Top-Ranked, Market- Beating Stocks to Buy for Surprising Value

August inflation data came in largely as projected on Wednesday. Wall Street traders upped their bets on a Fed pause at its September meeting next week following the CPI release, with the odds now at 97% vs. 92% yesterday.

Core YoY inflation hit 4.3% vs. 4.7% in July, with monthly Core CPI at 0.3% vs. 0.2% in the prior month. Inflation still remains well above the Fed’s 2% floating target range, and surging oil and gas prices are putting pressure on headline inflation and the wallets of American consumers.

Image Source: Zacks Investment Research

Nonetheless, the Fed appears to be near the end of its rate hiking cycle and the S&P 500 earnings outlook for 2024 and 2025 showcases stellar growth. Plus, both the S&P 500 and the Nasdaq are once again trying to retake their 50-day moving averages, having found support at their 21-day levels.

The bullish backdrop appears firmly in place. This means it’s time to explore two Zacks Rank #1 (Strong Buy) stocks that have crushed the market over the past two years and the last 20. On top of that, both stocks offer impressive value compared to their own historic levels.

Nvidia (NVDA) transformed from a somewhat under-the-radar tech star to a Wall Street heavyweight on the back of its artificial intelligence-driven boom in 2023 as companies of all stripes dive headfirst into AI.

Nvidia burst onto the scene as a gaming industry darling, driven by the power of its graphics processing units.The chip firm then spent the last 10-plus years expanding its reach into data centers, AI, and more.

Image Source: Zacks Investment Research

The power and quality of its GPUs in various key markets helped it post 24% average revenue expansion in the five-year stretch between FY15 and FY19. The company posted a slight downturn during Covid before it ripped off 53% sales growth in FY21 and 62% top-line expansion in FY22.

Nvidia’s fiscal 2023 revenue (period ended on Jan. 29) then came in flat. But the generative AI boom is sending NVDA’s outlook into hyperdrive. “Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry,” CEO Jensen Huang said last quarter (Q2 FY24). “The race is on to adopt generative AI.”

Nvidia’s revenue is projected to grow by 82% this year and another 44% next year, based on Zacks estimates, to soar from under $30 billion in FY23 all the way to $77.70 billion next year. And its adjusted earnings are projected to skyrocket by 220% and 49%, respectively.

Image Source: Zacks Investment Research

Wall Street analysts can hardly keep up with Nvidia’s AI-boosted guidance. Its soaring earnings outlook helps it grab a Zacks Rank #1 (Strong Buy) right now. The GPU maker has skyrocketed over 200% YTD to hit fresh record highs along the way, topping second-place Meta’s 150% climb in 2023. NVDA is now up 560% during the last five years vs. Tech’s 80%.

The stock just popped back above its 50-day. On top of that, NVDA is trading 39% below its average Zacks price target. Still, some might be nervous about “chasing” Nvidia here.

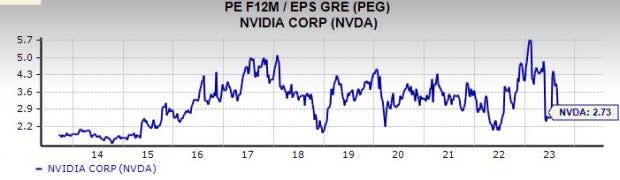

Yet, Nvidia trades at a 50% discount to its own 10-year highs at a PEG ratio of 2.7 and 15% below its median. Nvidia also offers 23% value compared to the Zacks Semiconductor market. And it is now hovering around neutral RSI levels on a 12-month timeframe.

Caterpillar (CAT) is one of the global leaders in construction and mining equipment that’s at the heart of economic growth in the U.S. and beyond. CAT’s recent growth has been fueled by the ongoing U.S. construction boom.

More crucially for long-term investors, Caterpillar is prepared to ride various megatrends for the remainder of the 2020s and the decades to come, including infrastructure, onshoring, the energy transition, and beyond. All of these efforts are being driven by a mixture of private and public spending, including a massive push from the U.S. federal government that will be calculated in the trillions when it’s all said and done.

Image Source: Zacks Investment Research

CAT topped our Q2 estimates in early August and boosted its guidance, with it projected to post 12% revenue growth to help boost its bottom line by 43%. This outlook is even more robust when considering that it posted 22% sales growth in 2021 and 17% expansion last year.

Caterpillar is projected to follow that up with another solid year of revenue and EPS expansion next year. Caterpillar’s positive EPS revisions help it land a Zacks Rank #1 (Strong Buy) right now.

Caterpillar stock has more than doubled the S&P 500 over the last 25 years, with it also up 220% in the past 10 years vs. the benchmark’s 173% and the Zacks Industrial Products sector’s 56%. Plus, CAT has ripped 48% higher over the last year, while trading around 7% below its recent highs. Its post-earnings release slide has pushed it below overbought RSI levels to below neutral. And it is possibly ready to test its 50-day moving average.

Image Source: Zacks Investment Research

On the valuation front, Caterpillar is trading 60% below its 10-year highs, nearly 20% below its median, and 15% beneath the Zacks Industrial sector at 13.4X forward 12-month earnings.

Caterpillar’s Manufacturing - Construction and Mining industry is in the top 2% of over 250 Zacks industries. And its 1.9% dividend yield tops its highly-ranked industry’s 1.6% average. Plus, CAT’s payout ratio sits at a very comfortable 26%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report