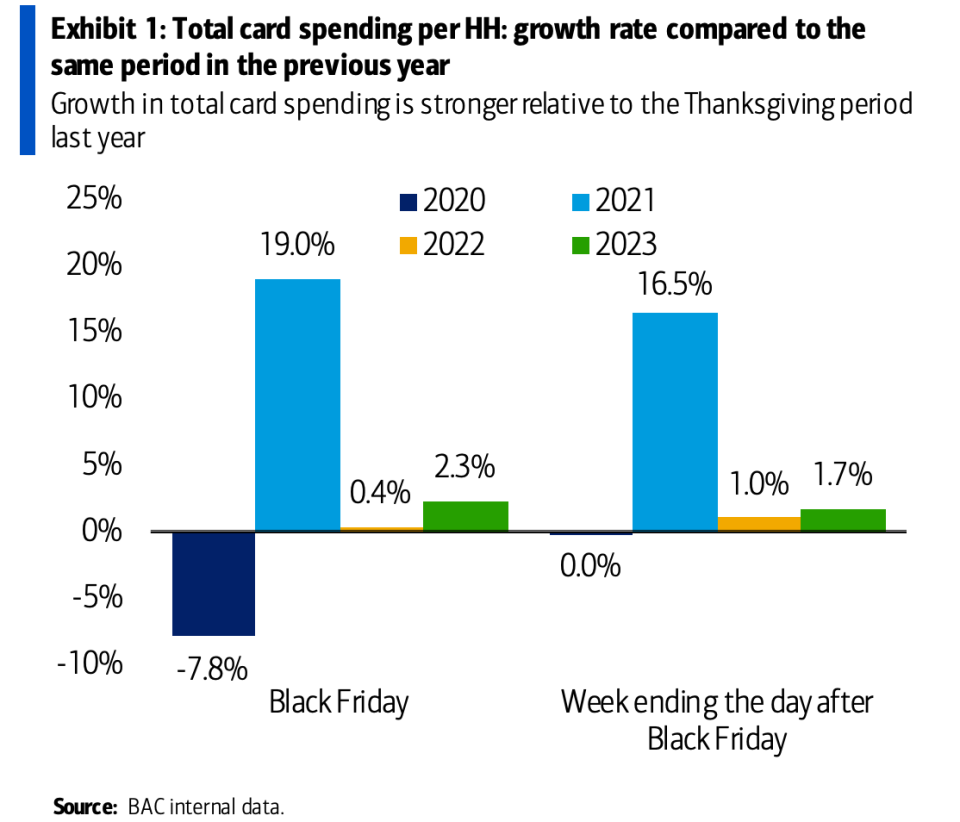

Holiday shopping season is off to a strong start. From BofA: "Card spending per household (HH), as measured by BAC aggregated credit and debit cards, was up 2.3% on Black Friday (November 24), compared to the Black Friday in 2022."

This is in line with other data from private firms showing Black Friday and Cyber Monday spending rising to record levels.

Restaurant spending is cooling. From Apollo Global’s Torsten Slok: "Indicators of restaurant activity continue to show signs of weakness, see chart below. This is not surprising. The Fed is trying to slow down the economy, and weakness is now starting to appear in consumer services."

