Viasat (VSAT) Explores Contingency Plans for Satellite Anomaly

Viasat, Inc. VSAT, a leading player in the satellite communications industry, has encountered an unexpected setback with its ViaSat-3 Americas satellite. The company revealed that an event during the reflector deployment likely had a material impact on the satellite's performance. Viasat is currently working closely with the reflector's manufacturer to determine the extent of the issue and explore potential remedial measures.

To mitigate the economic effects of this anomaly, Viasat is refining its contingency plans. These plans aim to minimize the impact on the company's operations. One potential option is to redeploy satellites from Viasat's extensive fleet to optimize global coverage. Another option under consideration is reallocating a subsequent ViaSat-3 class satellite to provide additional bandwidth for the Americas region. It is important to note that the initial service priority for ViaSat-3 Americas was to support the growth of Viasat's North American fixed broadband business.

Despite the sudden setback, customers have not experienced any disruption in service as the coverage and capacity of the existing Viasat and Inmarsat constellations remain unaffected. Viasat, following its acquisition of Inmarsat, operates 12 Ka-band satellites in space, excluding ViaSat-3. Additionally, the company has eight more Ka-band satellites under construction.

As Viasat navigates this unexpected challenge, investors should monitor its progress in resolving the satellite anomaly. The successful implementation of the contingency plans will be key in minimizing the impact on its performance and ensuring continued growth in core business areas.

Nevertheless, the growing adoption of in-flight Wi-Fi services in commercial aircraft is proving conducive to its business growth. Viasat’s impressive bandwidth productivity sets it apart from conventional and lower-yield satellite providers that run on incumbent business models. The company has a competitive advantage in bandwidth economics, global coverage, flexibility and bandwidth allocation, which makes it believe that mobile broadband will act as a profit churner with a significant improvement in in-flight connectivity revenues.

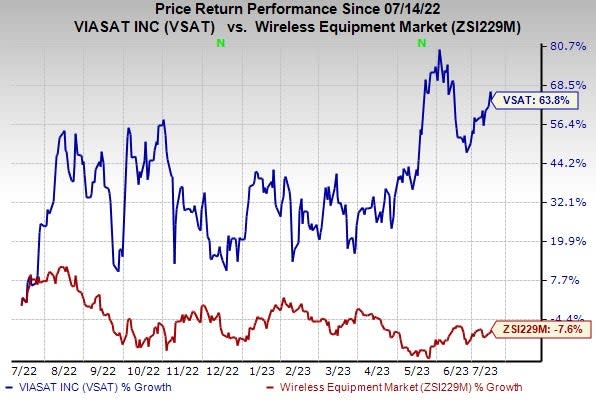

The stock has gained 63.8% over the past year against the industry's decline of 7.6%.

Image Source: Zacks Investment Research

Viasat currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Key Picks

InterDigital, Inc. IDCC, sporting a Zacks Rank #1, delivered an earnings surprise of 170.89%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 579.03%. It has a long-term earnings growth expectation of 13.9%.

It is a pioneer in advanced mobile technologies that enables wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular and wireless 3G, 4G and IEEE 802-related products and networks.

Akamai Technologies, Inc. AKAM, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 4.9%, on average, in the trailing four quarters. It has a long-term earnings growth expectation of 10%.

Akamai is a global provider of content delivery network and cloud infrastructure services. The company’s solutions accelerate and improve the delivery of content over the Internet, enabling faster response to requests for web pages, streaming of video & audio, business applications, etc. Akamai’s offerings are intended to reduce the impact of traffic congestion, bandwidth constraints and capacity limitations on customers.

Juniper Networks Inc. JNPR, carrying a Zacks Rank #2, is a leading provider of networking solutions and communication devices. The company develops, designs and sells products that help to build network infrastructure used for services and applications based on single Internet protocol network worldwide. Juniper offers a broad range of routing, switching and security products.

It delivered an earnings surprise of 5.2%, on average, in the trailing four quarters. Juniper has a long-term earnings growth expectation of 7.3%. It has a VGM Score of A.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Viasat Inc. (VSAT) : Free Stock Analysis Report