SNAP Shares Rise 8% on Deal to Sell Amazon Products on App

Snap Inc.’s SNAP shares rose 8% on Tuesday, Nov 14, after the company announced that it has entered into a partnership with Amazon AMZN to enable Snapchat users in the United States to buy products from the online retailer without leaving the app.

The rise in Snap's shares after the announcement suggests that investors see potential benefits and increased value in the company due to this collaboration. It also reflects confidence in the company's ability to leverage its platform for e-commerce and generate revenues through such partnerships.

Users have the choice to connect their Snapchat and Amazon accounts through a one-time set-up. This linking likely involves authentication and permission processes to establish a secure connection between the two accounts.

Once the accounts are successfully linked, users are provided with real-time pricing, Prime eligibility, delivery estimates and product details for selected Amazon product ads within Snapchat.

This move aims to eliminate friction in the buying process, offering a more seamless and convenient shopping experience.

Users who choose to make a purchase through Amazon within Snapchat can complete the checkout using their default Amazon shipping address and payment method. This simplifies the process, as users are not required to re-enter their information for each transaction.

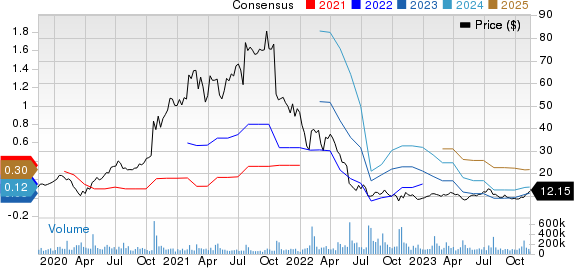

Snap Inc. Price and Consensus

Snap Inc. price-consensus-chart | Snap Inc. Quote

Social Media Giants Encourage E-Commerce Tie-Ups

Tech companies are increasingly focusing on e-commerce as a means to diversify their revenue sources and engage users in more ways beyond social networking. The competition in the space is heating up, with various platforms trying to create a comprehensive experience that combines social interaction with seamless shopping.

The deal with Snap is similar to Amazon’s partnership with Meta Platforms META, which was announced last week and allows users to purchase Amazon products directly from ads on Instagram and Facebook. The e-commerce giant also has a partnership with Pinterest PINS, announced back in April, that allows users to discover and buy relevant products through shoppable content.

By partnering with Amazon, Snapchat aims to offer users a more integrated and convenient shopping experience, potentially driving more transactions through the platform. It also benefits Amazon by expanding its reach to Snap's user base and tapping into the social commerce trend.

Snap and Amazon unveiled a collaboration last year that let Snapchat users "try on" eyeglasses using augmented reality (AR) and then buy those they liked at Amazon.

The latest move bodes well for this Zacks Rank #3 (Hold) company to capture a wider customer base through collaborative movements. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Snap has been facing challenges, particularly after the iOS privacy changes implemented by Apple in 2021, which impacted the ability of social media companies to target users with ads.

Despite the hurdles, Snap reported a 5% increase in year-over-year revenues for the third quarter, showing signs of recovery in user growth and a rise in Snapchat+ users. The company made considerable progress in diversifying revenues with Snapchat+, ARES and sponsored AR advertising.

Daily active users (DAUs) at the end of the reported quarter were 406 million, up 11.8% year over year. Snap added 43 million DAUs on a year-over-year basis. The Snapchat+ subscription service reached more than five million paying subscribers in the third quarter.

SNAP is broadening its presence in the realm of generative artificial intelligence (AI) through the introduction of many AI-integrated features. More than 200 million people have used the company’s AI chatbot.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Snap Inc. (SNAP) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report