Snowflake (SNOW) to Post Q4 Earnings: What's in the Offing?

Snowflake SNOW is set to report its fourth-quarter fiscal 2024 results on Feb 28.

The Zacks Consensus Estimate for the top line is pegged at $759.86 million, suggesting year-over-year growth of 29.01%.

The consensus mark for the bottom line is pegged at 17 cents per share, unchanged over the past 30 days, indicating 21.43% year-over-year growth.

The company’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 194.45%.

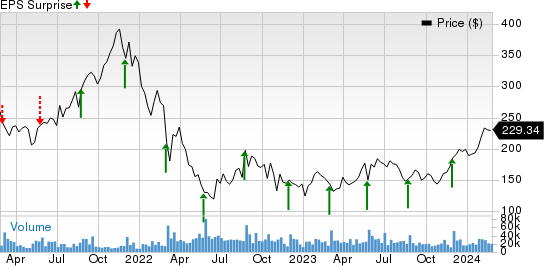

Snowflake Inc. Price and EPS Surprise

Snowflake Inc. price-eps-surprise | Snowflake Inc. Quote

Let’s see how things have shaped up before this announcement.

Factors to Note

Snowflake’s fiscal fourth-quarter performance is expected to have benefited from an expanding clientele and a strong partner base.

In third-quarter fiscal 2024, customers with trailing 12-month product revenues greater than $1 million increased 52% year over year. It had 647 Forbes Global 2000 customers, which increased 10.4% year over year. SNOW added 35 $1 million plus customers during the reported quarter.

Of the Global 2000 customers, 63% are using Snowpark on a weekly basis. Snowpark's consumption grew 47% sequentially. Consumption in October was up more than 500% since last year. Over 30% of customers used Snowflake to process unstructured data in October. Consumption of unstructured data was up 17 times year over year.

For the fourth quarter of fiscal 2024, Snowflake expects product revenues in the range of $716-$721 million. The projection range indicates year-over-year growth of 29-30%.

Customers are accessing Snowflake for data science, machine learning (ML) and AI. The growing adoption of Snowpark by data scientists and engineers is expected to have aided the company’s top-line growth in the to-be-reported quarter.

The company has introduced Snowflake Cortex to leverage AI and ML on Snowflake. Cortex is a managed service for inferencing large language models.

The company is also benefiting from a strong partner base that includes the likes of NVIDIA, Microsoft, Amazon, ServiceNow, Cognizant and Dell Technologies.

What Our Model Indicates

Per the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the exact case here.

Snowflake has an Earnings ESP of +54.34% and a Zacks Rank #4 (Sell) at present. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few companies worth considering, as our model shows that these have the right combination of elements to beat on earnings in their upcoming releases:

Semrush SEMR has an Earnings ESP of +23.08% and currently has a Zacks Rank #2. You can find the complete list of today’s Zacks #1 Rank stocks here.

Semrush is set to announce fourth-quarter 2023 results on Mar 4. SEMR shares have declined 7.6% year to date.

Guidewire GWRE has an Earnings ESP of +4.76% and a Zacks Rank #3 at present.

Guidewire is set to announce second-quarter fiscal 2024 results on Mar 7. GWRE’s shares have gained 10.3% year to date.

Pure Storage PSTG currently has an Earnings ESP of +2.68% and a Zacks Rank #3.

Pure Storage is set to announce fourth-quarter fiscal 2024 results on Feb 28. PSTG shares have returned 9.3% year to date.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report

Snowflake Inc. (SNOW) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

SEMrush Holdings, Inc. (SEMR) : Free Stock Analysis Report