Want More Than 7% Dividend Yield? Keep an Eye on Truist (TFC)

This year is not turning out to be a good one for banks. The collapse of three large banks, deposit flight and competition, the Federal Reserve’s aggressive rate hikes, waning loan demand and weakening asset quality are some of the major factors keeping investors on the sidelines.

But there are many fundamentally solid lenders worth keeping an eye on because of the robust dividend yield. One such bank is Truist Financial TFC. This Charlotte, NC-based bank, formed following the merger between BB&T Corp and SunTrust Banks, is one of the largest commercial banks in the country.

TFC has been increasing its quarterly dividend on a regular basis, with the last hike of 8.3% to 52 cents per share announced last year. Over the last five-year period, the company raised the dividend thrice, with an annualized dividend growth rate of 5.58%.

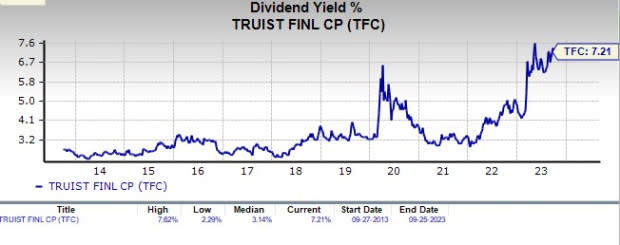

Considering yesterday’s closing price of $28.84, Truist Financial’s dividend yield currently stands at 7.21%. This is impressive compared with the industry average of 4.8% and attractive for income investors as it represents a steady income stream.

Image Source: Zacks Investment Research

Should you keep an eye on Truist Financial’s stock to earn this high dividend? Before making any investment decision, let’s check out the company fundamentals to understand risk and rewards.

Earlier this month, TFC announced its strategic expense-saving program, which will result in approximately $750 million of gross savings (excluding one-time severance charges). This is likely to be realized in 12 to 18 months.

As part of this program, Truist Financial plans "sizable reductions" in the workforce. These have already commenced this quarter and will continue till the first quarter of 2024 and are expected to lead to roughly $300 million of cost savings. The CEO Bill Rogers said, “Other cost savings initiatives include aggressively managing third-party spend, further reducing our corporate real estate footprint and rationalizing tech spend.” These will, in total, result in almost $450 million in expense savings.

Driven partially by these initiatives, the company expects 2024 adjusted non-interest expenses to be relatively stable or rise nearly 1%. It expects the metric to grow almost 7% in 2023.

Truist Financial has been recording a rise in net interest income (NII). While the metric declined in 2021, it witnessed a three-year CAGR of 25.1% (ended 2022) on the back of decent loan demand, the merger deal and rising rates. NII grew on a year-over-year basis in the first half of 2023, too. While high interest rates are expected to continue aiding NII, gradually waning loan demand and a rise in deposit costs will weigh heavily on it.

Further, TFC remains focused on the growth of non-interest revenue sources. While the metric declined in 2022, the same witnessed at a three-year (2019-2022) CAGR of 18.4%, mainly on the back of the merger deal and strength in wealth management and insurance businesses. A similar trend continued in the first six months of 2023.

Management is open to strategic business restructuring initiatives to further improve fee income growth. In sync with this, the company divested a 20% stake in its subsidiary, Truist Insurance Holdings, in April. Also, to further bolster the insurance business, it acquired BankDirect Capital Finance, BenefitMall, Kensington Vanguard National Land Services and Constellation Affiliated Partners in the past few years.

Therefore, despite near-term headwinds like worsening asset quality and mounting costs, TFC is well-placed to counter the challenges and sustain profitability. So far this year, shares of Truist Financial have lost 33% compared with the industry’s decline of 8%.

Image Source: Zacks Investment Research

Hence, income investors should keep this Zacks Rank #3 (Hold) stock on their radar as it will help generate robust returns over time.

Other Bank Stocks Worth a Look

A couple of other banks like, KeyCorp KEY and Huntington Bancshares HBAN, are worth a look based on robust dividend yields.

Considering the last day’s closing price, KeyCorp’s dividend yield currently stands at 7.73%. KEY carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Based on the last day’s closing price, Huntington Bancshares’ dividend yield currently stands at 6.01%. HBAN also carries a Zacks Rank of 3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report