Warner Bros. Discovery Sees $2.1 Billion Loss in Q4 After Big Writedown; Ad Sales Tumble

Warner Bros. Discovery continued to work on making all its various pieces, merged together last year, into a cohesive whole.

The New York owner of the TNT and TBS cable networks, the HBO Max streaming service and the Warner Bros. production studio reported a net loss of $2.1 billion for its fiscal fourth quarter after the company wrote down $1.85 billion in assets and faced nearly $1.2 billion in restructuring expenses.

More from Variety

Revenue fell 9%, excluding the results of foreign exchange, and the company saw ad sales decrease 14% as its TV networks, even as it worked to add subscribers to its HBO Max and Discovery+ streaming outlets.

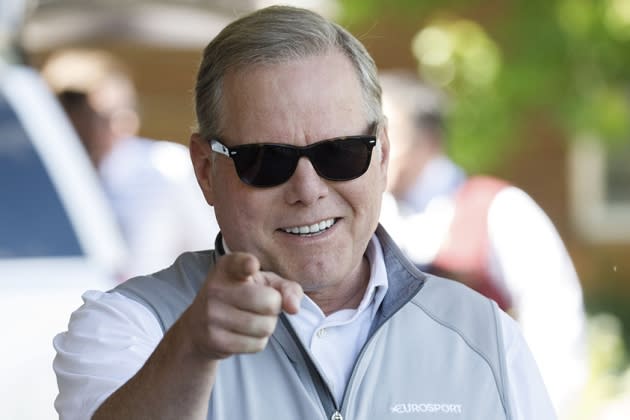

In a statement, David Zaslav, the company’s CEO, suggested that much of the hard work involved knitting together the former WarnerMedia and Discovery Communications, was complete. “We’re seeing strong

momentum across the enterprise,” he said, noting that “we believe we have repositioned our businesses to take full advantage of the many opportunities ahead.”

But the large media conglomerate faced declines in its main TV business even as it worked to goose the financials of its new streaming assets.

Warner Bros. Discovery’s TV networks, which also include Discovery, CNN and Food Network saw revenue fall 6% to roughly $5.5 billion, with declines evident in affiliate fees as well as advertising. Studios operations saw revenue fall about 23% as the company’ collected less from licensing of its content.

Meanwhile, losses in its streaming operations narrowed. The operating loss in its streaming operations came to $217 million in the quarter for its streaming assets, compared with pro-forma losses of $728 million in the year-earlier period.

During a call with investors, Gunnar Wiedenfels, the company’s chief financial officer, indicated a new projection for $4 billion in cost savings by the end of 2024, a new target.

Best of Variety

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.