Top 5 High-Flying Reopening Stocks in 2021 With More Upside

Wall Street has maintained its northbound journey in 2021. The large-cap centric indexes — the Dow, the S&P 500 and the Nasdaq Composite — are up more than 10% year to date. Moreover, both the small-cap specific Russell 2000 and the mid-cap centric S&P 400 have gained more than 16% so far this year, indicating a broad-based rally in U.S. stock markets.

However, the driver of the rally has changed. Cyclical sectors like consumer discretionary, industrials, materials, financials and oil-energy have taken the reins over in 2021 from the growth-oriented technology space in 2020. Year to date, all 11 broad sectors of the market's benchmark S&P 500 Index are in positive territory with cyclical sectors being the best performers.

Nationwide deployment of COVID-19 vaccines, a sharp decline in new coronavirus cases and faster-than-expected reopening have resulted in a robust recovery of the U.S. economy from the pandemic-led disruptions.

Several reopening stocks have skyrocketed in 2021. Out of those stocks, a handful of corporate bigwigs (market capital > $50 billion) with a favorable Zacks Rank still have more upside left. Investment in these stocks may be fruitful going forward.

Wall Street is Not Overvalued

Before the global outbreak of the coronavirus, the U.S. stock markets were going through their historically longest bull run. The advent of the pandemic put Wall Street in recession within less than a month. However, this recession was not due to any economic or financial factors but purely owing to an unprecedented health hazard.

The three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have soared 86%, 93.5% and 115.2%, respectively, from the recession trough on Mar 23, 2020. However, if we eliminate the coronavirus-led recession, the Dow is up 14.6% from its pre-pandemic high recorded on Feb 12, 2020 to Jun 23, 2021. The S&P 500 has gained 25.3% from the pre-pandemic high registered on Feb 19, 2020 to Jun 23, 2021. The teach-heavy Nasdaq Composite rallied 45.1% in the same period.

None of the above-mentioned figures looks like exaggerated returns given the unprecedented fiscal and monetary stimulus injected into the U.S. economy. On Jun 23, the Nasdaq Composite attained its 16th all-time high in 2021 despite Fed's sooner-than-expected rate hike signal. The S&P 500 and the Dow are respectively 0.4% and 3.6% away from their all-time highs. Moreover, the Russell 2000 is 2.5% behind its recent all-time high.

Sustainable Current Valuation

The current market valuation is likely to be sustained by a robust projection of U.S. GDP in 2021 and record-breaking corporate profits. Notably, Fed officials' informal discussions about a possible deviation from the existing easy-money policy are solely due to an impressive recovery of the U.S. economy, beyond the central bank's own expectations.

U.S. manufacturing is firing on all cylinders, and of late, the services sector is also thriving. Consumer spending, the largest driver of the GDP remains strong buoyed by around $2.3 trillion of forced savings. The labor market is settling down gradually. Finally, consumers' satisfaction optimization indexes remain elevated.

The Federal Reserve raised the U.S. GDP growth rate for 2021 to 7% in June from 6.5% in March. Several globally recognized economic and financial agencies like the World Bank, the IMF, OECD and Oxford Economics also projected U.S. economic growth within the range of 6.5% to 7% for 2021 — the highest in 38 years.

Per our projections on Jun 23, total earnings of the market's benchmark — the S&P 500 Index — are expected to climb 35.3% year over year on 10.6% higher revenues in 2021 compared with a 13.1% year-over-year decline in earnings on 1.7% lower revenues in the coronavirus-ridden 2020. Moreover, in 2022, total earnings of the S&P Index are forecast to grow 11.2% year over year on 8.3% higher revenues.

Our Top Picks

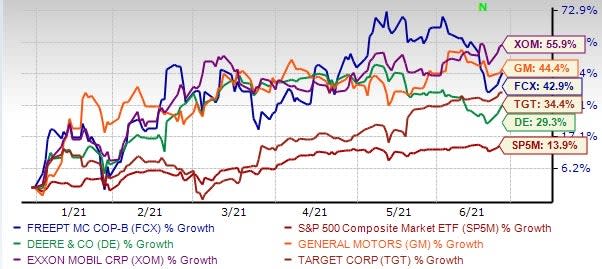

We have narrowed down our search to five corporate giants that have popped nearly 30% or more year to date and still have strong upside for the rest of 2021. All these stocks have seen solid earnings estimate revisions within the last 30 days indicating market's expectations of growing businesses in the near term. Finally, each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Exxon Mobil Corp. XOM made multiple world-class oil discoveries at the Stabroek Block, located off the coast of Guyana. It recently announced another significant oil discovery at the Longtail-3 well, offshore Guyana which added to the prior estimate of gross recoverable resource of 9 billion barrels of oil equivalent. Moreover, the company also has a strong presence in the prolific Permian where it continues to lower its fracking & drilling costs.

This Zacks Rank #1 company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for the current year has improved 2.4% over the last 7 days. The stock price has soared 55.9% year to date.

General Motors Co. GM has been witnessing strong demand for profitable trucks and SUVs. The company’s hot-selling brands in America like Chevrolet Silverado, Equinox and GMC Sierra are driving the top line. General Motors’ big push toward electric vehicles (EV) is commendable. The automaker plans to roll out 30 fresh EV models by 2025-end.

This Zacks Rank #1 company has an expected earnings growth rate of 24.9% for the current year. The Zacks Consensus Estimate for the current year has improved 11.9% over the last 7 days. The stock price has jumped 44.4% year to date.

Freeport-McMoRan Inc. FCX is conducting exploration activities near its existing mines with a focus on opportunities to expand reserves. It is optimistic about automotive electrification, which is a positive for copper as EVs consume more copper. The company anticipates a strong potential for the EV market and expects rapid growth over the next decade, with additional annual copper usage expected to be 500,000 tons to more than 1 million metric ton by 2025.

This Zacks Rank #1 company has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for the current year has improved 10.2% over the last 30 days. The stock price has climbed 42.9% year to date.

Target Corp. TGT has undertaken several strategic initiatives to boost performance. It has been deploying resources to enhance omni-channel capacities, including same-day delivery of in-store purchases and accelerate technology improvements. Target has been aggressively adopting strategies to provide a seamless shopping experience through miscellaneous channels.

This Zacks Rank #1 company has an expected earnings growth rate of 25.6% for the current year (ending January 2022). The Zacks Consensus Estimate for its current-year earnings has improved 36.6% over the last 60 days. The stock price has rallied 34.4% year to date.

Deere & Co. DE has been benefiting from improving farm income driven by recovering agricultural commodity prices. This has encouraged farmers to resume investing in new equipment and replace their aging fleet. The company has been witnessing improvement in the Construction & Forestry segment backed by strength in the housing market as well in the non-residential sector.

This Zacks Rank #2 company has an expected earnings growth rate of more than 100% for the current year (ending October 2021). The Zacks Consensus Estimate for its current-year earnings has improved 1.1% over the last 7 days. The stock price has surged 29.3% year to date.

More Stock News: This Is Bigger than the iPhone!

t could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

FreeportMcMoRan Inc. (FCX) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research