Things to Consider Ahead of O'Reilly's (ORLY) Q2 Earnings

O'Reilly Automotive, Inc. ORLY is slated to release second-quarter 2022 results on Jul 27, after the closing bell. The Zacks Consensus Estimate for the quarter’s earnings and revenues is pegged at $8.99 per share and $3.71 billion, respectively.

The Zacks Consensus Estimate for O’Reilly’s second-quarter earnings per share has been revised upward by 1 cent in the past seven days. The bottom-line projection implies year-over-year growth of 8%. Further, the Zacks Consensus Estimate for quarterly revenues suggests a year-over-year rise of 7%.

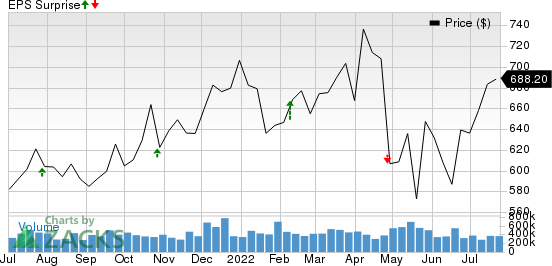

This U.S.-based specialty retailer of automotive parts came up with weaker-than-anticipated earnings in the last reported quarter. The top line, however, beat the consensus mark on higher-than-expected comps. Over the trailing four quarters, the company surpassed earnings estimates thrice and missed once, with the average being 13.43%. This is depicted in the graph below:

O'Reilly Automotive, Inc. Price and EPS Surprise

O'Reilly Automotive, Inc. price-eps-surprise | O'Reilly Automotive, Inc. Quote

Earnings Whispers

Our proven model predicts an earnings beat for O’Reilly this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This has been elaborated below.

Earnings ESP: O’Reilly has an Earnings ESP of +0.40%. This is because the Most Accurate Estimate is pegged 4 cents higher than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: O’Reilly carries a Zacks Rank of 3 currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors at Play

Robust demand for vehicles is likely to have supported the sales of O’Reilly’s products and services. ORLY’s wide-ranging product portfolio serving the Do-it-Yourself and Do-it-for-Me customers provides the company with a competitive edge and is anticipated to have fueled comparable-store sales growth during the second quarter. The Zacks Consensus Estimate for the to-be-reported quarter’s comps growth is pegged at 5.36%, higher than 4.8% recorded in the first quarter of 2022. This is likely to have buoyed O’Reilly’s top line during the April-June period.

Further, O’Reilly’s customer-centric business model and surging demand for technologically-advanced auto parts are likely to have bolstered sales during the June-end quarter. Robust digitization efforts are also likely to have boosted the company’s performance during the quarter in discussion.

ORLY is also likely to have gained from the opening of new stores and distribution centers in profitable regions during the to-be-reported quarter. The consensus mark for total store count as of June end is pegged at 5,888, implying an uptick from 5,838 as of Mar 31, 2022. ORLY’s upbeat full-year 2022 earnings and sales outlook also instills optimism for the to-be-reported quarter.

Other Stocks With the Favorable Combination

Here are a few other stocks in the auto sector lined up to release quarterly results soon. Encouragingly, our model predicts an earnings beat for these stocks as well:

Oshkosh Corporation OSK has an Earnings ESP of +8.67% and a Zacks Rank #3. The stock is set to report second-quarter 2022 earnings on Jul 28.

The Zacks Consensus Estimate for Oshkosh’s to-be-reported quarter’s earnings and revenues is pegged at 93 cents per share and $2.2 billion, respectively. Over the trailing four quarters, OSK surpassed earnings estimates twice for as many misses, with the average negative surprise being 1.21%.

Magna International MGA has an Earnings ESP of +5.82% and a Zacks Rank #3. The company is slated to release second-quarter results on Jul 29.

The Zacks Consensus Estimate for Magna’s to-be-reported quarter’s earnings and revenues is pegged at 95 cents per share and $8.77 billion, respectively. Over the trailing four quarters, MGA surpassed earnings estimates twice for as many misses, with the average being 12.6%.

Lear Corporation LEA has an Earnings ESP of +6.93% and a Zacks Rank #3. The company is set to post second-quarter results on Aug 2.

The Zacks Consensus Estimate for Lear’s to-be-reported quarter’s earnings and revenues is pegged at $1.18 per share and $4.75 billion, respectively. LEA surpassed earnings estimates in three of the last four quarters and missed once, with the average being 6.53%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research