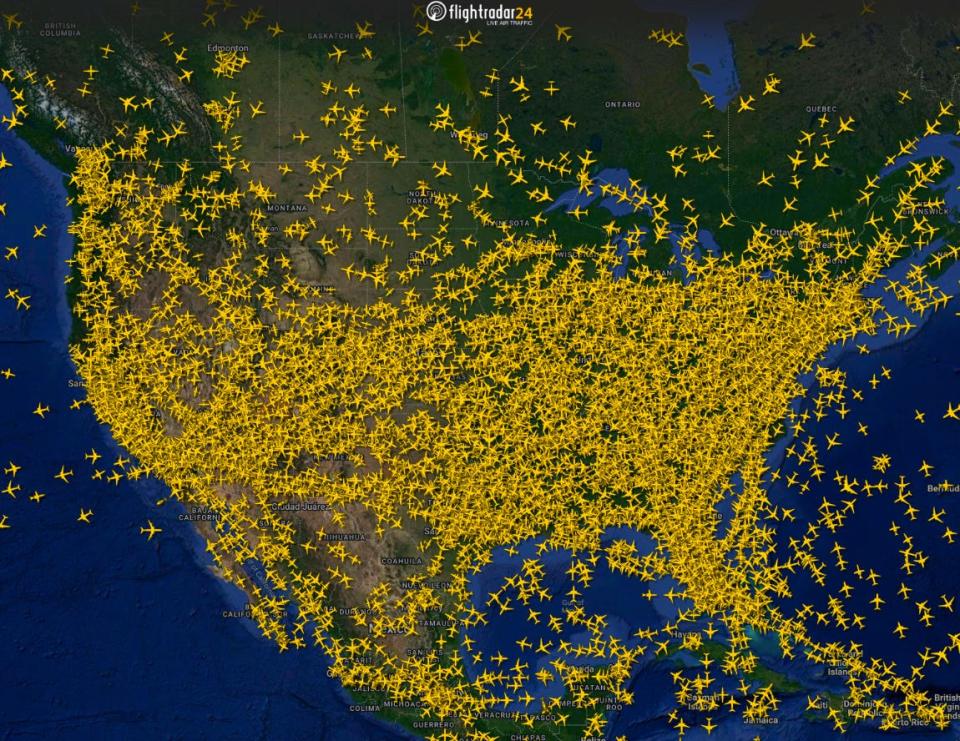

Air travel’s busiest day. From the TSA: "Yesterday (Nov. 26), TSA screened just over 2.9M individuals at airports nationwide, which represents an agency record – the busiest day ever for air travel."

Unemployment claims rise. Initial claims for unemployment benefits increased to 218,000 during the week ending November 25, up from 209,000 the week prior. While this is up from a September 2022 low of 182,000, it continues to trend at levels associated with economic growth.

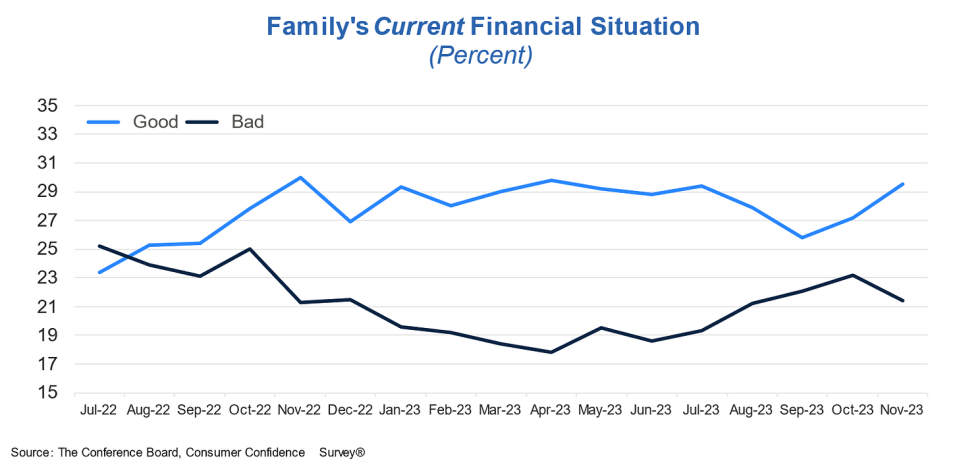

Consumer confidence improves. On Tuesday, we learned The Conference Board’s Consumer Confidence Index increased in November. From the firm’s Dana Peterson: "General improvements were seen across the spectrum of income groups surveyed in November. Nonetheless, write-in responses revealed consumers remain preoccupied with rising prices in general, followed by war/conflicts and higher interest rates… Assessments of the present situation ticked down in November, driven by less optimistic views on current job availability, which outweighed slightly improved views on the state of business conditions."

Meanwhile, "Consumers’ assessment of their Family’s Current Financial Situation improved in November."

And, "Consumers’ assessment of their Family’s Expected Financial Situation, Six Months Hence was also more optimistic in November."

