Will Strong Segment Sales Boost Teledyne's (TDY) Q2 Earnings?

Teledyne Technologies Incorporated TDY is slated to report its second-quarter 2022 results on Jul 27 before market open.

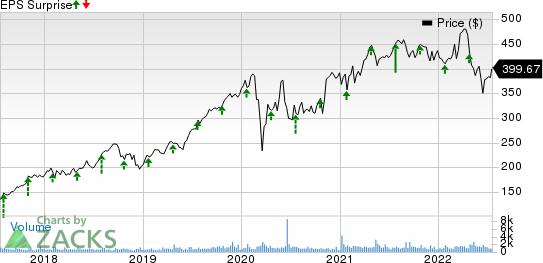

Teledyne has a four-quarter earnings surprise of 21.67%, on average. The solid performance of the majority of TDY’s segments in the second quarter is likely to favorably contribute to the company’s overall results.

Digital Imaging – a Key Catalyst for Revenues

The Teledyne FLIR business has been instrumental to the Digital Imaging segment’s revenues since the acquisition of FLIR. It is likely to have once again contributed favorably to the Digital Imaging segment’s revenues in the soon-to-be-reported quarter. Additionally, the strong sales growth of the industrial and scientific vision sensors and systems as well as low-dose high- resolution digital x-ray detectives is expected to have benefited the top line of the segment in the second quarter.

The Zacks Consensus Estimate for the Digital Imaging segment’s revenues in the second quarter is pegged at $783 million, indicating a whopping improvement of 35% from the revenues reported in the year-ago quarter.

Teledyne Technologies Incorporated Price and EPS Surprise

Teledyne Technologies Incorporated price-eps-surprise | Teledyne Technologies Incorporated Quote

Instrumentation Revenues – Another Growth Driver

The Instrumentation business segment’s revenues are anticipated to have continued their growth pace in the second quarter as well. The higher sales of electronic tests and measurement instrumentation as well as marine instrumentation are likely to have boosted the top line of this segment.

The Zacks Consensus Estimate for the Instrumentation segment’s revenues in the second quarter is pegged at $311 million, indicating an improvement of 6.9% from the revenues reported in the year-ago quarter.

Aerospace & Defense Electronics Revenues May Continue to be Strong

The robust sales volume of Teledyne’s commercial aerospace products, buoyed by the significant recovery in the commercial aerospace segment, is likely to have bolstered the Aerospace and Defense Electronics segment’s second-quarter revenues. Moreover, the higher sales of defense and space electronics products are expected to have positively impacted the segment’s revenues in the soon-to-be-reported quarter.

The Zacks Consensus Estimate for Aerospace and Defense Electronics’ revenues in the second quarter is pegged at $167 million, indicating growth of 9.9% from the revenues reported in the year-ago quarter.

Engineered Systems to Reflect Bright Performance

Engineered systems’ revenues might have been hurt by lower sales of the turbine engine business, mainly due to its exit from this business last year. Nevertheless, the gradual recovery in the commercial aerospace industry might have boosted demand and in turn this segment’s Q2 performance.

The Zacks Consensus Estimate for Engineered Systems’ revenues in the second quarter is pegged at $101 million, indicating an increase of 3.1% from the revenues reported in the year-ago quarter.

Other Factors to Consider

Such growth expectations for the majority of its segments make Teledyne optimistic about its overall revenue performance in the second quarter. This is likely to have bolstered the bottom line of the company as well. However, the impact of inflation and supply-chain constraints might have an adverse impact on TDY’s soon-to-be-reported quarterly results.

Q2 Estimates

The Zacks Consensus Estimate for second-quarter revenues is pegged at $1.35 billion, suggesting growth of 20.6% from the figure reported in the year-ago quarter.

The Zacks Consensus Estimate for second-quarter earnings is pegged at $4.39 per share, indicating a 4.8% decline from the prior-year reported figure.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Teledyne this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that is not the case here.

Teledyne has an Earnings ESP of 0.00% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are three defense companies you may want to consider as they have the right combination of elements to post an earnings beat this season:

L3Harris Technologies LHX: It is scheduled to release its second-quarter results on Jul 28. LHX holds a Zacks Rank #3 and an Earnings ESP of +1.09%. You can see the complete list of today’s Zacks #1 Rank stocks here.

LHX delivered a four-quarter average earnings surprise of 2.32%. The Zacks Consensus Estimate for L3Harris’ second-quarter earnings, pegged at $3.16, has moved up 0.3% over the past seven days.

Spire Global, Inc. SPIR has an Earnings ESP of +9.43% and a Zacks Rank #3. It is expected to release its second-quarter results on Aug 10.

Spire delivered an earnings surprise of 7.7% in the last reported quarter The Zacks Consensus Estimate for Spire’s second-quarter sales and earnings is pegged at $18.93 billion.

CAE Inc. CAE: The company is expected to release its fiscal first-quarter results soon. It holds a Zacks Rank #3 and an Earnings ESP of +2.27%.

The Zacks Consensus Estimate for CAE’s fiscal first-quarter earnings, pegged at 18 cents, has remained unchanged over the past seven days. CAE delivered a four-quarter average earnings surprise of 7.67%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

CAE Inc (CAE) : Free Stock Analysis Report

Spire Global, Inc. (SPIR) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research