Walmart (WMT) Continues to Stand Strong: Stock Up 20% in a Year

Walmart Inc. WMT has carved a robust position in the retail world with its constant endeavors to enhance omnichannel operations and serve customers better. The company has been witnessing year-over-year growth in its comp sales for a while now due to solid store and e-commerce performance.

These upsides continued to be drivers in the first quarter of fiscal 2024, wherein both the top and bottom lines increased year over year and cruised ahead of the Zacks Consensus Estimate. Strong comp sales growth globally and expense leverage were upsides.

For fiscal 2024, Walmart expects consolidated net sales growth of nearly 3.5% at constant currency or cc. Management expects the consolidated operating income to increase roughly 4-4.5% at cc, including 100 bps from LIFO. For the second quarter of fiscal 2024, Walmart expects consolidated net sales growth of around 4% at cc.

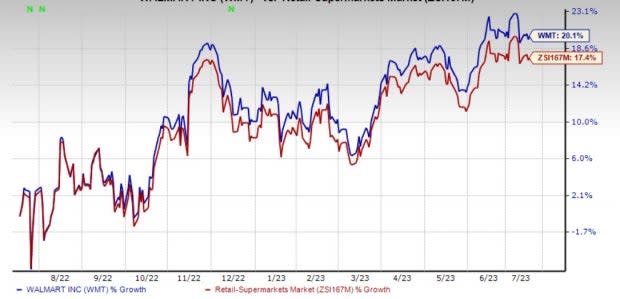

This Zacks Rank #2 (Buy) stock has rallied 20.1% in the past year compared with the industry’s growth of 17.4%. The Zacks Consensus Estimate for fiscal 2024 earnings per share has moved up from $6.12 to $6.21 over the past 60 days.

Walmart Inc. Price, Consensus and EPS Surprise

Walmart Inc. price-consensus-eps-surprise-chart | Walmart Inc. Quote

Robust Comp Sales

Walmart has been undertaking several efforts to enhance merchandise assortments. Also, the company has been focused on store remodeling to upgrade them with advanced in-store and digital innovations. The company remodeled 96 U.S. stores in the first quarter of fiscal 2024. Walmart is also gaining from its compelling pricing strategy, which helps it draw customers.

U.S. comp sales, excluding fuel, improved by 7.4% due to a 4.4% increase in the average ticket, and transactions rose 2.9% year over year. Comp sales were mainly driven by strength in food categories, the solid sales of private brands, an elevated average ticket and increased store transactions. The segment continued to see an increased market share in grocery.

E-commerce boosted comps by 270 bps. Sam’s Club’s comp sales, excluding fuel, grew 7%. While transactions grew 2.9%, the average ticket rose 4%. Comp sales saw strength across most categories, mainly led by food and consumables.

Image Source: Zacks Investment Research

E-commerce – a Major Driver

Walmart’s e-commerce business and omnichannel penetration have been increasing. The company’s global e-commerce sales form more than 13% of its sales as of the end of fiscal 2023.

WMT has been taking several e-commerce initiatives, including buyouts, alliances, and improved delivery and payment systems. The company is innovating in the supply chain and adding capacity as well as building businesses, such as Walmart GoLocal, Walmart Connect, Walmart Luminate, Walmart+, Spark Delivery, Marketplace and Walmart Fulfillment Services.

In the first quarter of fiscal 2024, e-commerce sales surged 26% globally on omnichannel strength, including pickup and delivery. U.S. e-commerce sales rose 27%, driven by strength in pickup & delivery and advertising. International segment e-commerce sales ascended 25% on store-fulfilled and advertising strength. At Sam’s Club, e-commerce sales jumped 19% on strong curbside performances.

Walmart is making aggressive efforts to expand in the booming online grocery space, which has long been a major contributor to e-commerce sales. This is evidenced by its partnership with Salesforce, the expansion of the InHome delivery service, investments in DroneUp, a pilot with HomeValet, the introduction of Carrier Pickup by FedEx, the launch of the Walmart+ membership program, drone delivery pilots in the United States with Flytrex and Zipline and a pilot with Cruise to test grocery delivery through self-driven all-electric cars.

Before this, Walmart unveiled Express Delivery and joined forces with Point Pickup, Roadie and Postmates, alongside acquiring Parcel to enhance its delivery service. Furthermore, the company’s store and curbside pickup options add to customers’ convenience. As of the first quarter of fiscal 2024, Walmart U.S. had 4,600 pickup locations and more than 3,900 same-day delivery stores.

Considering the abovementioned upsides, the supermarket giant is set to keep its growth story going.

Other Promising Stocks

Abercrombie & Fitch ANF, which operates as a specialty retailer, currently sports a Zacks Rank #1 (Strong Buy). ANF has a trailing four-quarter earnings surprise of 480.6%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year EPS suggests a considerable increase from the year-ago reported number.

Urban Outfitters URBN, which engages in the retail and wholesale of general consumer products, currently sports a Zacks Rank #1. URBN has a trailing four-quarter earnings surprise of 12.2%, on average.

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year earnings suggests growth of 57.1% from the year-ago reported number.

The TJX Companies TJX, an off-price retailer, currently carries a Zacks Rank #2. TJX has a trailing four-quarter earnings surprise of 4.4%, on average.

The Zacks Consensus Estimate for The TJX Companies’ current fiscal-year earnings suggests growth of 14.8% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report