Synopsys' (SNPS) Design Flows Get Certification for N2 Process

Synopsys SNPS, the global leader in electronic design automation (EDA) and semiconductor Intellectual Property (IP), announced that its digital and analog design flows received the certification for Taiwan Semiconductor Manufacturing Company’s (“TSMC”) N2 process technology.

Digital and analog design flows are a series of steps and tools designed to verify a chip. While digital flow involves logic-based and digital components of a chip, analog deals with circuits and signal processing.

These design flows are aimed at fast-tracking N2 designs, while enabling designers in differentiating their System-on-Chips with improved power, performance and chip density. The design flows come with the promise of reducing time to market and as a result, the design flows are gaining traction with the adoption of both analog and digital flows by the designers.

Both the designs are powered by an artificial intelligence (AI)-driven EDA suite, namely Synopsys.ai, to boost productivity. Synopsys.ai saw the addition of an extension called Synopsys.da that enhanced its data analysis capabilities earlier this month.

The company is also developing Foundation and Interface IP, which is specifically compatible with the TSMC N2 process. It will also enable Synopsys DSO.ai, an AI-driven design technology to optimize the power performance and area of N2-based designs.

These design flows are the latest outcome of the long-standing partnership between SNPS and TSMC. This year also marked the deployment of Synopsys’ advanced Radio Frequency Complementary metal–oxide–semiconductor design flow for TSMC's N6RF process in April 2023.

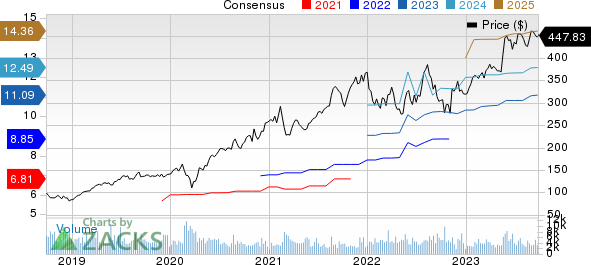

Synopsys, Inc. Price and Consensus

Synopsys, Inc. price-consensus-chart | Synopsys, Inc. Quote

Synopsys Gains From Its Robust Customer Base

Shares of SNPS have rallied 40.3% year to date, outperforming the Computer and Technology Sector’s rise of 33.3%.

Synopsys has a robust customer base that includes the likes of Advanced Micro Devices AMD, Intel INTC, Juniper Networks, Realtek, Teradici, NetLogic Microsystems, Toshiba and Wolfson.

Its partners across the world have adopted Synopsys Fusion Compiler, a key component in efficient chip design. The Fusion Compiler has been deployed at important nodes, such as TSMC N2, TSMC N5A, Samsung SF3 and Intel 18A, and has significantly contributed to the growth of SNPS’ Design Automation segment. This segment achieved revenues of more than $1 billion in the third quarter of 2023.

Another partner of Synopsys, Advanced Micro Devices, recently collaborated with the company to utilize its EDA solutions designed for the latest-generation AMD EPYC processors. As SNPS is a leading player in the EDA market, the companies are strengthening the supplier relationship with SNPS for improving its cost efficiencies.

The innovative products and solutions are boosting the company’s revenues. In the third quarter of fiscal 2023, Synopsys generated $1.49 billion in revenues, up 19% year over year. In the fourth quarter of 2023, the company expects its revenues in the band of $1.567 billion to $1.597 billion. The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $1.58 billion, indicating a year-over-year increase of 23.3%.

For fiscal 2023, the company expects revenues in the band of $5.81-$5.84 billion. The Zacks Consensus Estimate is pegged at $5.83 billion, suggesting 14.7% growth from fiscal 2022.

Zacks Rank & Other Stock to Consider

SNPS carries Zacks Rank #2 (Buy) at present, and INTC and AMD carry a Zacks Rank #3 (Hold). Shares of Intel and Advanced Micro Devices have rallied 32.4% and 50.3%, respectively, year to date.

Another top-ranked stock from the broader technology sector is Splunk SPLK, which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Splunk's third-quarter fiscal 2024 earnings has been revised upward by 12 cents to $1.11 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by a penny to $3.77 per share in the past seven days.

Splunk’s earnings beat the Zacks Consensus Estimate in all the preceding quarters with the average surprise being 154.9%. Shares of SPLK have surged 68.2% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Splunk Inc. (SPLK) : Free Stock Analysis Report