Valero Energy (VLO) Q1 Earnings Beat Estimates, Revenues Miss

Valero Energy Corporation VLO reported first-quarter 2021 loss of $1.73 per share, narrower than the Zacks Consensus Estimate of a loss of $1.91. In the year-ago quarter, the company reported earnings of 34 cents per share.

Total revenues fell from $22,102 million in the prior-year period to $20,806 million. Moreover, the top line missed the Zacks Consensus Estimate of $22,078 million.

The narrower-than-expected loss can be attributed to significant improvement in refining margins and product demand. This was offset partially by lower ethanol production volumes.

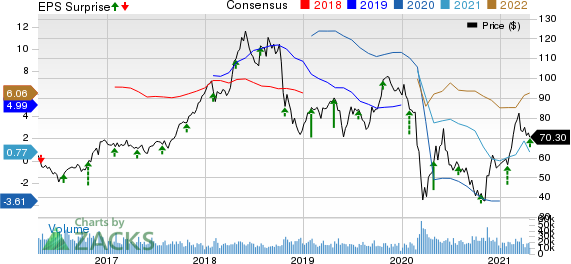

Valero Energy Corporation Price, Consensus and EPS Surprise

Valero Energy Corporation price-consensus-eps-surprise-chart | Valero Energy Corporation Quote

Segmental Performance

Operating loss at the Refining segment was reported at $592 million, narrower than $2,087 million of loss in the year-ago quarter. Lower refinery throughput volumes amid the coronavirus pandemic affected the segment. The negative was more than offset by a significant improvement in refining margins and products demand.

In the Ethanol segment, it reported operating loss of $56 million compared with a loss of $197 million in first-quarter 2020. Lower ethanol production volumes affected the segment. This was more than offset by higher margin.

Operating income at the Renewable Diesel segment increased to $203 million from $198 million in the year-ago period owing to higher margin.

Cost of Sales

Total cost of sales decreased to $21,214 million from the year-ago figure of $24,187 million.

Throughput Volumes

For the quarter, refining throughput volumes were 2,410 thousand barrels per day (Mbpd), down from the prior-year quarter’s 2,824 Mbpd.

In terms of feedstock composition, sweet crude, medium/light sour crude and heavy sour crude accounted for 47.4%, 11.4% and 14.7%, respectively, of its total volume. The remaining volumes came from residuals, other feedstock, and blendstocks and others.

The Gulf Coast contributed approximately 62.8% to total throughput volume. Mid-Continent, North Atlantic and West Coast regions accounted for 15.9%, 13.3% and 7.9%, respectively, of the total throughput volume.

Throughput Margins

Refining margin per barrel of throughput decreased to $6.68 from the year-ago level of $7.24. Refining operating expense per barrel was $6.78 compared with $3.87 in the year-ago quarter. Depreciation and amortization expenses increased to $2.46 a barrel from $2.09 in the prior-year quarter. As such, adjusted refining operating loss was recorded at $2.56 per barrel of throughput against the year-ago profit of $1.28.

Capital Investment & Balance Sheet

First-quarter capital investment totaled $582 million. Of the total amount, $333 million was allotted for sustaining the business. Through the March quarter, the leading independent refiner and marketer of petroleum products returned $400 million to stockholders as dividend payments.

At quarter-end, Valero had cash and cash equivalents of $2,254 million. As of Mar 31, 2021, it had a total debt of $14,664 million, signifying a debt to capitalization of 45.2%.

Guidance

The company is optimistic about its refining business as product demand and refining margins continue to improve.

Zacks Rank & Stocks to Consider

Valero Energy currently has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space include EOG Resources, Inc. EOG, Diamondback Energy, Inc. FANG and Matador Resources Company MTDR. All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EOG Resources is likely to see earnings growth of 272.6% in 2021.

Diamondback is expected to witness earnings growth of 112.5% in 2021.

Matador is likely to see earnings growth of 300% in 2021.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.