Time to Buy Bitcoin? Multiple Bullish Catalysts on the Horizon (revised)

Bitcoin just completed a technical chart pattern that may indicate the start of another major bull market. Additionally, with the Fed likely cutting interest rates, a Bitcoin ETF in the pipeline, and a new credible exchange, it might be time to get involved.

On the price chart of Bitcoin below we can see that the cryptocurrency has built out an ideal cup and handle pattern, from which it broke out today. Furthermore, the price cleared, then retested the 30-week moving average and traded higher, confirming a stage one breakout.

Image Source: TradingView

Stage Analysis

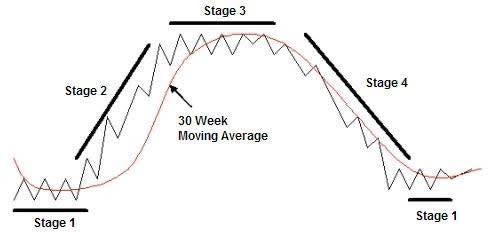

According to stage analysis, a stage one breakout follows a prolonged horizontal consolidation phase on the chart, known as a base. This occurs when the stock trades sideways instead of exhibiting a clear upward or downward trend.

Typically, the base develops following a decline in the stock price. The duration of the base is crucial, as a longer base establishes a stronger support level and facilitates the transfer of stock ownership from weaker to stronger hands. Throughout the formation of the base, the stock's price action typically fluctuates above and below the 30-week moving average.

This is exactly how the Bitcoin price chart is developing. It also has the added advantage of a clear technical chart pattern.

Image Source: Next Big Trade

Bitcoin ETF

BlackRock BLK, the world's largest asset manager, recently declared its plan to introduce the first Bitcoin exchange-traded fund (ETF) in the United States.

BlackRock's recent filing carries significant weight as it arrives amidst the SEC's previous denial of similar attempts to launch spot Bitcoin ETFs. Grayscale Investments GBTC has even taken legal action against the SEC, aiming to convert its Bitcoin trust into the first spot Bitcoin ETF to be listed in the United States.

The SEC has adopted a stricter stance on cryptocurrency platforms and brokers, exemplified by their recent lawsuits against Coinbase and Binance, accusing them of operating as unregistered securities exchanges.

Eric Balchunas, a Senior ETF Analyst at Bloomberg, expressed surprise at BlackRock's move, acknowledging the lack of indications from the SEC regarding approval for such a fund. Nevertheless, BlackRock's connections and influence may provide them with an advantageous position in this endeavor.

New Exchange

A new crypto exchange backed by Citadel Securities, Fidelity, and Charles Schwab recently started up operations. EDX Markets is a noncustodial exchange, meaning it won’t be directly handle clients digital assets, but will rather be running a marketplace where other firms can transact. This contrasts with most crypto exchanges that typically require customers to store coins on the exchange.

EDX markets quietly started seeking business from brokers and investors and has begun trading on its platform. Considering pressure from the SEC cracking down on crypto broadly over the last year, it comes as a surprise to most that there is enough demand for this exchange but it’s clear there is interest from investors who may be coming back around to crypto.

Bitcoin Stocks

For investors who don’t want to buy Bitcoin directly, there are a couple of ways they can access exposure to Bitcoin though equities.

BITO BITO Bitcoin Strategy ETF by ProShares is an excellent way to get exposure to Bitcoin. BITO has managed to work around the regulations by structuring its ETF with Bitcoin futures, rather than Bitcoin itself. BITO has done a great job of tracking the cryptocurrency and can be considered for those trying to get exposure. BITO is up 57% YTD.

Another way to get access to Bitcoin indirectly is to buy shares in MicroStrategy MSTR, the enterprise software company, whose founder and CEO Michael Saylor has purchased $4 billion worth of Bitcoin. MicroStrategy also currently boasts a Zacks Rank #1 (Strong Buy), indicating upward trending earnings revisions.

Bottom Line

Bitcoin’s resurgence has been quite astounding. Even after numerous shakedowns from regulators, fraudsters, scandals and vitriol the nascent asset slowly continues to grow.

NOTE: This article has been re-published to correct an error. The original version, posted [6/20/2023], should no longer be relied upon.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Grayscale Bitcoin Trust (GBTC): ETF Research Reports

ProShares Bitcoin Strategy ETF (BITO): ETF Research Reports