Western Digital (WDC) Announces Restructuring, Stock up 6.7%

Western Digital WDC recently announced that it was splitting its flash and HDD (hard disk drive) business in two separate segments as a part of its diversification strategy for its storage portfolio, which is valued at $16.7 billion.

Per Western Digital, the restructuring will help it leverage its “go-to-market and operational synergies” and position the company to focus on the needs of its customers more efficiently.

Both the HDD and Flash units will be under separate leadership. For Flash division, Western Digital zeroed on Robert Soderbery as the general manager, while the search is on for the general manager position for its HDD division.

Following the business units’ restructuring announcement, shares of Western Digital jumped 6.7% and closed at $38.92 on Sep 23. Investors are speculating that the Western Digital might split up in to separate business entities in the future that will boost shareholders’ value.

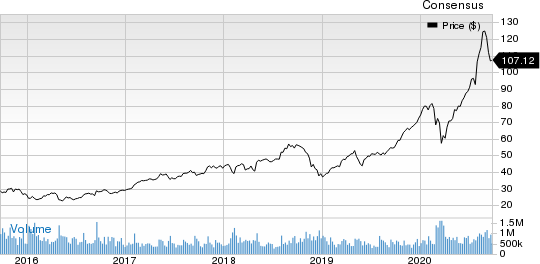

Western Digital Corporation Price and Consensus

Western Digital Corporation price-consensus-chart | Western Digital Corporation Quote

Western Digital is one of the leading hard disk drive (HDD) producers in the United States. However, HDD business is under pressure due to the rapid uptake of flash storage and SDDs. The splitting up will help to rationalize the operations and enhance profitability of both the businesses.

New Product Launches Hold Promise

Apart from restructuring, the company recently introduced two new storage solutions — 18TB surveillance HDD and 1 TB SC QD101 microSD card — under its WD Purple storage solutions banner.

The 18TB HDD is powered by Western Digital’s AllFrame AI technology which supports up to 64 high-definition cameras. The technology also provides additional 32 streams for deep learning analytics. The HDD will support workload rate of 360TB/year and it will find applications in DVR (digital video recorder) and NVR (network video recorder) surveillance systems. It will be available to consumers beginning October 2020.

The microSD card is powered by the company’s advanced 96-layer 3D NAND technology and is built for usage in futuristic AI enabled security systems.

Rapid uptake of dynamic and complex AI and data-centric applications, including surveillance cameras requires 24/7 video capture that creates immense workload which requires advanced data storage architecture. Western Digital’s latest WD Purple HDD and microSD offerings are expected to cater to this demand of data storage effectively.

Per Omdia report, as revealed by Western Digital in the press release, shipments of cameras assisted with deep learning algorithms will witness a CAGR of 67% between 2019 and 2024 while deep-learning analytics embedded NVRs are projected to witness a CAGR of 37% over the same time period. Moreover, video analytics appliances shipments are forecasted to grow at a CAGR of 43% between 2019 and 2024.

Meanwhile, the company has also unveiled its next-generation WD brand My Passport, in August 2020. The palm-sized SSD, based on NVMe technology, features write speeds of up to 1000MB/s and read speeds of up to 1050MB/s. This storage device is aimed at enhancing overall drive capacity, dependability, and performance.

The company’s expansion into the SSD storage market with new product launches bodes well for its top line in the days ahead.

Per a Global Market Insights report, the SSD market is anticipated to witness a CAGR of 15% during 2020-2026. Markedly, the coronavirus crisis has triggered a work-from-home wave that has led to an increasing adoption of advanced data storage solutions.

Exponential growth in digital data and increasing penetration of high-end cloud platforms, including public and private clouds, is bolstering the uptake of SSDs.

Risks Remain

In the near term, supply chain disruptions and lockdowns stemming from the coronavirus outbreak are likely to affect the end-market demand for Western Digital, especially at brick and mortar stores. Moreover, management expects higher COVID-19-related logistics costs to be a headwind on the gross margin.

Further, increasing expenses on product enhancements to counter stiff competition from storage players such as Seagate Technology STX and Micron Technology, are likely to weigh on the bottom line, at least in the near term.

Moreover, the company has suspended its dividend policy to strengthen reinvestment in innovation and growth as well as to facilitate ongoing deleveraging efforts.

Zacks Rank and Key Picks

At present, Western Digital carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks worth considering in the broader sector are Zoom Video Communications ZM and Blackbaud BLKB, both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Zoom Video and Blackbaud is pegged at 25% and 7.6%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Seagate Technology PLC (STX) : Free Stock Analysis Report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research