Synchrony Financial (SYF) Q3 Earnings Miss Estimates, Down Y/Y

Synchrony Financial’s SYF third-quarter 2020 earnings per share of 72 cents missed the Zacks Consensus Estimate by 13.3%. Further, the bottom line plunged 41% year over year due to muted revenues.

Results in Detail

The company’s net interest income decreased 21.2% to $3.5 billion in the third quarter due to the impact of the Walmart consumer portfolio sale and the COVID-19 pandemic.

However, its other income increased 54.1% to $131 million, primarily attributable to lower loyalty program expenses.

In the quarter under review, loan receivables declined 6% year over year.

Deposits were $63.5 billion, down 4% from the year-ago quarter.

Provision for credit loss increased 19% year over year to $1.2 billion on the back of Walmart-related prior-year reserve reduction and a hike in reserve induced by COVID-19 related losses. The same was partly offset by lower net charge-offs.

Total other expenses rose 0.3% year over year to $1.07 billion due to the restructuring charge and expenses related to the COVID-19 pandemic.

However, the same was offset by decreased cost from Walmart, lower purchase volume and accounts, and reduced discretionary cost.

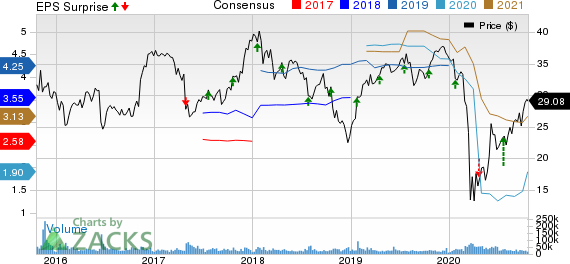

Synchrony Financial Price, Consensus and EPS Surprise

Synchrony Financial price-consensus-eps-surprise-chart | Synchrony Financial Quote

Sales Platforms Update

Retail Card

The company’s interest and fees on loans fell 27% year over year due to the sale of the Walmart consumer portfolio and lower loan receivables.

Loan receivables were down 6% due to COVID-19 impact while the average active accounts declined 19%.

Payment Solutions

Interest and fees on loans dropped 10% year over year owing to lower late fees. Loan receivables slid 5% year over year.

Purchase volume contracted 6% while average active account slipped 7%.

CareCredit

Interest and fees on loans decreased 8% year over year due to fall in merchant discount as a result of shrinkage in purchase volume.

Loan receivables were down 7% year over year on account of the coronavirus impact.

While purchase volume decreased 3%, the average active account fell 8%.

Financial Position

Total assets as of Sep 30, 2020 were $95.6 billion, down 9.7% year over year.

Total borrowings as of Sep 30, 2020 were $15.7 billion, down 22.6% from the year-ago quarter.

The company’s balance sheet was consistently strong during the reported quarter with total liquidity of $26.8 billion reflecting 28% of total assets.

While return on assets was 1.3%, the return on equity was 10.3%.

Efficiency ratio was 39.7% in third-quarter 2020.

Capital Deployment

During the quarter under consideration, the company returned $129 million in capital through common stock dividends.

Zacks Rank

Synchrony Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases From Finance Sector

Some stocks worth considering from the finance sector with a perfect mix of elements to surpass estimates in the upcoming quarterly releases are as follows:

Capital One Financial Corporation COF has an Earnings ESP of +11.31% and a Zacks Rank #3 (Hold), currently. The company is scheduled to release third-quarter earnings 2020 on Oct 22.

Moodys Corporation MCO is set to report third-quarter earnings 2020 on Oct 29. The stock has a Zacks Rank of 2 and an Earnings ESP of +1.93% at present.

Arthur J. Gallagher Co. AJG is slated to announce third-quarter earnings 2020 on Oct 29. The stock has an Earnings ESP of +6.91% and is presently Zacks #2 Ranked.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moodys Corporation (MCO) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

Arthur J. Gallagher Co. (AJG) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

To read this article on Zacks.com click here.