Time to Buy Apple Stock for More Upside as Earnings Approach?

Edging out some nice gains this year all eyes are on Apple (AAPL) this week with the company set to release its fiscal second-quarter earnings on Thursday, May 4.

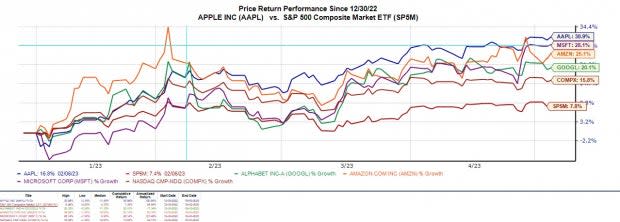

Apple’s performance has been strong outperforming most of its big tech peers such as Alphabet (GOOGL), Amazon (AMZN), and Microsoft (MSFT) while easily topping the broader indexes.

With Apple stock now up +30% in 2023, investors are wondering if strong second-quarter results and positive guidance can help the computer and technology innovator divvy up more gains like it is historically known to do.

Image Source: Zacks Investment Research

Q2 Preview

Apple’s second-quarter earnings are expected to dip -5% at $1.44 per share compared to EPS of $1.52 in Q2 2022. Sales are forecasted to be down -4% from the prior year quarter at $93.32 billion.

Still, Apple’s stock tends to pop after beating earnings expectations and investors are certainly hoping the company can do so.

Image Source: Zacks Investment Research

Wall Street will be monitoring Apple's guidance to see if operating conditions are stabilizing going forward.

Last quarter, CEO Tim Cook stated a stronger dollar, production issues in China, and the broader challenges in the macroeconomic environment affected results. To that point, Apple most recently missed its first quarter top and bottom line expectations by a slight margin.

Image Source: Zacks Investment Research

Notably, Q1 sales missed top-line estimates by -3% and declined -5% YoY which was the largest quarterly drop since 2016 and the first decline in quarterly revenue since 2019.

With Apple expected to post another quartely decline in sales, Wall Street will be seeing if the company's outlook indicates a stop to the bleeding. With that being said, the sentiment toward tech stocks is very positive as inflation begins to ease and the ability to offer positive guidance could extend Apple’s rally.

Growth & Outlook

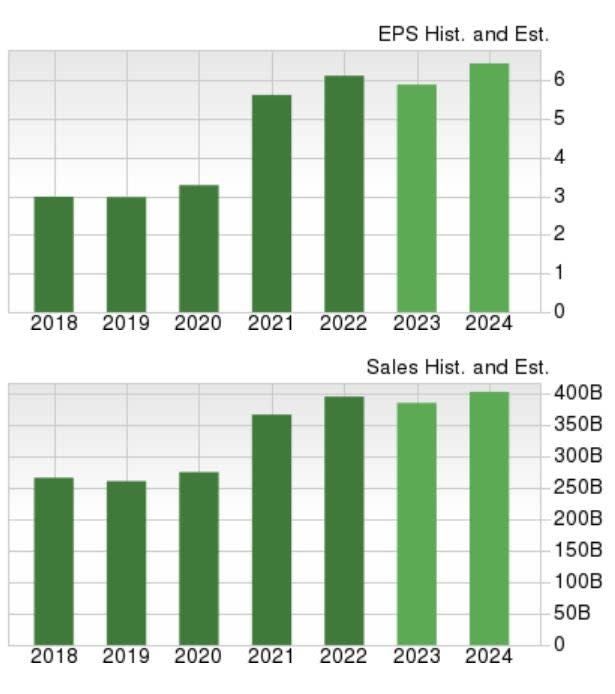

According to Zacks estimates, Apple’s sales are now forecasted to be down -1% this year but rebound and rise 7% in FY24 to $414.61 billion. More importantly, fiscal 2024 would be a 59% increase from 2019 pre-pandemic sales of $260.17 billion.

On the bottom line, earnings are projected to slightly decline by -1% in FY23 but jump 11% in FY24 at $6.66 per share. Fiscal 2024 would represent a very impressive 124% growth in EPS since the pandemic with 2019 earnings at $2.97 per share.

Image Source: Zacks Investment Research

Performance & Valuation

With its growth story seemingly intact, investors may be more intrigued by the strong performance in Apple stock this year. To that point, Apple’s stellar growth has led to the stock soaring +951% over the last decade.

This has crushed the S&P 500 and the Nasdaq, while also topping the performance of Alphabet, Amazon, and Microsoft stocks.

Image Source: Zacks Investment Research

Trading around $168 per share, Apple stock trades at 28X forward earnings which is nicely below its decade-long high of 38.6X but above the median of 16X.

Although this is above the industry average of 9.1X and the S&P 500’s 18.9X, Apple is the clear-cut leader in its space and Wall Street has historically been ok with paying a premium for AAPL shares due to the company’s growth potential.

Plus, when considering Apple’s growth rate its PEG ratio of 2.1 is slightly below the industry average and not too far above the S&P 500’s 1.72 although the optimum level is less than 1.0.

Image Source: Zacks Investment Research

Bottom Line

Apple stock currently lands a Zacks Rank #3 (Hold) going into its fiscal second quarter report. Looking at Apple’s historical performance and the expected growth next year there could still be a nice amount of upside from current levels.

However, more upside in Apple stock will largely depend on the company’s ability to offer positive or better-than-expected guidance and put an end to the decline in quarterly sales.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report