UBS Group (UBS) Closes Swiss Arm & Credit Suisse (Schweiz) Merger

UBS Group AG UBS marks an important milestone in the integration of UBS and Credit Suisse by completing the merger of UBS Switzerland AG and Credit Suisse (Schweiz) AG. This merger aligns with UBS' growth strategy to strengthen its market presence in competitive regions.

Following this merger, Credit Suisse (Schweiz) AG has been deregistered from the Commercial Register of the Canton of Zurich and no longer exists as a separate business. Consequently, UBS Switzerland AG now owns all the rights and obligations of Credit Suisse (Schweiz) AG.

The merging of the Swiss entities simplifies the transition of clients and operations from Credit Suisse (Schweiz) AG to the UBS platform following business, client and product-specific needs. Clients of Credit Suisse (Schweiz) AG have become clients of UBS Switzerland AG as a result of the merger. However, they will continue to interact with UBS using current Credit Suisse platforms and tools, until otherwise communicated.

Sabine Keller-Busse, president of UBS Switzerland, stated, “The migration of the majority of client transactions in Switzerland to the UBS platform will take place in 2025 and will be gradual, with tailored updates to our clients. As the integration progresses, our clients will be able to access the capabilities and support of the combined firm. We will continue to focus on providing our clients with comprehensive services to achieve their financial goals and acting as a strong pillar of economic support in Switzerland.”

According to its business restructuring plans, UBS Group is likely to wind down its Non-Core and Legacy portfolio, releasing more than $6 billion of capital by the end of 2026. Through these efforts, the company aims to achieve gross cost reductions of around $13 billion by the end of 2026 compared with 2022 levels. The bank has already achieved $1 billion in gross cost savings in the first quarter of 2024 and aims to achieve another $1.5 billion in gross cost savings by the end of this year.

In line with this, the merger of UBS Group AG and Credit Suisse AG was completed on May 31, 2024, with the transition to a single U.S. intermediate holding company planned for the second quarter of 2024. This move is expected to enhance capabilities in wealth and asset management as well as aid in growing its capital-light businesses.

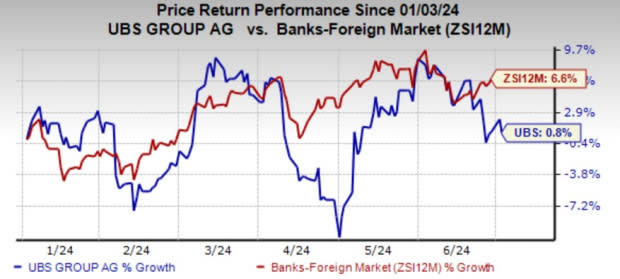

UBS Group’s shares have risen 0.8% on the NYSE over the past six months compared with the industry’s 6.6% growth.

Image Source: Zacks Investment Research

Currently, UBS carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Inorganic Expansion Efforts by Other Banks

This week, BlackRock BLK announced a deal to acquire Preqin, a premier provider of private markets data, for almost $3.2 billion (£2.55 billion) in cash.

This acquisition marks a significant milestone in BLK’s strategy to enhance its private markets capabilities by integrating investments, technology, and data across the entire portfolio.

In June, NatWest Group plc NWG announced an agreement to acquire the retail banking assets and liabilities of Sainsbury’s Bank plc.

This acquisition aligns with NWG’s growth strategy, adding scale and boosting its market presence in competitive areas.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

UBS Group AG (UBS) : Free Stock Analysis Report

NatWest Group plc (NWG) : Free Stock Analysis Report