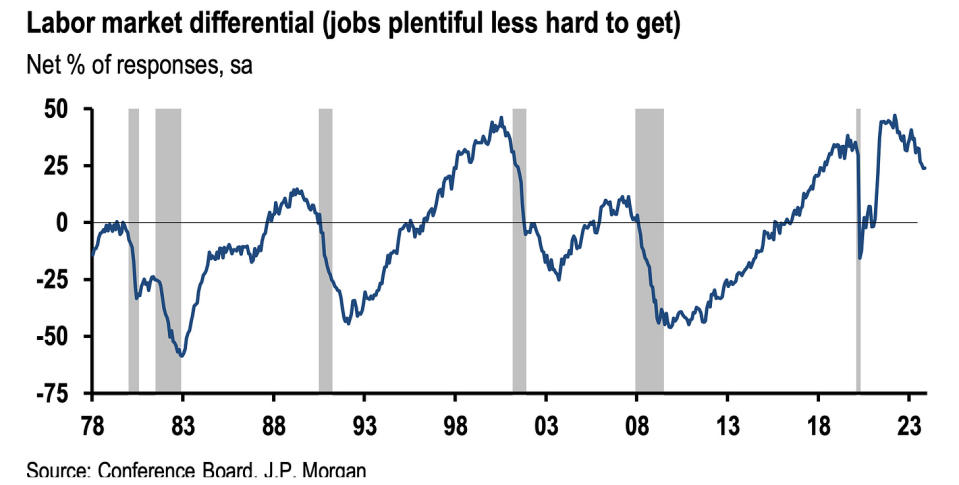

Labor market confidence improves slightly but trend reflects cooling. From The Conference Board’s September Consumer Confidence survey: "39.3% of consumers said jobs were ‘plentiful,’ up slightly from 37.9% in October. However, 15.4% of consumers said jobs were ‘hard to get,’ up from 14.1%."

Many economists monitor the spread between these two percentages (a.k.a., the labor market differential), and it’s been reflecting a cooling labor market.

Americans’ sentiment is detached from reality. From the FT: "Americans are consistently wrong in the negative direction on almost every measure we polled. By huge margins, they believe inflation is still rising (it’s falling), that it has outstripped wage growth (wages have outpaced prices), and that they have become less wealthy (they’ve become much wealthier)… My advice: if you want to know what Americans really think of economic conditions, look at their spending patterns. Unlike cautious Europeans, US consumers are back on the pre-pandemic trendline and buying more stuff than ever."

Mortgage rates decline. According to Freddie Mac, the average 30-year fixed-rate mortgage fell to 7.22%. From Freddie Mac: "The current trajectory of rates is an encouraging development for potential homebuyers, with purchase application activity recently rising to the same level as mid-September when rates were similar to today’s levels. The modest uptick in demand over the last month signals that there will likely be more competition in a market that remains starved for inventory."

Home prices rise. According to the S&P CoreLogic Case-Shiller index, home prices rose 0.3% month-over-month in September. From SPDJI’s Craig Lazzara: "On a year-to-date basis, the National Composite has risen 6.1%, which is well above the median full calendar year increase in more than 35 years of data. Although this year's increase in mortgage rates has surely suppressed the quantity of homes sold, the relative shortage of inventory for sale has been a solid support for prices. Unless higher rates or exogenous events lead to general economic weakness, the breadth and strength of this month's report are consistent with an optimistic view of future results."

New home sales fall. Sales of newly built homes fell 5.6% in October to an annualized rate of 679,000 units.

Profit margins were up in Q3. From Schwab’s Liz Ann Sonders: "Corporate profit margins rebounded in 3Q23, helping reverse some of past year’s decline."

Manufacturing surveys don’t look good. From S&P Global’s November Manufacturing PMI report: "U.S. manufacturers reported yet another tough month in November. Output barely rose as inflows of new work showed a renewed decline, hinting at little – if any – contribution to fourth quarter GDP from the goods-producing sector."

Similarly, the ISM’s July Manufacturing PMI signaled contraction in the sector for the 13th consecutive month.

These unfavorable survey results continue to come as hard broad measures of the economy continue to hold up.

It’s worth remembering that soft data like the PMI surveys don’t necessarily reflect what’s actually going on in the economy.

Manufacturing construction is booming. Construction spending data from the Census Bureau suggests the state of manufacturing is much stronger than implied by the soft survey data.

Near-term GDP growth estimates are cooling. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 1.2% rate in Q4.

Putting it all together

We continue to get evidence that we could see a bullish "Goldilocks" soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Note: A version of this article was published on Tker.co.