Sturdy Comps Performance to Aid Costco's (COST) Q4 Earnings

Costco Wholesale Corporation COST is likely to register an increase in the top line when it reports fourth-quarter fiscal 2020 numbers on Sep 24, after the closing bell. The Zacks Consensus Estimate for revenues is pegged at $52,608 million, indicating an improvement of 10.8% from the prior-year reported figure.

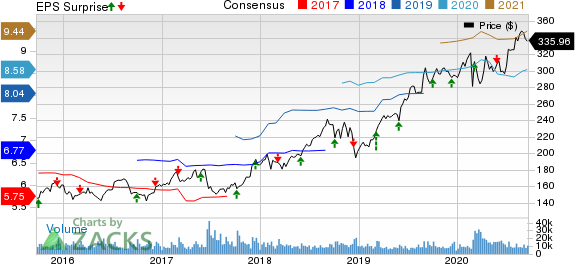

Again, we note that the Zacks Consensus Estimate for earnings for the quarter under review has increased by 1.8% over the past 30 days to $2.85. The figure suggests growth of roughly 6% from the year-ago period.

Notably, this Issaquah, WA-based company has a trailing four-quarter earnings surprise of 1.9%, on average. In the last reported quarter, the company delivered a negative earnings surprise of 1.6%.

Key Factors to Note

Costco’s growth strategies, better price management, decent membership trends and increasing penetration of e-commerce business have been contributing to its upbeat performance. Thanks to its status of “essential retailers,” the company has been benefiting from coronavirus-induced spike in demand. Cumulatively, these factors have been aiding this operator of membership warehouses in registering impressive comparable sales run.

In fact, the company’s strategy to sell products at discounted prices has helped it expand customer base. Under the current circumstances, people are exhibiting a preference for discount stores for essentials or other daily purchases. Apparently, Costco has emerged as viable option for them. The company’s differentiated product range resonates well with customers’ spending habits.

For the 16-week fourth quarter ended Aug 30, Costco delivered net sales of $52.3 billion, which reflects an increase of 12.7% compared with net sales of $46.4 billion reported during the same period last year. Again, comparable sales for the quarter under review rose 11.4%, reflecting an increase of 11%, 9.1% and 16.1% in the United States, Canada and Other International locations, respectively.

The company has been rapidly adopting the omni-channel mantra to provide a seamless shopping experience, whether online or in stores. Consumers’ increased shift to online purchasing owing to the coronavirus outbreak seems to have worked in favor of the company. The company’s e-commerce sales have been showcasing a sharp increase owing to growing stay-at-home trends to maintain social distancing amid the pandemic. We note that e-commerce comparable sales soared 90.6% during the quarter.

Certainly, the company’s strategic endeavors have been fueling traffic. However, analysts pointed that any deleverage in SG&A rate, higher labor and occupancy costs, and increased marketing and other store-related expenses might compress margins. Further, incremental wages and sanitation costs owing to the coronavirus outbreak cannot be ignored.

Costco Wholesale Corporation Price, Consensus and EPS Surprise

Costco Wholesale Corporation price-consensus-eps-surprise-chart | Costco Wholesale Corporation Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Costco this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Costco has a Zacks Rank #2 and an Earnings ESP of +1.20%.

3 More Stocks With the Favorable Combination

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Darden Restaurants DRI has an Earnings ESP of +69.08% and a Zacks Rank #2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dominos Pizza DPZ currently has an Earnings ESP of +3.02% and a Zacks Rank #2.

AutoZone AZO presently has an Earnings ESP of +12.90% and a Zacks Rank #3.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dominos Pizza Inc (DPZ) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research