Treasury sec-gen: Govt’s move to rationalise diesel subsidies first step towards cutting back on RON95 subsidies

KUALA LUMPUR, Oct 16 — The federal government’s recent move to rationalise diesel subsidies by moving away from blanket subsidies towards a more targeted measure is the first step towards implementing a similar policy shift for RON95 petrol in the future, a senior Treasury official said today.

Treasury secretary-general Datuk Johan Mahmood Merican said while rationalising subsidies for RON95 petrol is something the Finance Ministry ‘is actively looking into’, such consideration is still too early to be firmly determined at the present.

“Between diesel and petrol, we went with diesel first because petrol, worst case scenario, generally yes, is being used by the T20 but ultimately, it is largely used by Malaysians.

“So diesel is certainly the one with a clear case of leakage where the commercial sector is not using it for its intended purposes.

“So that is the rationale behind the sequencing of what we announced and certainly, it is not the case we are not proceeding with petrol subsidies, but we thought it was important to focus on the immediate term.

“We wanted to lay out the sequencing and start off our journey towards targeted subsidies but better targeting of petrol subsidies is not off the table,” he told participants at the Belanjawan 2024 post-Budget debate held at Sime Darby Convention Centre, Bukit Kiara here.

Johan said Prime Minister Datuk Seri Anwar Ibrahim should be given some credit for being honest with the people of the nation’s unsustainable circumstances by affording blanket subsidies with such a low tax base.

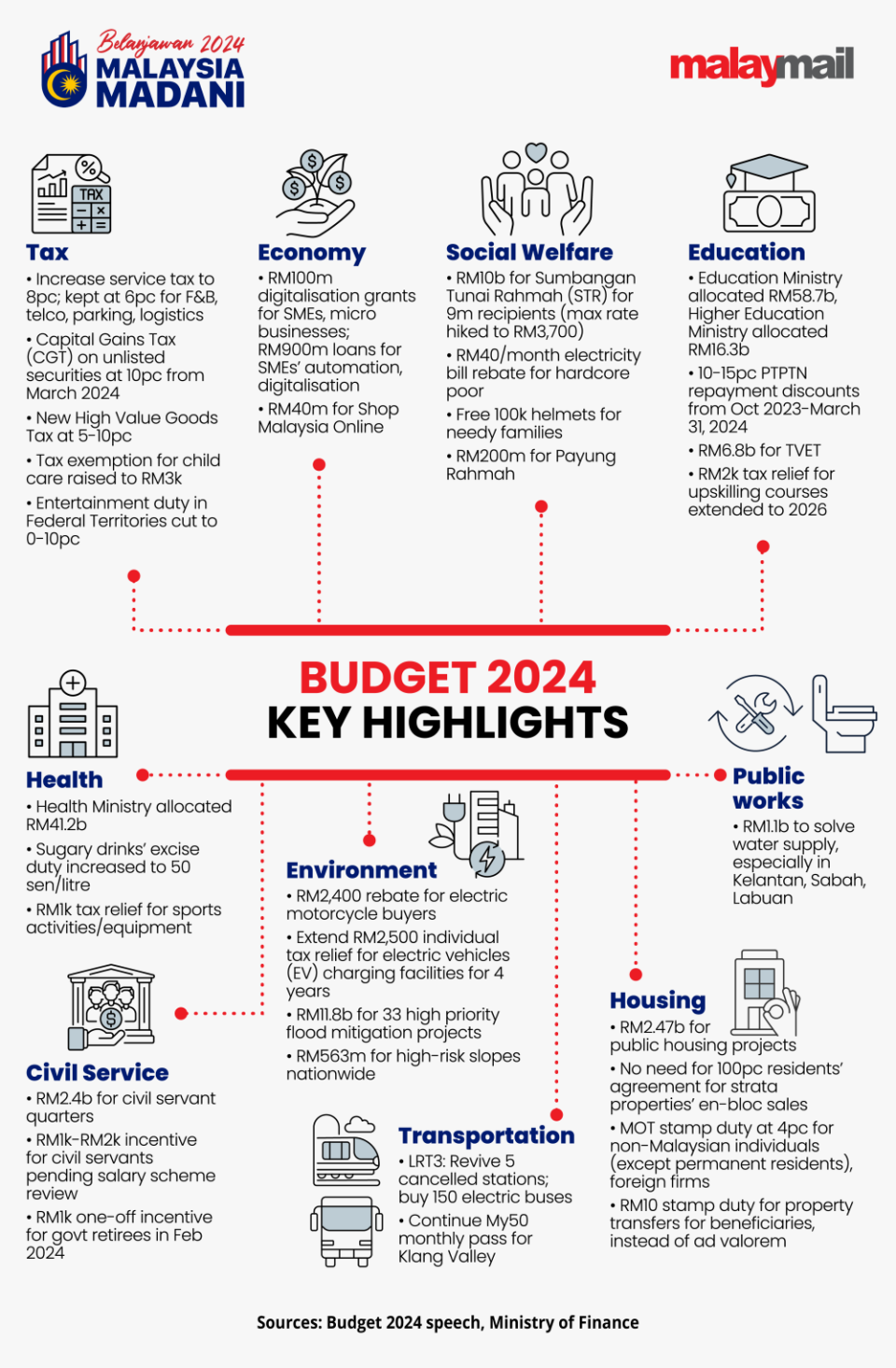

On the revised taxation rate for SST, Johan reiterated that there is a need for the country to broaden its tax base without having the need to reintroduce the now-abolished Goods and Services Tax (GST).

He said whilst the GST is ultimately the most efficient and transparent tax system, there is some element of it being regressive in nature when asked whether the government would consider reintroducing GST at a much lower rate than raising the rates of SST.

“Given the challenges our rakyat continues to face such as the cost of living, there is a priority need to reduce leakages and government expenditures while finding means to not burden the lower income group.

He also said it ‘would not make sense’ to reinstate the GST at a lower rate of three to four per cent, citing to the short-lived consumption-based tax which was politically weaponised as a tool of oppression by the Opposition when it was introduced in 2015.

Moreover, Johan said a reintroduction would also require fresh legislative process to be undertaken and time for implementation, where efforts to broaden the country’s tax base is a time-sensitive matter.

“So we focus on what we could do immediately in 2024,” he said.

Separately, Johan also said the federal government is forecasting some additional RM3 billion in Sales and Services Tax (SST) revenue will be generated from the present six per cent to eight per cent rate revision as announced in Budget 2024.

“As mentioned by the Finance Ministry, we are estimating at least RM3 billion (in additional revenue) from this announcement,” he told reporters on the sideline briefly.

Aside from the higher rate, the scope of the SST will also be widened to include logistics services, brokerage and underwriting, as well as karaoke.