Have surging stock markets become detached from reality?

Wall Street is not feeling the pain being suffered on Main Street. While US unemployment is expected to be confirmed at 20pc on Friday, New York’s benchmark stock index is higher now than it was seven months ago.

The fastest collapse into a bear market in history has been followed by a rapid recovery even as shocking economic figures roll in.

Markets in the US are well on their way to the all-time highs reached in February while European shares are also staging a recovery against a backdrop of record plunges in GDP.

The S&P 500, New York’s benchmark index, has surged 37pc since hitting a three-year low in March, leaving it just 9pc down on its all-time high. The FTSE 100 has recovered 25pc while global stocks are down just 8pc this year and higher than they were last October.

Some observers warn that stock markets are becoming detached from the economic fundamentals. The economy and jobs market will not recover anywhere nearly as quickly as stock valuations.

Goldman Sachs equity strategist David Kostin calls the market rally “unloved, but welcome”. He pins the rebound on huge stimulus efforts by the central bank and Trump administration, the recovery of a “narrow group” of giant US stocks and hopes of the economy’s reopening.

Analysts believe the mammoth support provided by central banks, particularly the Federal Reserve, has been crucial for aiding the turnaround on markets.

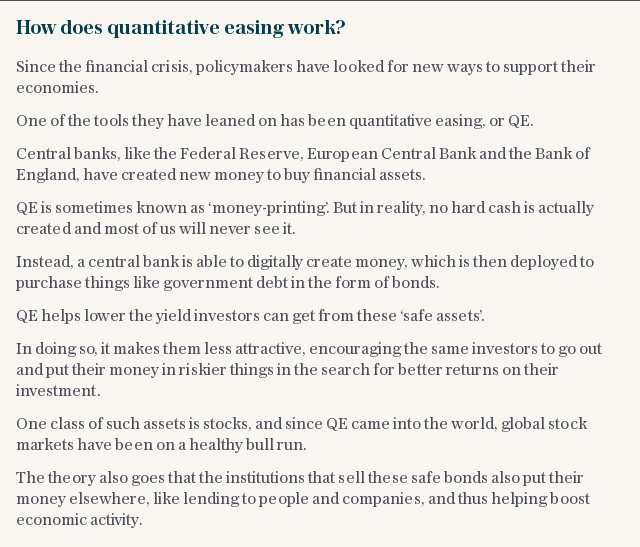

With interest rates close to the floor, central banks have turned to quantitative easing (QE), also known as money printing, to spur the recovery.

The Federal Reserve is buying bonds worth trillions of dollars under QE, lowering long-term interest rates, pushing investors out of safer assets into riskier stocks and providing liquidity to markets. The European Central Bank is expected to boost its bond buying at its meeting on Thursday while the Bank of England has also turned to QE.

Neil MacKinnon, global macro strategist at VTB Capital, says stock markets "have gone up because of central bank liquidity pure and simple”.

“These policy actions, monetary and fiscal, are epic and unprecedented and it’s pumping up stock markets. We may make new highs in the major stock markets.”

MacKinnon says markets have become “addicted” to the central bank stimulus and warns it is creating “fake prices”.

“It creates the potential for a massive liquidity bubble and all bubbles burst.”

Mike Bell, global market strategist at JP Morgan Asset Management, believes a sector-by-sector look at markets tells a more nuanced story.

The hardest hit sectors remain heavily down while other sectors, such as online retail, are underpinning the overall market’s rebound, he says. Bell says this also explains why the UK market’s recovery has lagged behind Wall Street, which has more online retail and tech stocks.

Some big name investors believe the rally has inflated overall stock valuations too far, however.

David Tepper, the billionaire founder of hedge fund Appaloosa Management, calls the current US stock market the second most overvalued he has ever seen, only behind the Dotcom bubble in the late 1990s and early 2000s. Howard Marks, founder of investment giant Oaktree Capital, warns the market is being "artificially supported" by Fed intervention and questions if the US rate-setters can "keep it up forever".

Stocks valuations are pushing towards frothy levels by many valuation measures. Estimates for corporate earnings have collapsed as stock markets have bounced back. The S&P 500’s forward price to earnings ratio, which takes into account expectations for future earnings, is at its highest level since the dotcom bubble.

The Shiller price to earnings ratio, another closely-watched valuation measure in the US, holds close to levels seen at the 1929 crash. But these lofty valuations have not been unusual in recent years.

The big risk facing stocks markets is a second Covid-19 wave that delivers a further blow to the economy and corporate earnings. Optimism could quickly fizzle out if the US and UK face another spike in the virus amid warnings they are reopening too soon.

"The market is not priced for a reacceleration in the infection rate," warns Bell.

"Most sectors would go down but the ones that would be the hardest hit are the ones that are already the most beaten up.

"They go from being the ones beaten up to people genuinely worrying about their survival."