Tapping into India's Growth: 3 ADRs to Own Now

What is an American Depositary Receipt (ADR)?

An American Depositary Receipt (ADR) is like a passport for foreign stocks to be traded on U.S. exchanges. When a non-U.S. company wants to make its shares available to American investors, it teams up with a U.S. depository bank. The bank buys a bunch of the foreign company’s shares and issues ADRs, which represent those shares. These ADRs can then be bought and sold on U.S. stock markets, making it simpler for American investors to access and trade stocks from companies based internationally.

What Advantages do ADRs offer U.S. Investors?

Trading ADRs offers three main advantages to domestic investors:

1. Diversification: Because ADRs represent non-US equities, they offer U.S. investors a means to invest in stocks that are not correlated to U.S. stocks. Such diversification can help investors to reduce risk and limit downside should U.S. equities retreat.

2. Growth Opportunities: ADRs allow investors to tap into the growth potential of fast-growing international economies. By investing in companies from emerging markets with ADRs, investors can capitalize on the economic expansion and development in those countries without directly navigating their sometimes-complex local stock exchanges.

3. Regulated: To become an ADR, international companies must pass certain regulatory hurdles.

India’s Unique Opportunity on the World Stage

India, Asia’s third-largest economy, saw its economy expand by a blistering 7.6% in the September quarter, much higher than the Reserve Bank of India’s estimate of 6.5%. As China’s economy continues to struggle, India is picking up the slack. Tense U.S./China relations are allowing India’s manufacturing sector to thrive. Meanwhile, India’s government is showing itself to be pro-business, even offering EV-King Tesla (TSLA) billions in incentives to start manufacturing some of its batteries in India.

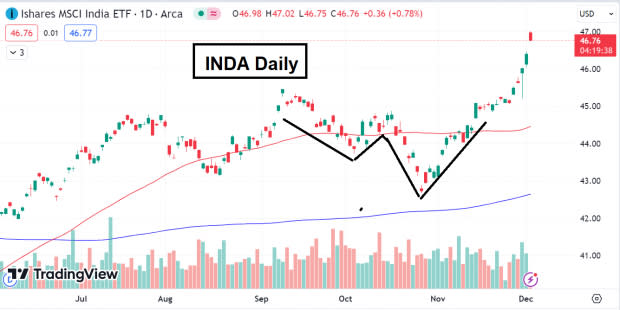

India’s stock market is beginning to respond to the unique opportunities the country is taking advantage of. Tuesday, the iShares MSCI India ETF (INDA) gained ground for a fourth straight session. Currently, the ETF is emerging from a classic double-bottom base structure.

Image Source: TradingView

Below are 3 Indian ADRs worth owning:

“The Priceline of India”

MakeMyTrip (MMYT) is an online travel company that facilitates travel bookings and services. Primarily focused on the Indian market, MakeMyTrip allows users to book flights, hotels, buses, trains, and holiday packages through its platform.

As India’s economy continues to grow, so will its middle class. A larger middle class means more travel for Indian citizens. For 2024, Zacks Consensus Estimates expect annual EPS growth to explode by 135.42% year-over-year.

Image Source: Zacks Investment Research

Tapping into IT Growth

Infosys (INFY) is an information technology services company that helps businesses worldwide with their technology needs. INFYS offers various services, including software development, consulting, and outsourcing. The company works on projects related to fast-growing industries such as cloud computing, artificial intelligence, and digital transformation.

Image Source: Zacks Investment Research

Banking Boom

ICICI Bank (IBN) is a financial institution that provides various banking and financial services like credit cards, investment products, and savings and checking accounts. As India’s economy grows, the need for banking will grow exponentially. Tuesday, shares gapped up 5% on massive volume – a sign that heavy-pocketed investors were buying shares.

Image Source: TradingView

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Noble Gas Inc. (INFY) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

MakeMyTrip Limited (MMYT) : Free Stock Analysis Report

iShares MSCI India ETF (INDA): ETF Research Reports